Answered step by step

Verified Expert Solution

Question

1 Approved Answer

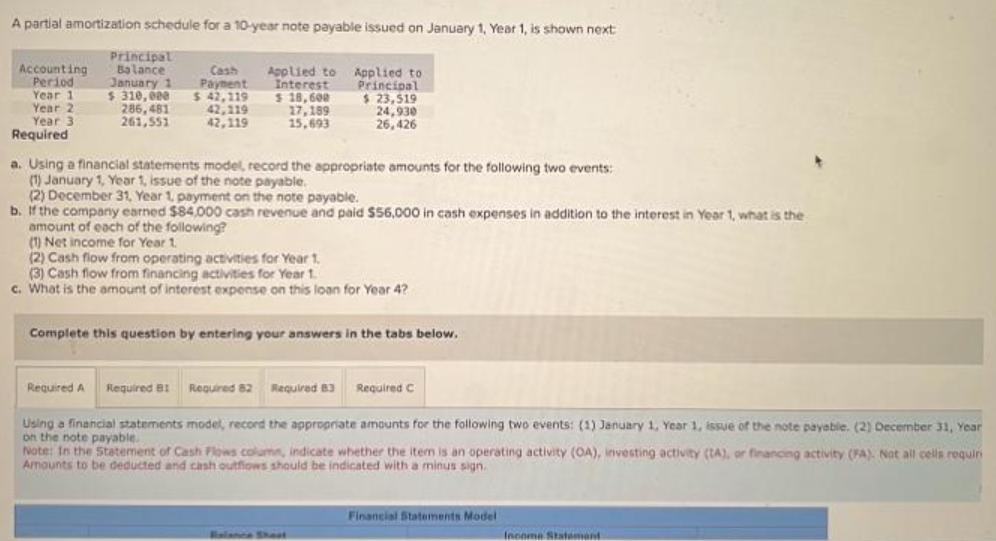

A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next Accounting Principal Balance Period Year 1

