Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. On 12 January 2012, Eugene acquired a piece of land for RM2,000,000, paying stamp duty of RM30,000 and professional fees of RM20,000. On

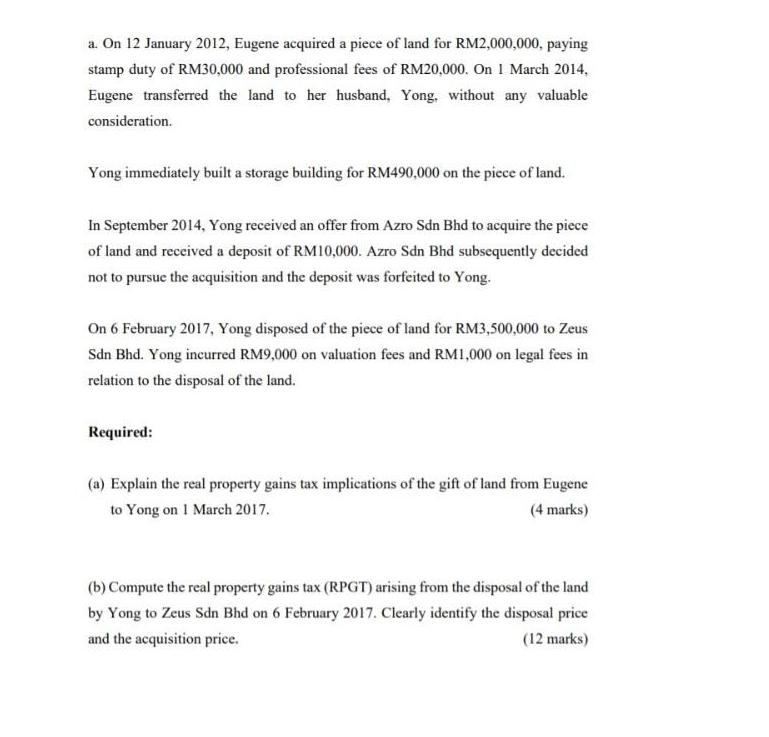

a. On 12 January 2012, Eugene acquired a piece of land for RM2,000,000, paying stamp duty of RM30,000 and professional fees of RM20,000. On 1 March 2014, Eugene transferred the land to her husband, Yong, without any valuable consideration. Yong immediately built a storage building for RM490,000 on the piece of land. In September 2014, Yong received an offer from Azro Sdn Bhd to acquire the piece of land and received a deposit of RM10,000. Azro Sdn Bhd subsequently decided not to pursue the acquisition and the deposit was forfeited to Yong. On 6 February 2017, Yong disposed of the piece of land for RM3,500,000 to Zeus Sdn Bhd. Yong incurred RM9,000 on valuation fees and RM1,000 on legal fees in relation to the disposal of the land. Required: (a) Explain the real property gains tax implications of the gift of land from Eugene to Yong on 1 March 2017. (4 marks) (b) Compute the real property gains tax (RPGT) arising from the disposal of the land by Yong to Zeus Sdn Bhd on 6 February 2017. Clearly identify the disposal price and the acquisition price. (12 marks)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Answer RPGT real property grain tax is a type of capital grain tax that homeowners and companies in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started