Answered step by step

Verified Expert Solution

Question

1 Approved Answer

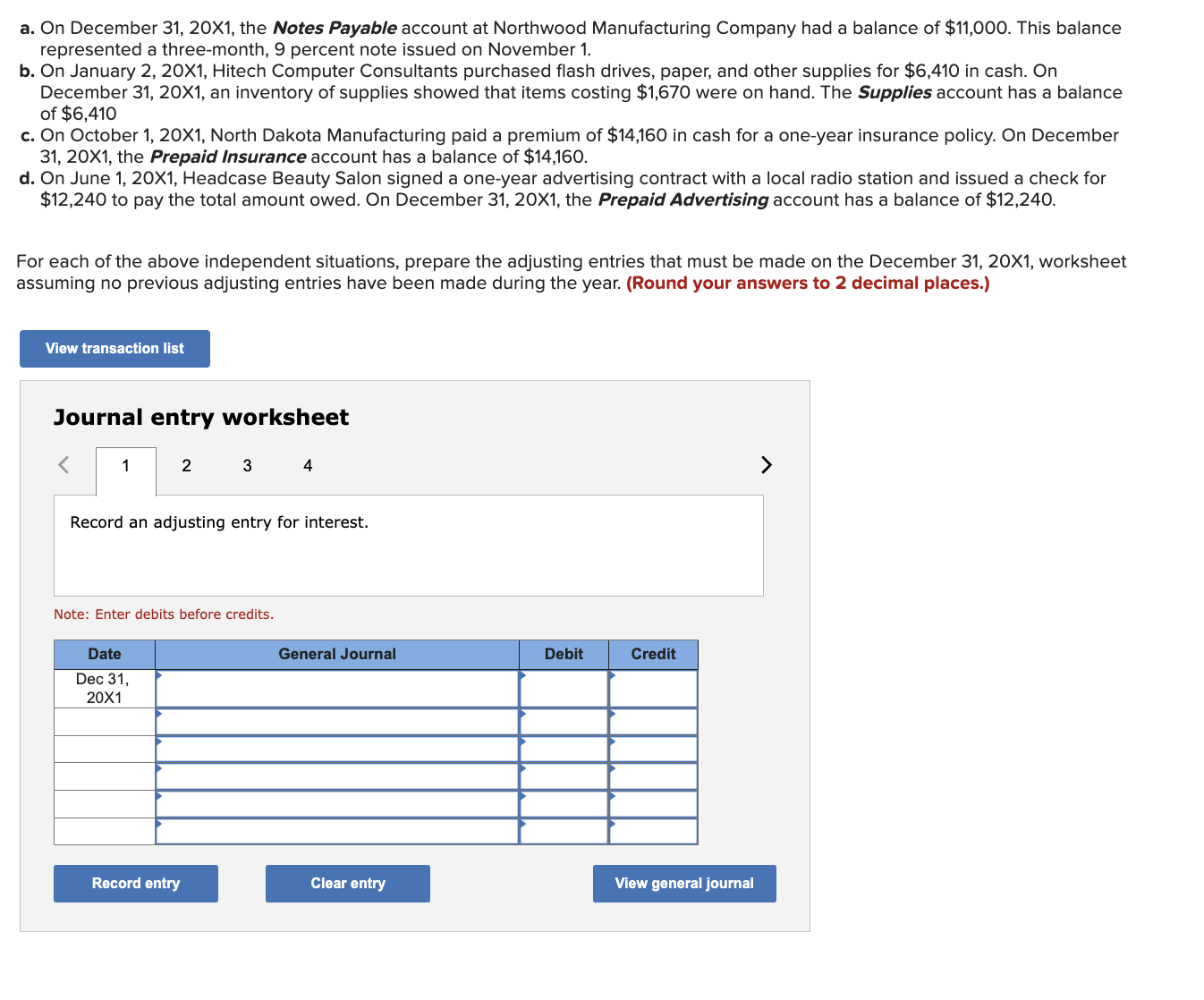

a. On December 31,201, the Notes Payable account at Northwood Manufacturing Company had a balance of $11,000. This balance represented a three-month, 9 percent note

