Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 A parent makes an interest-bearing loan to its 90%-owned subsidiary in 2016, which is still outstanding in 2017. The eliminating entries (1) on

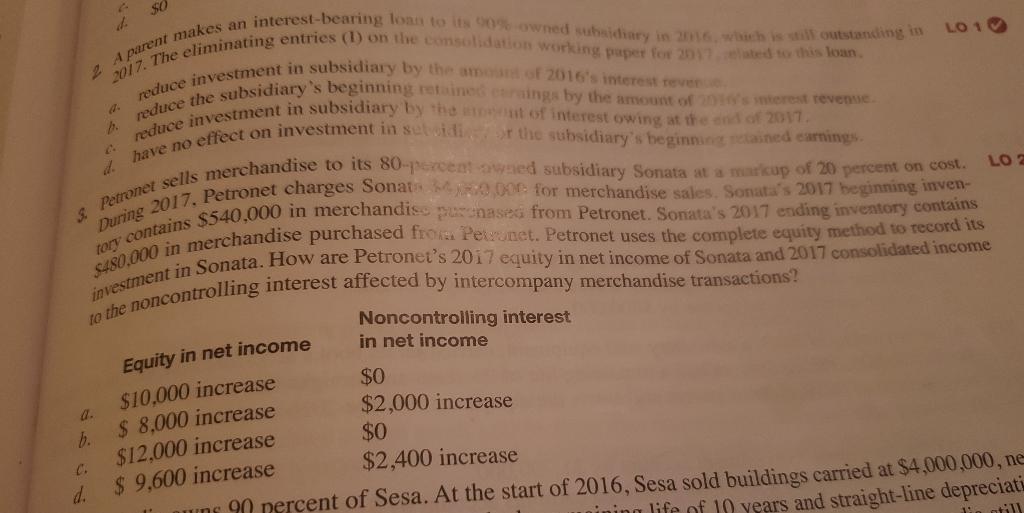

2 A parent makes an interest-bearing loan to its 90%-owned subsidiary in 2016, which is still outstanding in 2017. The eliminating entries (1) on the consolidation working paper for 2017, elated to this loan. reduce investment in subsidiary by the amount of 2016's interest revere b. reduce the subsidiary's beginning retained earnings by the amount of 2016's interest revenue. reduce investment in subsidiary by the moont of interest owing at the end of 2017. d. have no effect on investment in seboidi or the subsidiary's beginning retained earnings. & Petronet sells merchandise to its 80-percent owned subsidiary Sonata at a markup of 20 percent on cost. During 2017, Petronet charges Sonate $40,000 for merchandise sales. Sonata's 2017 beginning inven- $480,000 in merchandise purchased from Petronet. Petronet uses the complete equity method to record its tory contains $540,000 in merchandise purchases from Petronet. Sonata's 2017 ending inventory contains investment in Sonata. How are Petronet's 2017 equity in net income of Sonata and 2017 consolidated income to the noncontrolling interest affected by intercompany merchandise transactions? $0 a. Equity in net income $10,000 increase $8,000 increase $12,000 increase C. d. $ 9,600 increase b. LO 1 LO 2 Noncontrolling interest in net income $0 $2,000 increase $0 $2,400 increase uns 90 percent of Sesa. At the start of 2016, Sesa sold buildings carried at $4,000,000, ne nining life of 10 years and straight-line depreciati die still

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Sonatas Closing Inventory 480000 Sonatas Beginning Inventory 540000 If P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started