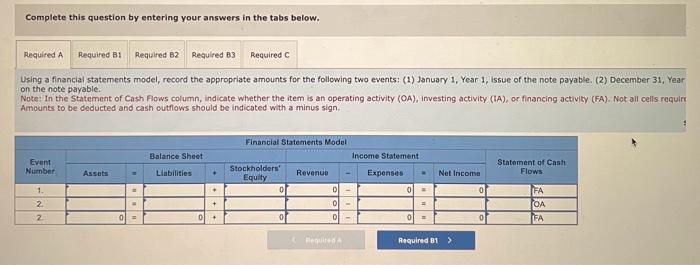

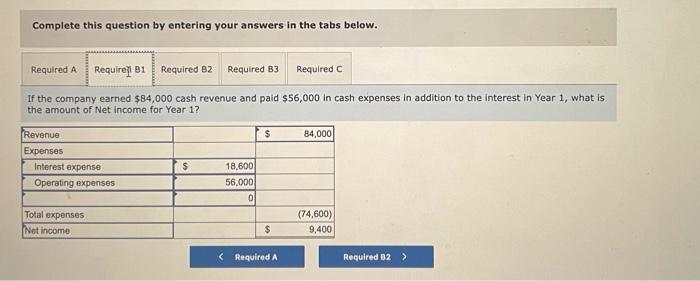

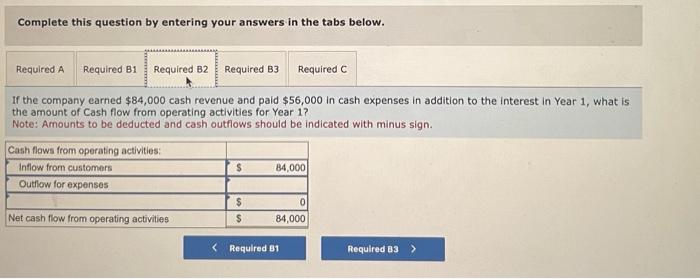

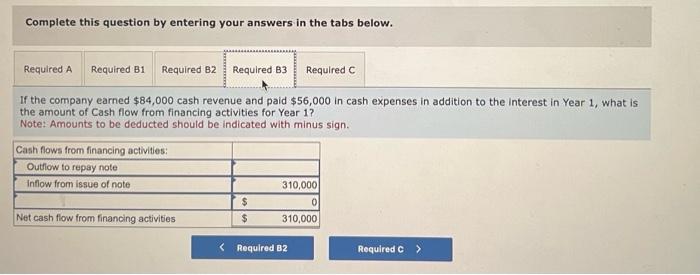

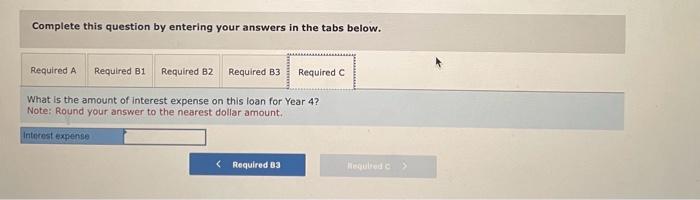

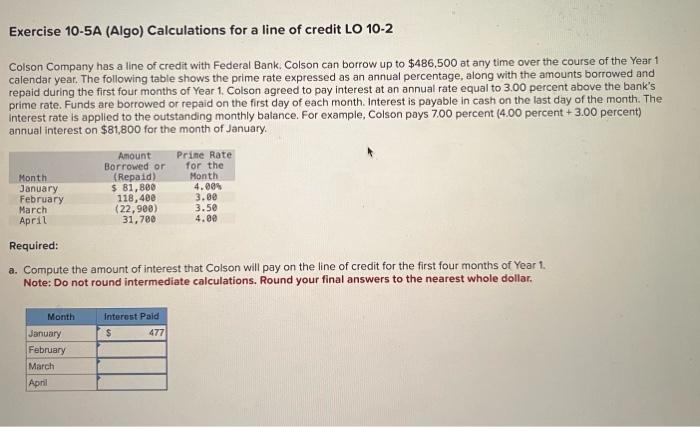

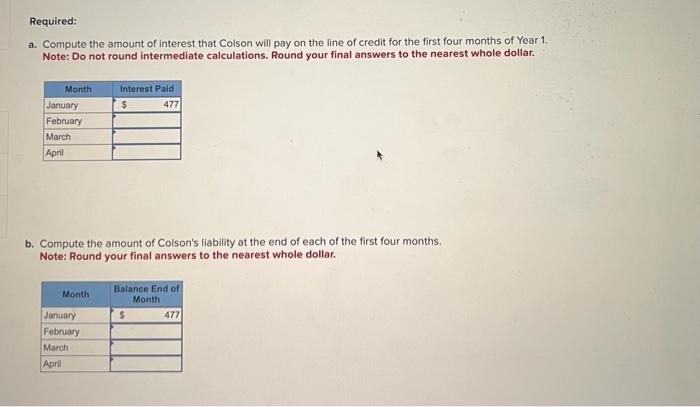

A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next Accounting Principal Balance Period Year 1 Year 2 January 1 $310,000 286,481 Cash Payment $42,119 Applied to Interest Applied to Principal $18,600 42,119 17,189 Year 3 Required 261,551 42,119 15,693 $23,519 24,930 26,426 a. Using a financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $84,000 cash revenue and paid $56,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following? (1) Net income for Year 1. (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1. c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required B1 Required 82 Required B3 Required C Using a financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, issue of the note payable. (2) December 31, Year on the note payable. Note: In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (TA), or financing activity (FA). Not all cells requiri Amounts to be deducted and cash outflows should be indicated with a minus sign. Financial Statements Model Income Statement Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required 83 Required C Using a financial statements model, record the appropriate amounts for the following two events: (1) January 1, Year 1, Issue of the note payable. (2) December 31, Year on the note payable. Note: In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells require Amounts to be deducted and cash outflows should be indicated with a minus sign. Balance Sheet Event Number Assets Liabilities 1. 2. 2 Stockholders' Equity Revenue + D D + 0 = 0 + 0 - Financial Statements Model Income Statement Expenses Net Income Statement of Cash Flows 0 of FA OA FA = Required A Required B1> Complete this question by entering your answers in the tabs below. Required A Require B1 Required B2 Required B3 Required C If the company earned $84,000 cash revenue and paid $56,000 in cash expenses in addition to the interest in Year 1, what is the amount of Net income for Year 1? Revenue $ 84,000 Expenses Interest expense $ 18,600 Operating expenses 56,000 0 Total expenses Net income $ (74,600) 9,400 Required B2 > < Required A Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required C If the company earned $84,000 cash revenue and paid $56,000 in cash expenses in addition to the interest in Year 1, what is the amount of Cash flow from operating activities for Year 1? Note: Amounts to be deducted and cash outflows should be indicated with minus sign. Cash flows from operating activities: Inflow from customers $ 84,000 Outflow for expenses $ 0 Net cash flow from operating activities $ 84,000 Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required C If the company earned $84,000 cash revenue and paid $56,000 in cash expenses in addition to the interest in Year 1, what is the amount of Cash flow from financing activities for Year 1? Note: Amounts to be deducted should be indicated with minus sign. Cash flows from financing activities: Outflow to repay note Inflow from issue of note $ 310,000 0 Net cash flow from financing activities $ 310,000 Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required C What is the amount of interest expense on this loan for Year 4? Note: Round your answer to the nearest dollar amount. Interest expense < Required 83 Required C> Exercise 10-5A (Algo) Calculations for a line of credit LO 10-2 Colson Company has a line of credit with Federal Bank. Colson can borrow up to $486,500 at any time over the course of the Year 1 calendar year. The following table shows the prime rate expressed as an annual percentage, along with the amounts borrowed and repaid during the first four months of Year 1. Colson agreed to pay interest at an annual rate equal to 3.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 7.00 percent (4.00 percent +3.00 percent) annual interest on $81,800 for the month of January. Amount Borrowed or (Repaid) Prime Rate for the Month $ 81,800 4.00% 118,400 3.00 (22,900) 3.50 31,700 4.00 Month January February March April Required: a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of Year 1. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Month January February March April Interest Paid $ 477 Required: a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of Year 1. Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar. Month January February Interest Paid $ 477 March April b. Compute the amount of Colson's liability at the end of each of the first four months. Note: Round your final answers to the nearest whole dollar. Balance End of Month Month January $ February March April 477

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started