Answered step by step

Verified Expert Solution

Question

1 Approved Answer

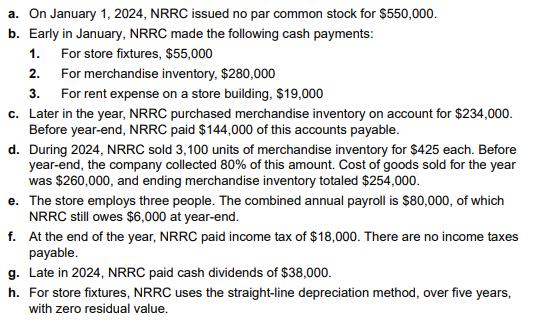

a. On January 1, 2024, NRRC issued no par common stock for $550,000. b. Early in January, NRRC made the following cash payments: 1.

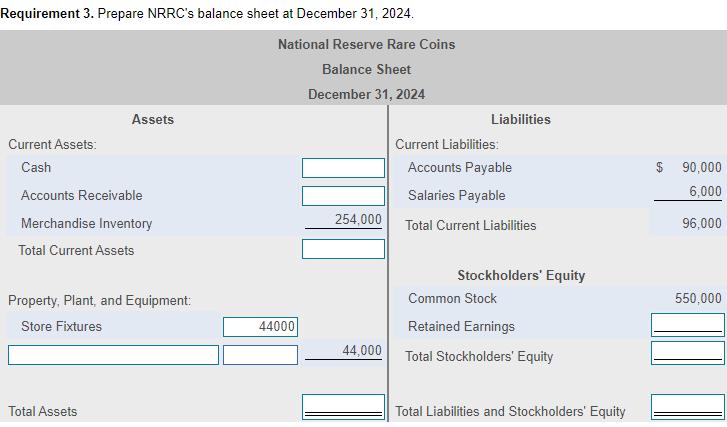

a. On January 1, 2024, NRRC issued no par common stock for $550,000. b. Early in January, NRRC made the following cash payments: 1. For store fixtures, $55,000 2. 3. For merchandise inventory, $280,000 For rent expense on a store building, $19,000 c. Later in the year, NRRC purchased merchandise inventory on account for $234,000. Before year-end, NRRC paid $144,000 of this accounts payable. d. During 2024, NRRC sold 3,100 units of merchandise inventory for $425 each. Before year-end, the company collected 80% of this amount. Cost of goods sold for the year was $260,000, and ending merchandise inventory totaled $254,000. e. The store employs three people. The combined annual payroll is $80,000, of which NRRC still owes $6,000 at year-end. f. At the end of the year, NRRC paid income tax of $18,000. There are no income taxes payable. g. Late in 2024, NRRC paid cash dividends of $38,000. h. For store fixtures, NRRC uses the straight-line depreciation method, over five years, with zero residual value. Requirement 3. Prepare NRRC's balance sheet at December 31, 2024. National Reserve Rare Coins Balance Sheet December 31, 2024 Assets Current Assets: Cash Accounts Receivable Merchandise Inventory Total Current Assets Property, Plant, and Equipment: Store Fixtures Total Assets 44000 254,000 Liabilities Current Liabilities: Accounts Payable Salaries Payable Total Current Liabilities Stockholders' Equity Common Stock Retained Earnings 44,000 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 69 90,000 6,000 96,000 550,000

Step by Step Solution

★★★★★

3.56 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Adjusted Trial Balance National Reserve Rare Coins Adjusted Trial Balance For the Year Ended Decembe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started