Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) On Friday 26 January 2018, the UK government held its weekly auction of government Treasury bills. The table below outlines prices for the

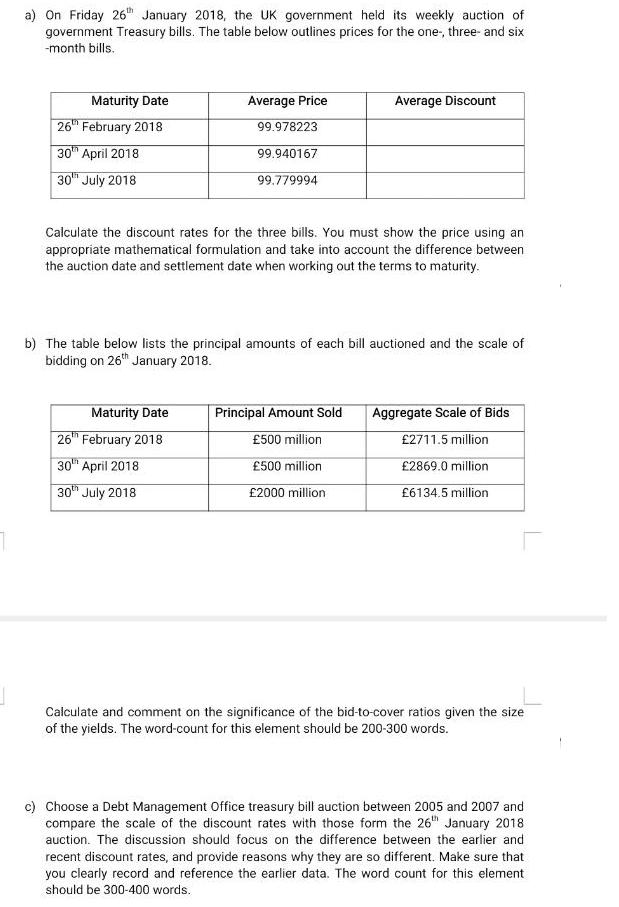

a) On Friday 26" January 2018, the UK government held its weekly auction of government Treasury bills. The table below outlines prices for the one-, three- and six -month bills. Maturity Date 26" February 2018 Average Price Average Discount 99.978223 30 April 2018 99.940167 30" July 2018 99.779994 Calculate the discount rates for the three bills. You must show the price using an appropriate mathematical formulation and take into account the difference between the auction date and settlement date when working out the terms to maturity. b) The table below lists the principal amounts of each bill auctioned and the scale of bidding on 26th January 2018. Maturity Date Principal Amount Sold Aggregate Scale of Bids 26" February 2018 500 million 2711.5 million 30" April 2018 500 million 2869.0 million 30h July 2018 2000 million 6134.5 million Calculate and comment on the significance of the bid-to-cover ratios given the size of the yields. The word-count for this element should be 200-300 words. c) Choose a Debt Management Office treasury bill auction between 2005 and 2007 and compare the scale of the discount rates with those form the 26" January 2018 auction. The discussion should focus on the difference between the earlier and recent discount rates, and provide reasons why they are so different. Make sure that you clearly record and reference the earlier data. The word count for this element should be 300-400 words.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The discount rates of Treasuries is given by the following Equation perio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started