Answered step by step

Verified Expert Solution

Question

1 Approved Answer

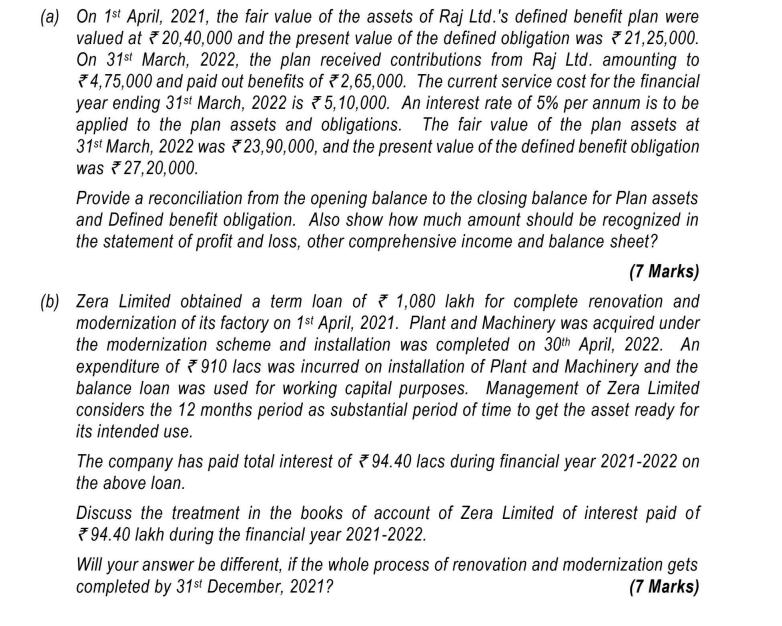

(a) On 1st April, 2021, the fair value of the assets of Raj Ltd.'s defined benefit plan were valued at 20,40,000 and the present

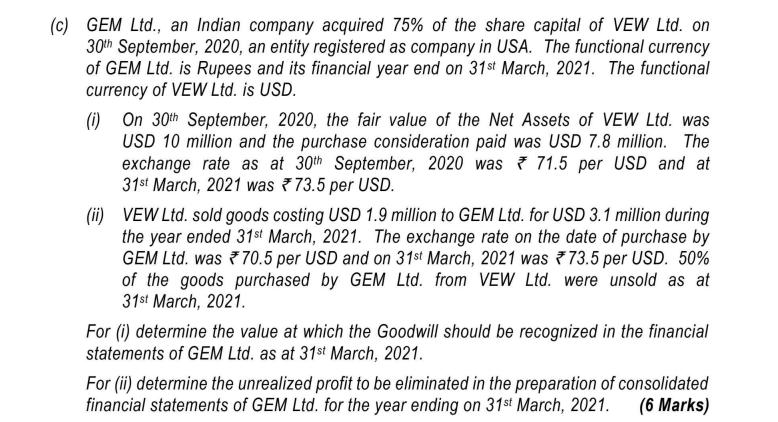

(a) On 1st April, 2021, the fair value of the assets of Raj Ltd.'s defined benefit plan were valued at 20,40,000 and the present value of the defined obligation was 21,25,000. On 31st March, 2022, the plan received contributions from Raj Ltd. amounting to *4,75,000 and paid out benefits of 2,65,000. The current service cost for the financial year ending 31st March, 2022 is 5,10,000. An interest rate of 5% per annum is to be applied to the plan assets and obligations. The fair value of the plan assets at 31st March, 2022 was 23,90,000, and the present value of the defined benefit obligation was 27,20,000. Provide a reconciliation from the opening balance to the closing balance for Plan assets and Defined benefit obligation. Also show how much amount should be recognized in the statement of profit and loss, other comprehensive income and balance sheet? (7 Marks) (b) Zera Limited obtained a term loan of 1,080 lakh for complete renovation and modernization of its factory on 1st April, 2021. Plant and Machinery was acquired under the modernization scheme and installation was completed on 30th April, 2022. An expenditure of 910 lacs was incurred on installation of Plant and Machinery and the balance loan was used for working capital purposes. Management of Zera Limited considers the 12 months period as substantial period of time to get the asset ready for its intended use. The company has paid total interest of 94.40 lacs during financial year 2021-2022 on the above loan. Discuss the treatment in the books of account of Zera Limited of interest paid of *94.40 lakh during the financial year 2021-2022. Will your answer be different, if the whole process of renovation and modernization gets completed by 31st December, 2021? (7 Marks) (c) GEM Ltd., an Indian company acquired 75% of the share capital of VEW Ltd. on 30th September, 2020, an entity registered as company in USA. The functional currency of GEM Ltd. is Rupees and its financial year end on 31st March, 2021. The functional currency of VEW Ltd. is USD. (i) On 30th September, 2020, the fair value of the Net Assets of VEW Ltd. was USD 10 million and the purchase consideration paid was USD 7.8 million. The exchange rate as at 30th September, 2020 was 71.5 per USD and at 31st March, 2021 was 73.5 per USD. (ii) VEW Ltd. sold goods costing USD 1.9 million to GEM Ltd. for USD 3.1 million during the year ended 31st March, 2021. The exchange rate on the date of purchase by GEM Ltd. was 70.5 per USD and on 31st March, 2021 was 73.5 per USD. 50% of the goods purchased by GEM Ltd. from VEW Ltd. were unsold as at 31st March, 2021. For (i) determine the value at which the Goodwill should be recognized in the financial statements of GEM Ltd. as at 31st March, 2021. For (ii) determine the unrealized profit to be eliminated in the preparation of consolidated financial statements of GEM Ltd. for the year ending on 31st March, 2021. (6 Marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started