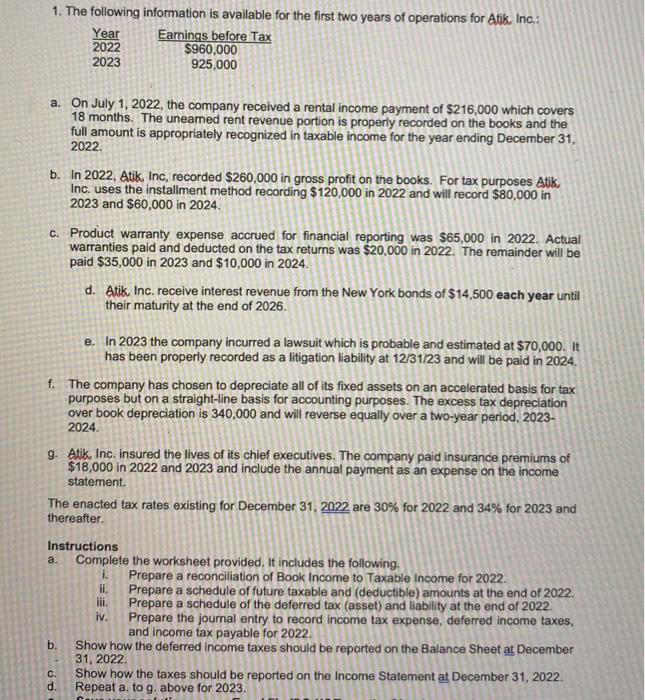

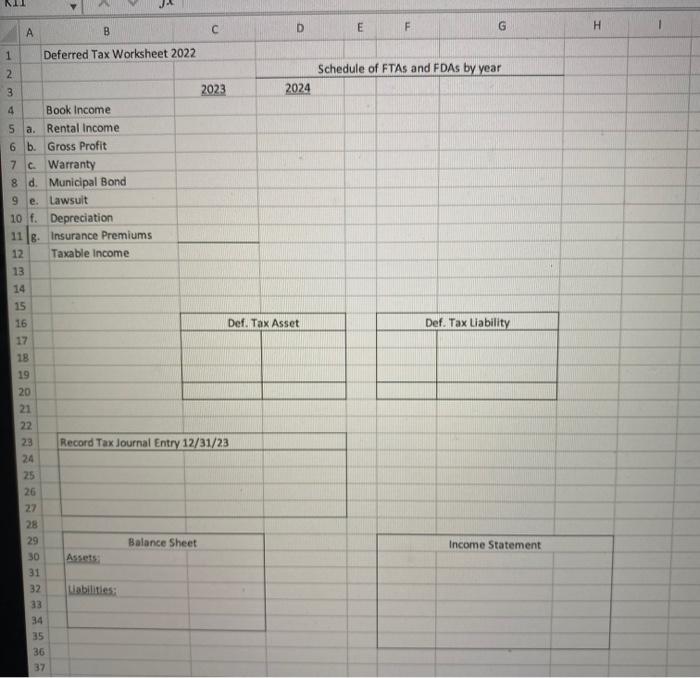

a. On July 1,2022 , the company received a rental income payment of $216,000 which covers 18 months. The unearned rent revenue portion is properly recorded on the books and the full amount is appropriately recognized in taxable income for the year ending December 31 , 2022. b. In 2022, Atik, Inc, recorded $260,000 in gross profit on the books. For tax purposes Atik, Inc. uses the installment method recording $120,000 in 2022 and will record $80,000 in 2023 and $60,000 in 2024. c. Product warranty expense accrued for financial reporting was $65,000 in 2022 . Actual warranties paid and deducted on the tax returns was $20,000 in 2022 . The remainder will be paid $35,000 in 2023 and $10,000 in 2024. d. Atik, Inc. receive interest revenue from the New York bonds of $14,500 each year until their maturity at the end of 2026. e. In 2023 the company incurred a lawsuit which is probable and estimated at $70,000. It has been properly recorded as a litigation liability at 12/31/23 and will be paid in 2024 . f. The company has chosen to depreciate all of its fixed assets on an accelerated basis for tax purposes but on a straight-line basis for accounting purposes. The excess tax depreciation over book depreciation is 340,000 and will reverse equally over a two-year period, 20232024. g. Atik, Inc. insured the lives of its chief executives. The company paid insurance premiums of $18,000 in 2022 and 2023 and include the annual payment as an expense on the income statement. The enacted tax rates existing for December 31,2022 are 30% for 2022 and 34% for 2023 and thereafter. Instructions a. Complete the worksheet provided, It includes the following. i. Prepare a reconciliation of Book Income to Taxable Income for 2022. ii. Prepare a schedule of future taxable and (deductible) amounts at the end of 2022. iii. Prepare a schedule of the deferred tax (asset) and liability at the end of 2022. iv. Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2022. b. Show how the deferred income taxes should be reported on the Balance Sheet at December - 31,2022. c. Show how the taxes should be reported on the income Statement at December 31, 2022. d. Repeat a. to g. above for 2023 . a. On July 1,2022 , the company received a rental income payment of $216,000 which covers 18 months. The unearned rent revenue portion is properly recorded on the books and the full amount is appropriately recognized in taxable income for the year ending December 31 , 2022. b. In 2022, Atik, Inc, recorded $260,000 in gross profit on the books. For tax purposes Atik, Inc. uses the installment method recording $120,000 in 2022 and will record $80,000 in 2023 and $60,000 in 2024. c. Product warranty expense accrued for financial reporting was $65,000 in 2022 . Actual warranties paid and deducted on the tax returns was $20,000 in 2022 . The remainder will be paid $35,000 in 2023 and $10,000 in 2024. d. Atik, Inc. receive interest revenue from the New York bonds of $14,500 each year until their maturity at the end of 2026. e. In 2023 the company incurred a lawsuit which is probable and estimated at $70,000. It has been properly recorded as a litigation liability at 12/31/23 and will be paid in 2024 . f. The company has chosen to depreciate all of its fixed assets on an accelerated basis for tax purposes but on a straight-line basis for accounting purposes. The excess tax depreciation over book depreciation is 340,000 and will reverse equally over a two-year period, 20232024. g. Atik, Inc. insured the lives of its chief executives. The company paid insurance premiums of $18,000 in 2022 and 2023 and include the annual payment as an expense on the income statement. The enacted tax rates existing for December 31,2022 are 30% for 2022 and 34% for 2023 and thereafter. Instructions a. Complete the worksheet provided, It includes the following. i. Prepare a reconciliation of Book Income to Taxable Income for 2022. ii. Prepare a schedule of future taxable and (deductible) amounts at the end of 2022. iii. Prepare a schedule of the deferred tax (asset) and liability at the end of 2022. iv. Prepare the journal entry to record income tax expense, deferred income taxes, and income tax payable for 2022. b. Show how the deferred income taxes should be reported on the Balance Sheet at December - 31,2022. c. Show how the taxes should be reported on the income Statement at December 31, 2022. d. Repeat a. to g. above for 2023