Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) On April 1, 2023, Kaur Company issued ( $ 1,000,000 ) face value, 16.3, ten-year bonds. The market rate December ( 31^{text {st }}

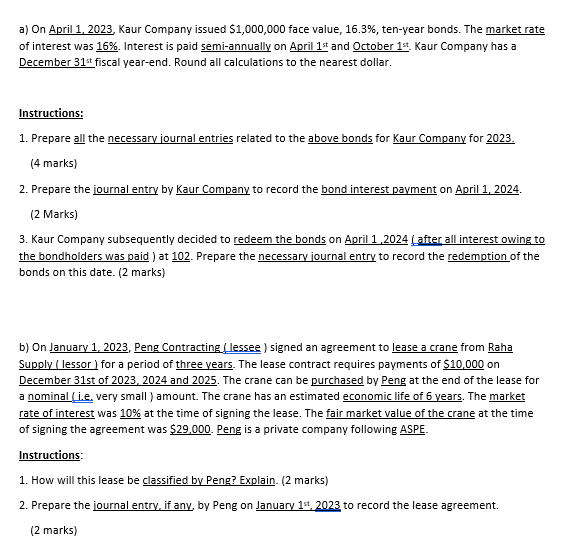

a) On April 1, 2023, Kaur Company issued \\( \\$ 1,000,000 \\) face value, \16.3, ten-year bonds. The market rate December \\( 31^{\\text {st }} \\) fiscal year-end. Round all calculations to the nearest dollar. Instructions: 1. Prepare all the necessarv journal entries related to the above bonds for Kaur Company for 2023. (4 marks) 2. Prepare the journal entry by Kaur Company to record the bond interest payment on April 1, 2024. (2 Marks) 3. Kaur Company subsequently decided to redeem the bonds on April 1,2024 (after all interest owing to the bondholders was paid ) at 102 . Prepare the necessarv journal entry to record the redemption of the bonds on this date. ( 2 marks) b) On Januarv 1, 2023, Peng Contracting (lessee ) signed an agreement to lease a crane from Raha Supply (lessor) for a period of three vears. The lease contract requires payments of \\( \\$ 10,000 \\) on December 31st of 2023, 2024 and 2025. The crane can be purchased by Peng at the end of the lease for a nominal (i.e. very small) amount. The crane has an estimated economic life of 6 years. The market rate of interest was \10 at the time of signing the lease. The fair market value of the crane at the time of signing the agreement was \\( \\$ 29,000 \\). Peng is a private company following ASPE. Instructions: 1. How will this lease be classified by Peng? Explain. (2 marks) 2. Prepare the journal entry, if any by Peng on January \\( 1^{\\text {st }} .2023 \\) to record the lease agreement. (2 marks)

a) On April 1, 2023, Kaur Company issued \\( \\$ 1,000,000 \\) face value, \16.3, ten-year bonds. The market rate December \\( 31^{\\text {st }} \\) fiscal year-end. Round all calculations to the nearest dollar. Instructions: 1. Prepare all the necessarv journal entries related to the above bonds for Kaur Company for 2023. (4 marks) 2. Prepare the journal entry by Kaur Company to record the bond interest payment on April 1, 2024. (2 Marks) 3. Kaur Company subsequently decided to redeem the bonds on April 1,2024 (after all interest owing to the bondholders was paid ) at 102 . Prepare the necessarv journal entry to record the redemption of the bonds on this date. ( 2 marks) b) On Januarv 1, 2023, Peng Contracting (lessee ) signed an agreement to lease a crane from Raha Supply (lessor) for a period of three vears. The lease contract requires payments of \\( \\$ 10,000 \\) on December 31st of 2023, 2024 and 2025. The crane can be purchased by Peng at the end of the lease for a nominal (i.e. very small) amount. The crane has an estimated economic life of 6 years. The market rate of interest was \10 at the time of signing the lease. The fair market value of the crane at the time of signing the agreement was \\( \\$ 29,000 \\). Peng is a private company following ASPE. Instructions: 1. How will this lease be classified by Peng? Explain. (2 marks) 2. Prepare the journal entry, if any by Peng on January \\( 1^{\\text {st }} .2023 \\) to record the lease agreement. (2 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started