Answered step by step

Verified Expert Solution

Question

1 Approved Answer

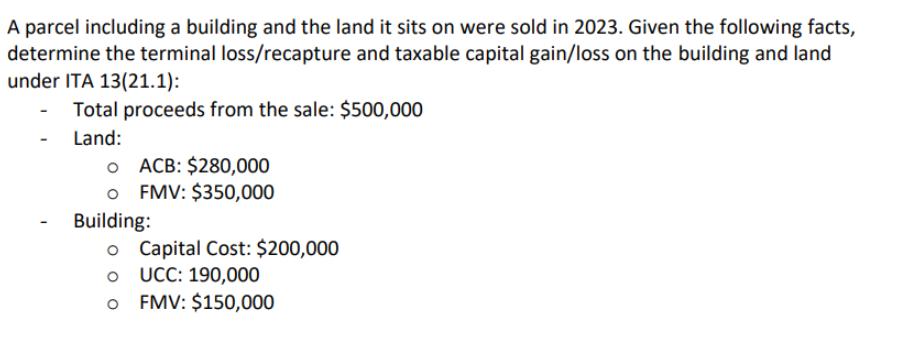

A parcel including a building and the land it sits on were sold in 2023. Given the following facts, determine the terminal loss/recapture and

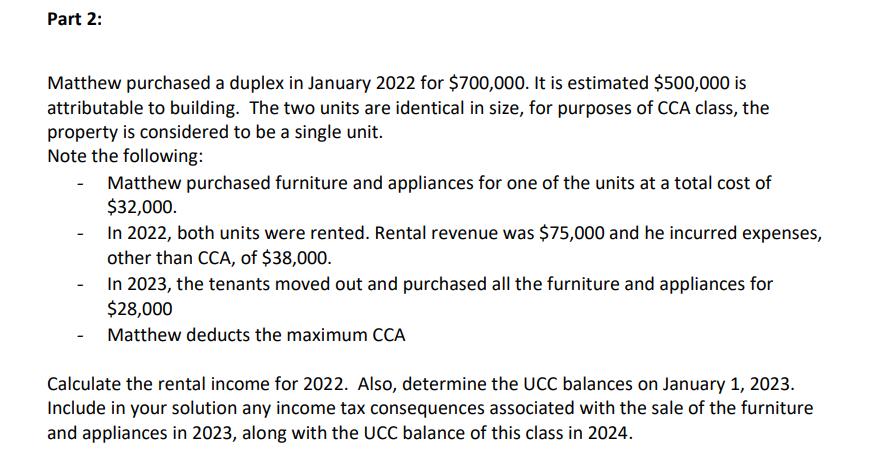

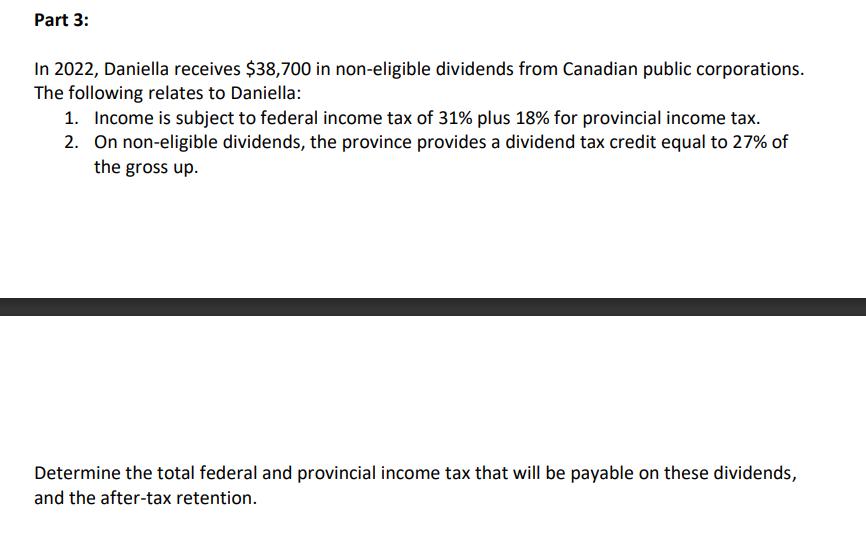

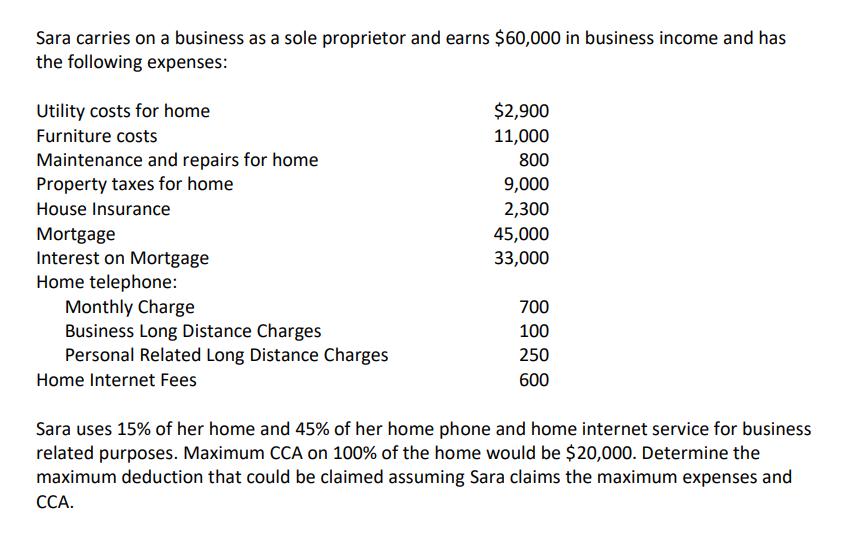

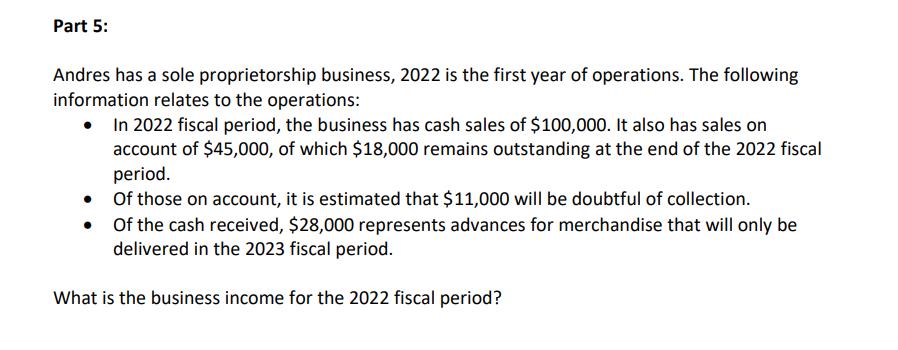

A parcel including a building and the land it sits on were sold in 2023. Given the following facts, determine the terminal loss/recapture and taxable capital gain/loss on the building and land under ITA 13(21.1): Total proceeds from the sale: $500,000 Land: o ACB: $280,000 o FMV: $350,000 Building: o Capital Cost: $200,000 o UCC: 190,000 FMV: $150,000 Part 2: Matthew purchased a duplex in January 2022 for $700,000. It is estimated $500,000 is attributable to building. The two units are identical in size, for purposes of CCA class, the property is considered to be a single unit. Note the following: Matthew purchased furniture and appliances for one of the units at a total cost of $32,000. In 2022, both units were rented. Rental revenue was $75,000 and he incurred expenses, other than CCA, of $38,000. In 2023, the tenants moved out and purchased all the furniture and appliances for $28,000 Matthew deducts the maximum CCA Calculate the rental income for 2022. Also, determine the UCC balances on January 1, 2023. Include in your solution any income tax consequences associated with the sale of the furniture and appliances in 2023, along with the UCC balance of this class in 2024. Part 3: In 2022, Daniella receives $38,700 in non-eligible dividends from Canadian public corporations. The following relates to Daniella: 1. Income is subject