Question

: a) On the role of an accountant, provide information to the management about various cost to be capitalized relevant to the asset in the

: a) On the role of an accountant, provide information to the management about various cost to be capitalized relevant to the asset in the corporation's financial statements.

b) What are the annual charges in the statement of comprehensive income related to the economic benefits arrived out of this asset?

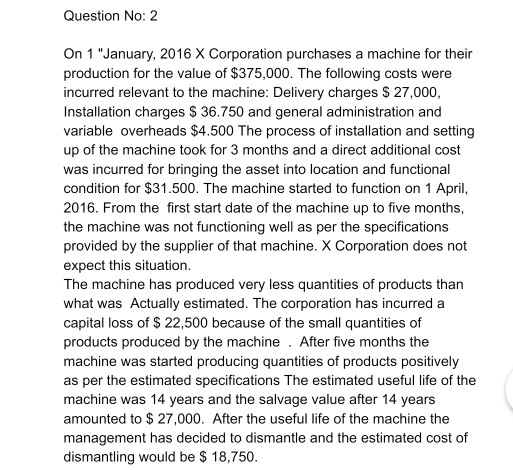

On 1 "January, 2016 X Corporation purchases a machine for their production for the value of $375,000. The following costs were incurred relevant to the machine: Delivery charges $ 27,000, Installation charges $ 36.750 and general administration and variable overheads $4.500 The process of installation and setting up of the machine took for 3 months and a direct additional cost was incurred for bringing the asset into location and functional condition for $31.500. The machine started to function on 1 April, 2016. From the first start date of the machine up to five months, the machine was not functioning well as per the specifications provided by the supplier of that machine. X Corporation does not expect this situation. The machine has produced very less quantities of products than what was Actually estimated. The corporation has incurred a capital loss of $ 22,500 because of the small quantities of products produced by the machine . After five months the machine was started producing quantities of products positively as per the estimated specifications The estimated useful life of the machine was 14 years and the salvage value after 14 years amounted to $ 27,000. After the useful life of the machine the management has decided to dismantle and the estimated cost of dismantling would be $ 18,750.

Required: a) On the role of an accountant, provide information to the management about various cost to be capitalized relevant to the asset in the corporation's financial statements.

Question No: 2 On 1 "January, 2016 X Corporation purchases a machine for their production for the value of $375,000. The following costs were incurred relevant to the machine: Delivery charges $ 27,000, Installation charges $ 36.750 and general administration and variable overheads $4.500 The process of installation and setting up of the machine took for 3 months and a direct additional cost was incurred for bringing the asset into location and functional condition for $31.500. The machine started to function on 1 April, 2016. From the first start date of the machine up to five months, the machine was not functioning well as per the specifications provided by the supplier of that machine. X Corporation does not expect this situation. The machine has produced very less quantities of products than what was Actually estimated. The corporation has incurred a capital loss of $ 22,500 because of the small quantities of products produced by the machine. After five months the machine was started producing quantities of products positively as per the estimated specifications The estimated useful life of the machine was 14 years and the salvage value after 14 years amounted to $ 27,000. After the useful life of the machine the management has decided to dismantle and the estimated cost of dismantling would be $ 18,750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started