Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Pacific Filght PLC has in issue K500,000 10% irredeemable debentures. Investors currently require 8% return per annum. What will be the market value

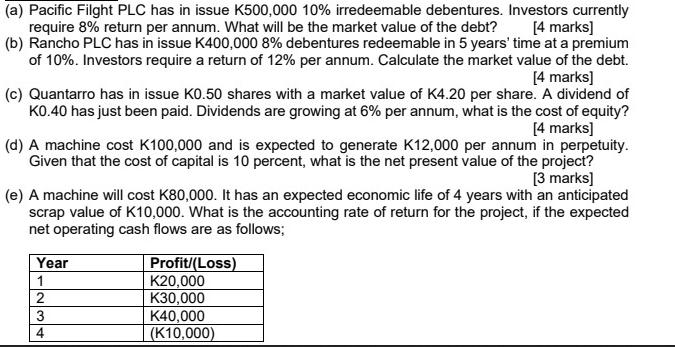

(a) Pacific Filght PLC has in issue K500,000 10% irredeemable debentures. Investors currently require 8% return per annum. What will be the market value of the debt? [4 marks] (b) Rancho PLC has in issue K400,000 8% debentures redeemable in 5 years' time at a premium of 10%. Investors require a return of 12% per annum. Calculate the market value of the debt. [4 marks] (c) Quantarro has in issue K0.50 shares with a market value of K4.20 per share. A dividend of KO.40 has just been paid. Dividends are growing at 6% per annum, what is the cost of equity? [4 marks] (d) A machine cost K100,000 and is expected to generate K12,000 per annum in perpetuity. Given that the cost of capital is 10 percent, what is the net present value of the project? [3 marks] (e) A machine will cost K80,000. It has an expected economic life of 4 years with an anticipated scrap value of K10,000. What is the accounting rate of return for the project, if the expected net operating cash flows are as follows; Year 1 2 3 4 Profit/(Loss) K20,000 K30,000 K40,000 (K10,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started