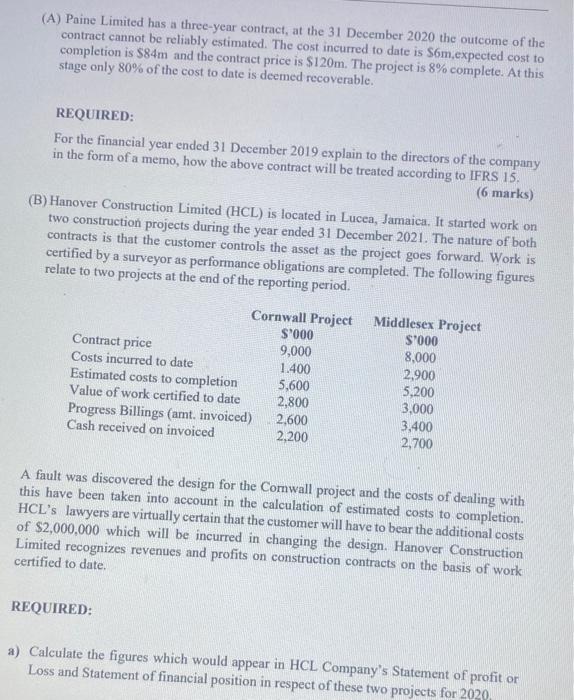

(A) Paine Limited has a three-year contract, at the 31 December 2020 the outcome of the contract cannot be reliably estimated. The cost incurred to date is $6m,expected cost to completion is 584m and the contract price is $120m. The project is 8% complete. At this stage only 80% of the cost to date is deemed recoverable. REQUIRED: For the financial year ended 31 December 2019 explain to the directors of the company in the form of a memo, how the above contract will be treated according to IFRS 15. ( 6 marks) (B) Hanover Construction Limited (HCL) is located in Lucea, Jamaica. It started work on two construction projects during the year ended 31 December 2021 . The nature of both contracts is that the customer controls the asset as the project goes forward. Work is certified by a surveyor as performance obligations are completed. The following figures relate to two projects at the end of the reporting period. A fault was discovered the design for the Cornwall project and the costs of dealing with this have been taken into account in the calculation of estimated costs to completion. HCL's lawyers are virtually certain that the customer will have to bear the additional costs of $2,000,000 which will be incurred in changing the design. Hanover Construction Limited recognizes revenues and profits on construction contracts on the basis of work certified to date. REQUIRED: a) Calculate the figures which would appear in HCL Company's Statement of profit or Loss and Statement of financial position in respect of these two projects for 2020 (A) Paine Limited has a three-year contract, at the 31 December 2020 the outcome of the contract cannot be reliably estimated. The cost incurred to date is $6m,expected cost to completion is 584m and the contract price is $120m. The project is 8% complete. At this stage only 80% of the cost to date is deemed recoverable. REQUIRED: For the financial year ended 31 December 2019 explain to the directors of the company in the form of a memo, how the above contract will be treated according to IFRS 15. ( 6 marks) (B) Hanover Construction Limited (HCL) is located in Lucea, Jamaica. It started work on two construction projects during the year ended 31 December 2021 . The nature of both contracts is that the customer controls the asset as the project goes forward. Work is certified by a surveyor as performance obligations are completed. The following figures relate to two projects at the end of the reporting period. A fault was discovered the design for the Cornwall project and the costs of dealing with this have been taken into account in the calculation of estimated costs to completion. HCL's lawyers are virtually certain that the customer will have to bear the additional costs of $2,000,000 which will be incurred in changing the design. Hanover Construction Limited recognizes revenues and profits on construction contracts on the basis of work certified to date. REQUIRED: a) Calculate the figures which would appear in HCL Company's Statement of profit or Loss and Statement of financial position in respect of these two projects for 2020