to federal income tax of 31% plus 18% for provincial income tax. 2. On non-eligible dividends, the province provides a dividend tax credit equal to 27% of the gross up. Determine the total federal and provincial income tax that will be payable on these dividends, and the after-tax retention. Sara carries on a business as a sole proprietor and earns $60,000 in business income and has the following expenses: Utility costs for home Furniture costs Maintenance and repairs for home Property taxes for home House Insurance Mortgage Interest on Mortgage Home telephone: Monthly Charge Business Long Distance Charges Personal Related Long Distance Charges Home Internet Fees $2,900 11,000 800 9,000 2,300 45,000 33,000 700 100 250 600 Sara uses 15% of her home and 45% of her home phone and home internet service for business related purposes. Maximum CCA on 100% of the home would be $20,000. Determine the maximum deduction that could be claimed assuming Sara claims the maximum expenses and CCA. Part 5: Andres has a sole proprietorship business, 2022 is the first year of operations. The following information relates to the operations: In 2022 fiscal period, the business has cash sales of $100,000. It also has sales on account of $45,000, of which $18,000 remains outstanding at the end of the 2022 fiscal period. Of those on account, it is estimated that $11,000 will be doubtful of collection. Of the cash received, $28,000 represents advances for merchandise that will only be delivered in the 2023 fiscal period. What is the business income for the 2022 fiscal period?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Land ACB 280000 FMV 350000 Capital gain on land 350000 280000 70000 Building Capital Cost 200...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started