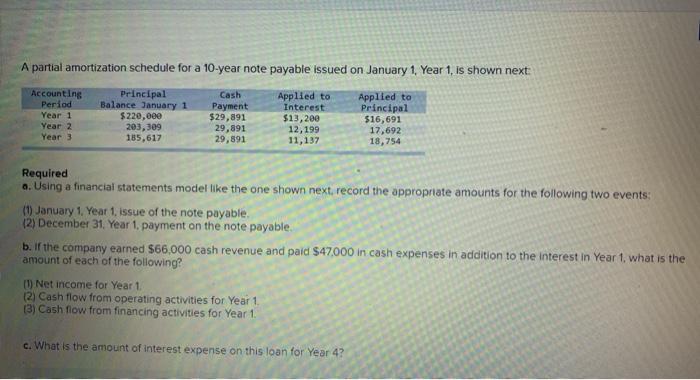

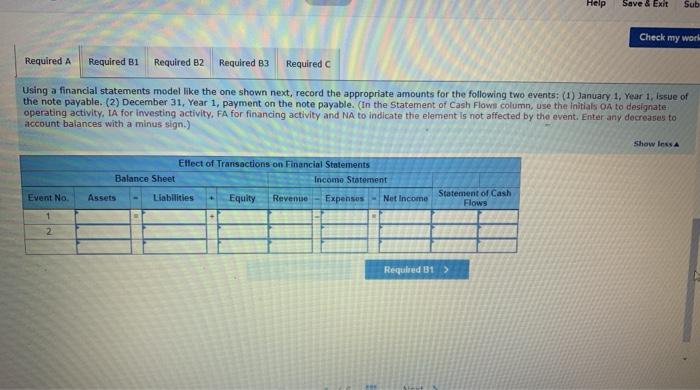

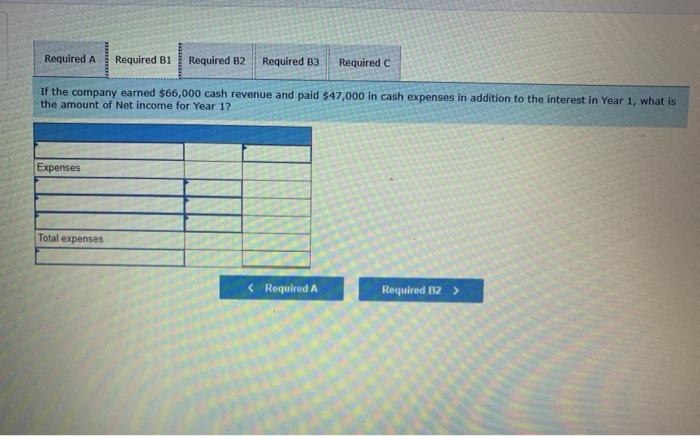

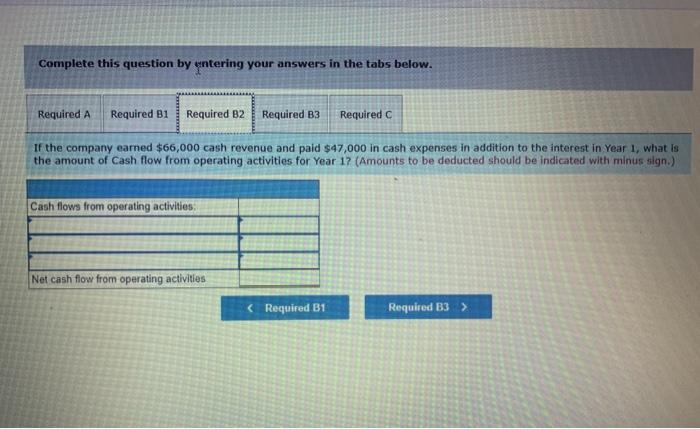

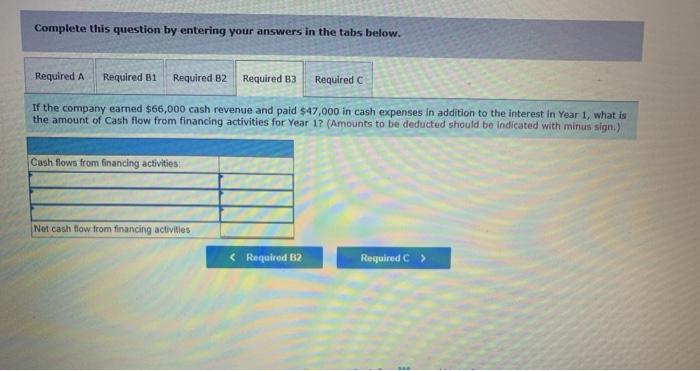

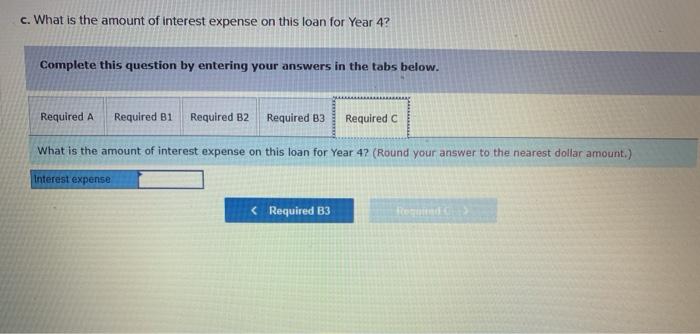

A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next: Accounting Principal Cash Applied to Applied to Period Balance January 1 Payment Interest Principal Year 1 $220,000 $29,891 $13,200 $16,691 Year 2 203,309 29,891 12,199 17,692 Year 3 185,617 29,891 11,137 18, 754 Required o. Using a financial statements model like the one shown next record the appropriate amounts for the following two events: (1) January 1 Year 1, issue of the note payable (2) December 31 Year 1. payment on the note payable. b. If the company earned $66.000 cash revenue and paid $47.000 in cash expenses in addition to the interest in Year 1 what is the amount of each of the following? (1) Net income for Year 1 (2) Cash flow from operating activities for Year 1 (3) Cash flow from financing activities for Year 1 c. What is the amount of interest expense on this loan for Year 4? Help Save & Exit Sub Check my work Required A Required B1 Required B2 Required B3 Required Using a financial statements model like the one shown next, record the appropriate amounts for the following two events: (1) January 1, Year 1, Issue of the note payable. (2) December 31, Year 1, payment on the note payable. (In the Statement of Cash Flows column, use the initials on to designate operating activity, IA for investing activity, FA for financing activity and NA to indicate the element is not affected by the event. Enter any decreases to account balances with a minus sign.) Show less Effect of Transactions on Financial Statements Balance Sheet Income Statement Assets Liabilities Equity Revenue Expenses Net Income Event No Statement of Cash Flows 2 Required 31 > Required A Required B1 Required 82 Required B3 Required C If the company earned $66,000 cash revenue and paid $47,000 in cash expenses in addition to the interest in Year 1, what is the amount of Net income for Year 12 Expenses Total expenses Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required If the company carned $66,000 cash revenue and paid $47,000 in cash expenses in addition to the interest in Year I, what is the amount of cash flow from operating activities for Year 12 (Amounts to be deducted should be indicated with minus sign.) Cash flows from operating activities Net cash flow from operating activities Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required If the company earned $66,000 cash revenue and paid $47,000 in cash expenses in addition to the interest in Year 1, what is the amount of Cash flow from financing activities for Year 1? (Amounts to be deducted should be indicated with minus sign.) Cash flows from financing activities Net cash flow from financing activities