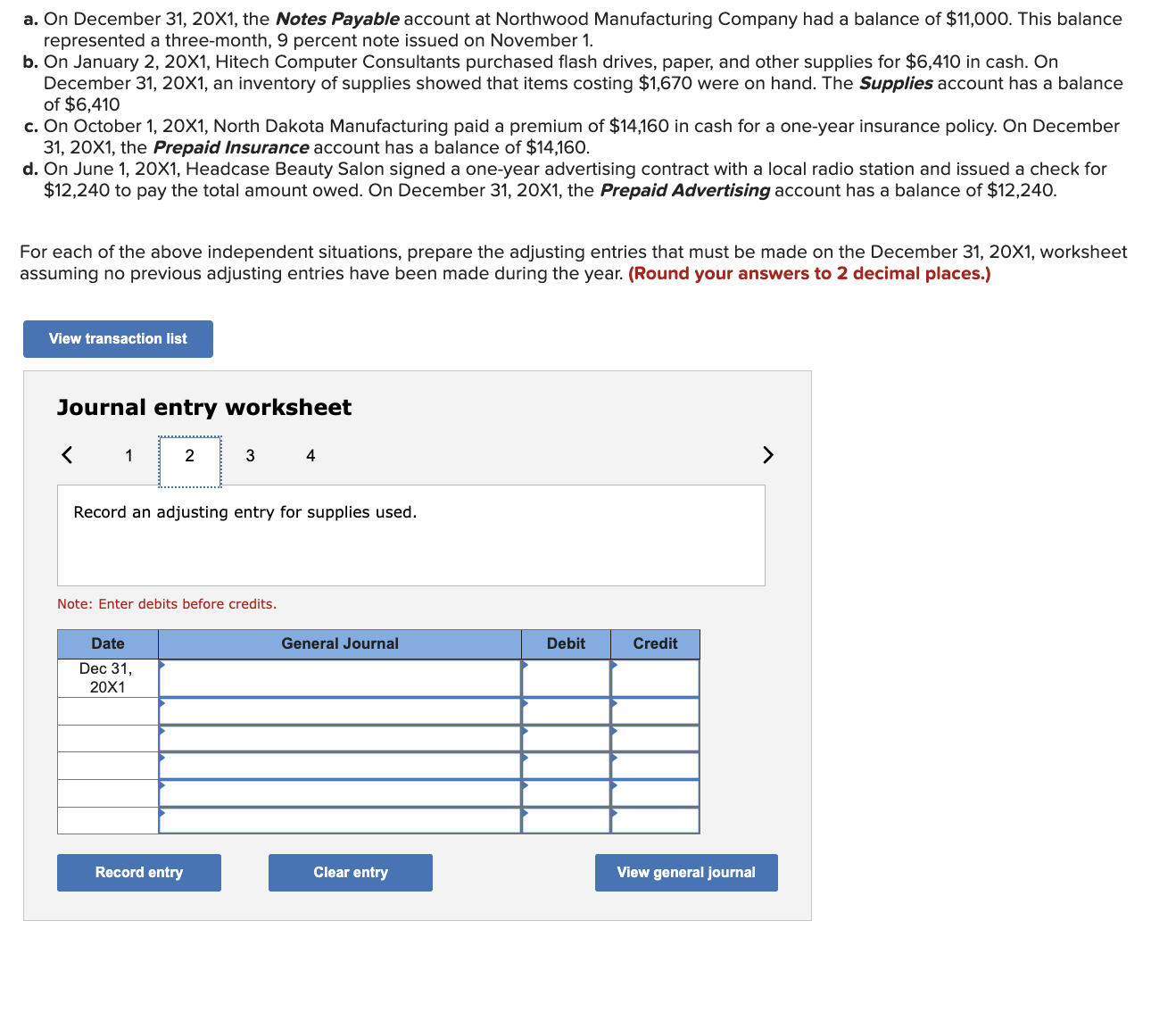

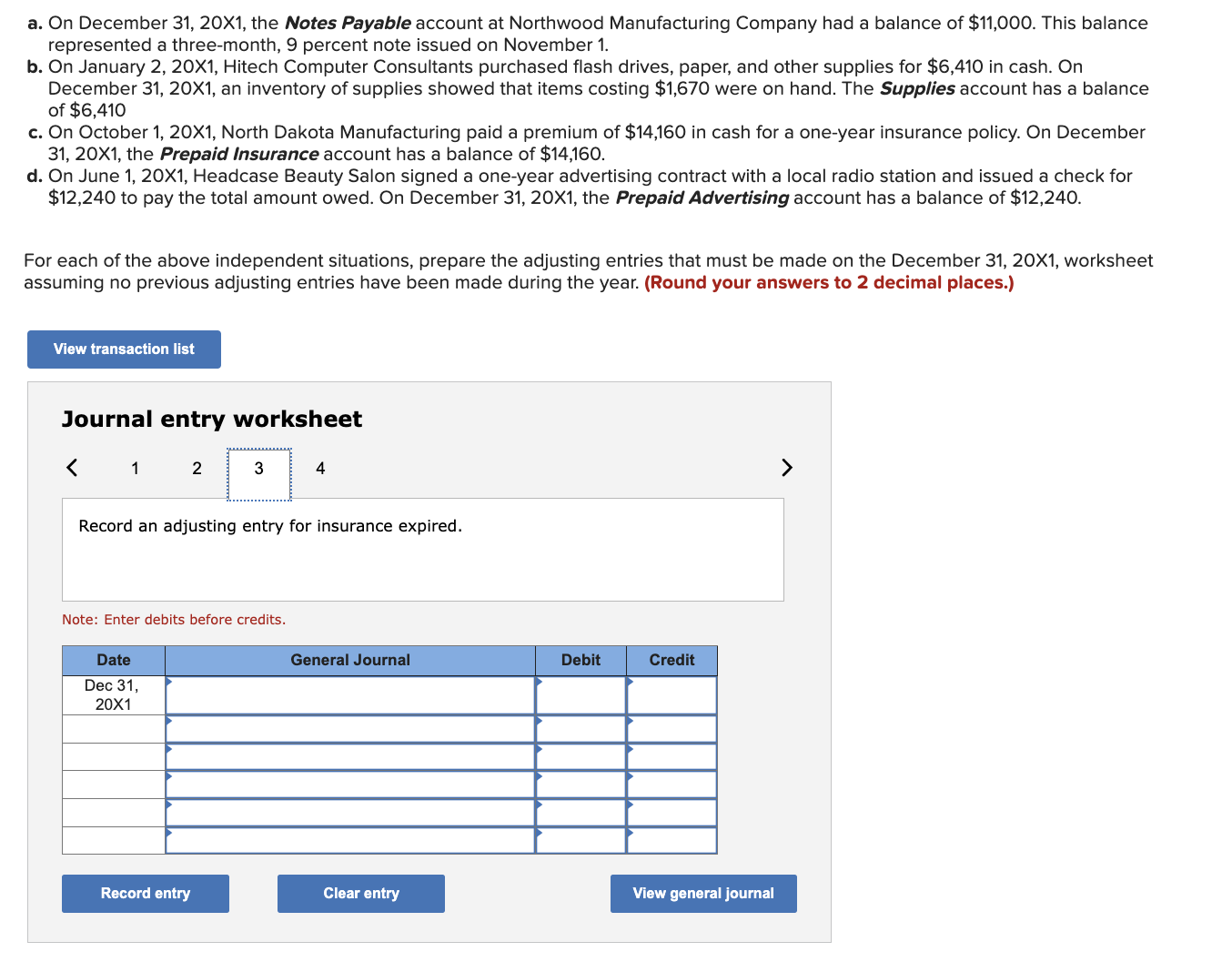

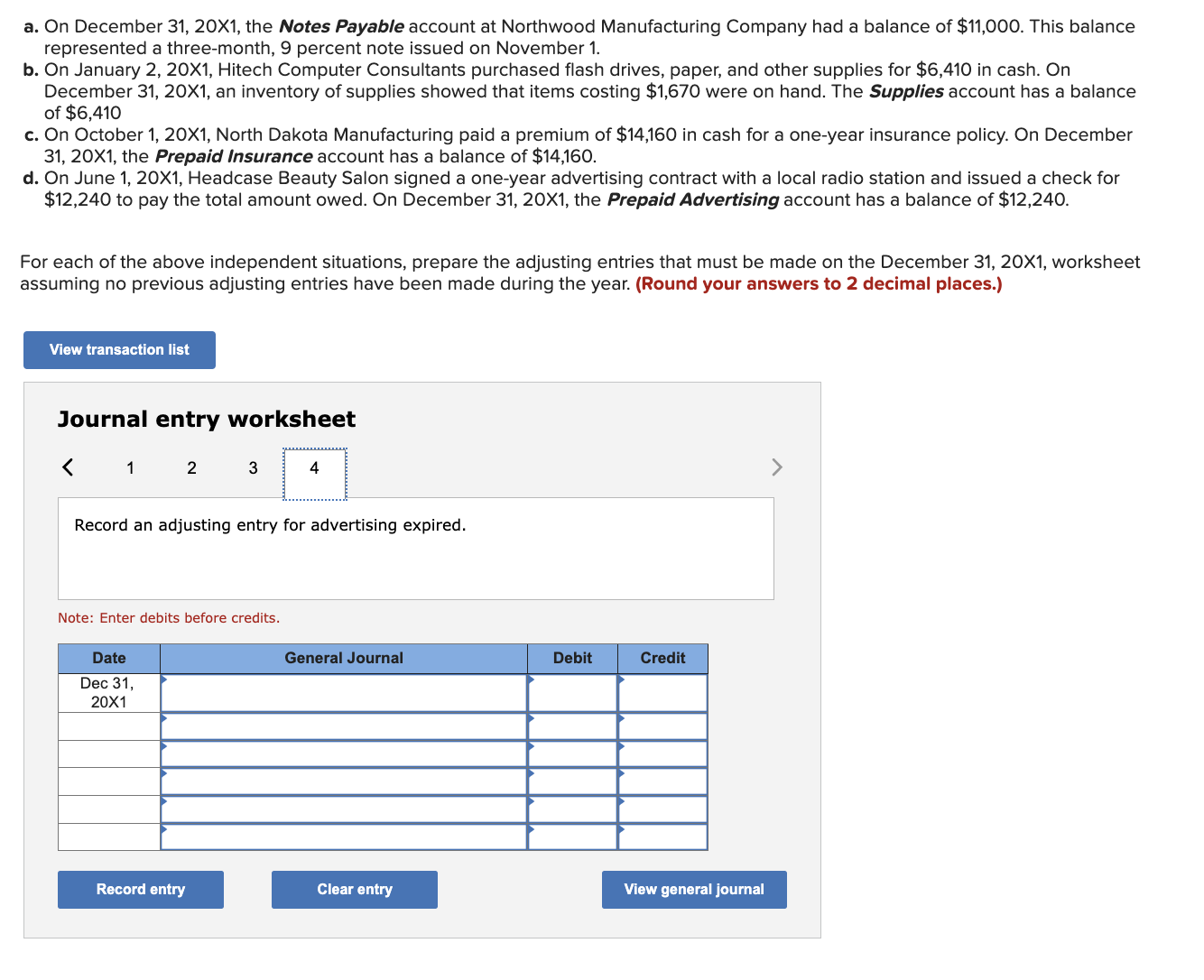

a. On December 31,201, the Notes Payable account at Northwood Manufacturing Company had a balance of $11,000. This balance represented a three-month, 9 percent note issued on November 1. b. On January 2, 20X1, Hitech Computer Consultants purchased flash drives, paper, and other supplies for $6,410 in cash. On December 31, 20X1, an inventory of supplies showed that items costing $1,670 were on hand. The Supplies account has a balance of $6,410 c. On October 1,201, North Dakota Manufacturing paid a premium of $14,160 in cash for a one-year insurance policy. On December 31, 20X1, the Prepaid Insurance account has a balance of $14,160. d. On June 1, 20X1, Headcase Beauty Salon signed a one-year advertising contract with a local radio station and issued a check for $12,240 to pay the total amount owed. On December 31, 20X1, the Prepaid Advertising account has a balance of $12,240. For each of the above independent situations, prepare the adjusting entries that must be made on the December 31 , 20X1, worksheet assuming no previous adjusting entries have been made during the year. (Round your answers to 2 decimal places.) Journal