Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A one-step binomial tree is used to model the impact of an important announcement on the stock price of Company XYZ. There is a

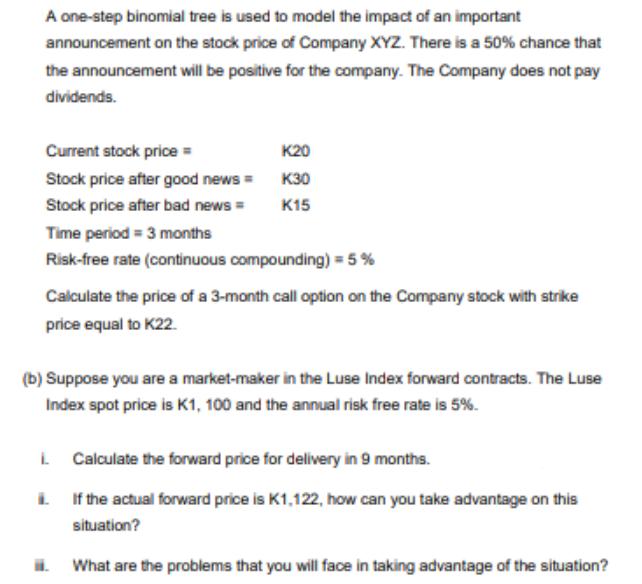

A one-step binomial tree is used to model the impact of an important announcement on the stock price of Company XYZ. There is a 50% chance that the announcement will be positive for the company. The Company does not pay dividends. Current stock price = K20 Stock price after good news = K30 Stock price after bad news = K15 Time period = 3 months Risk-free rate (continuous compounding) = 5% Calculate the price of a 3-month call option on the Company stock with strike price equal to K22. (b) Suppose you are a market-maker in the Luse Index forward contracts. The Luse Index spot price is K1, 100 and the annual risk free rate is 5%. Calculate the forward price for delivery in 9 months. i. If the actual forward price is K1,122, how can you take advantage on this situation? What are the problems that you will face in taking advantage of the situation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Call Option Price using Binomial Tree Given Current Stock Price S K20 Stock Price Up Su K30 Stock Price Down Sd K15 Time period t 3 months 025 years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started