entry worksheet 4 Record an adjusting entry for interest. Note: Enter debits before credits. a. On December 31,201, the Notes Payable account at Northwood Manufacturing Company had a balance of $11,000. This balance represented a three-month, 9 percent note issued on November 1. b. On January 2, 20X1, Hitech Computer Consultants purchased flash drives, paper, and other supplies for $6,410 in cash. On December 31, 20X1, an inventory of supplies showed that items costing $1,670 were on hand. The Supplies account has a balance of $6,410 c. On October 1, 20X1, North Dakota Manufacturing paid a premium of $14,160 in cash for a one-year insurance policy. On December 31, 20X1, the Prepaid Insurance account has a balance of $14,160. d. On June 1, 20X1, Headcase Beauty Salon signed a one-year advertising contract with a local radio station and issued a check for $12,240 to pay the total amount owed. On December 31,20X1, the Prepaid Advertising account has a balance of $12,240. For each of the above independent situations, prepare the adjusting entries that must be made on the December 31 , 20X1, worksheet assuming no previous adjusting entries have been made during the year. (Round your answers to 2 decimal places.) Journal entry worksheet Record an adjusting entry for supplies used. Note: Enter debits before credits. a. On December 31, 20X1, the Notes Payable account at Northwood Manufacturing Company had a balance of $11,000. This balance represented a three-month, 9 percent note issued on November 1 . b. On January 2, 20X1, Hitech Computer Consultants purchased flash drives, paper, and other supplies for $6,410 in cash. On December 31 , 20X1, an inventory of supplies showed that items costing $1,670 were on hand. The Supplies account has a balance of $6,410 c. On October 1, 20X1, North Dakota Manufacturing paid a premium of $14,160 in cash for a one-year insurance policy. On December 31, 20X1, the Prepaid Insurance account has a balance of $14,160. d. On June 1, 20X1, Headcase Beauty Salon signed a one-year advertising contract with a local radio station and issued a check for $12,240 to pay the total amount owed. On December 31, 20X1, the Prepaid Advertising account has a balance of $12,240. For each of the above independent situations, prepare the adjusting entries that must be made on the December 31 , 20X1, worksheet assuming no previous adjusting entries have been made during the year. (Round your answers to 2 decimal places.) Journal entry worksheet Record an adjusting entry for insurance expired. Note: Enter debits before credits. a. On December 31,201, the Notes Payable account at Northwood Manufacturing Company had a balance of $11,000. This balance represented a three-month, 9 percent note issued on November 1. b. On January 2, 20X1, Hitech Computer Consultants purchased flash drives, paper, and other supplies for $6,410 in cash. On December 31 , 20X1, an inventory of supplies showed that items costing $1,670 were on hand. The Supplies account has a balance of $6,410 c. On October 1, 20X1, North Dakota Manufacturing paid a premium of $14,160 in cash for a one-year insurance policy. On December 31, 20X1, the Prepaid Insurance account has a balance of $14,160. d. On June 1, 20X1, Headcase Beauty Salon signed a one-year advertising contract with a local radio station and issued a check for $12,240 to pay the total amount owed. On December 31, 20X1, the Prepaid Advertising account has a balance of $12,240. For each of the above independent situations, prepare the adjusting entries that must be made on the December 31 , 20X1, worksheet assuming no previous adjusting entries have been made during the year. (Round your answers to 2 decimal places.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started