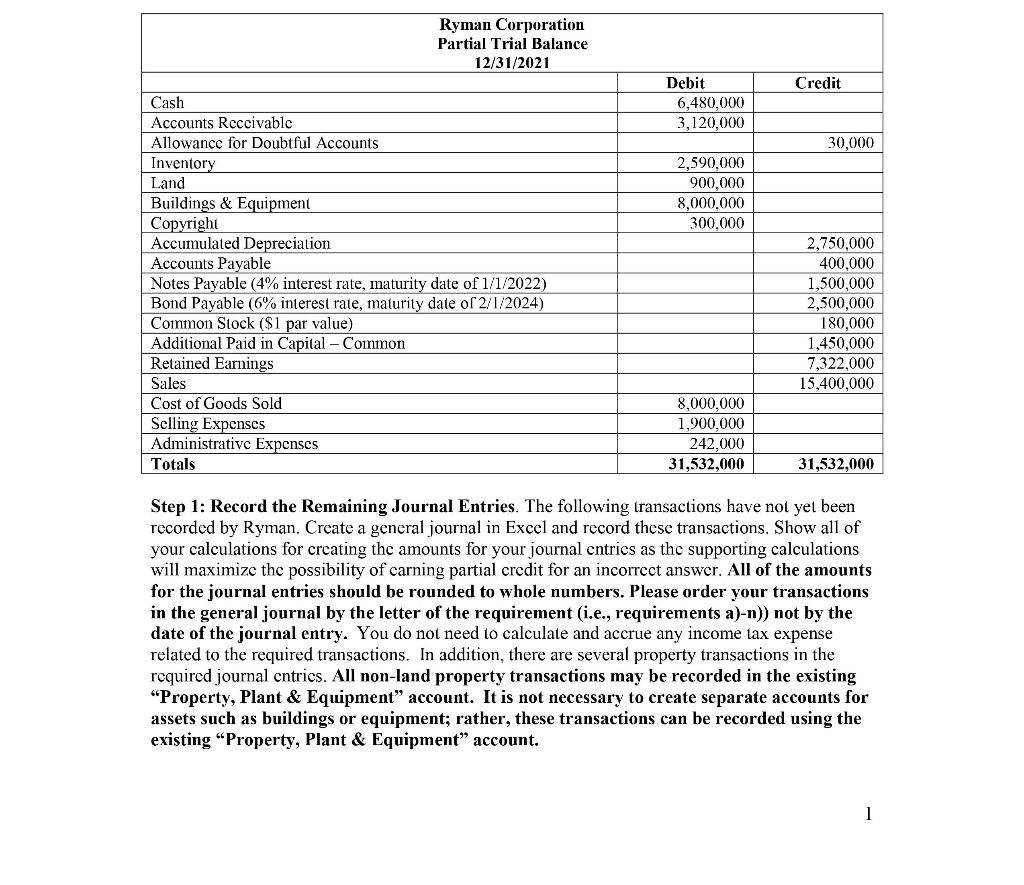

A partial trial balance for the Ryman Corporation is presented in the table below. Ryman has recorded some, but not all, of its transactions for

A partial trial balance for the Ryman Corporation is presented in the table below. Ryman has recorded some, but not all, of its transactions for the current reporting period, the year ending December 31, 2021. Record journal entries in a general journal, post these entries into a general ledger (T accounts), complete an adjusted trial balance, prepare three of the four financial statements (an Income Statement, a Statement of Changes in Stockholders? Equity, and a Balance Sheet), prepare closing entries for the period and prepare a post-closing trial balance. The steps for completing this project are presented below the trial balance.

Step 2: Create a General Ledger, Calculate the Ending Balances for the Accounts, and Prepare an Adjusted Trial Balance.

Step 3:?Prepare the Financial Statements

Step 4: Prepare the Closing Journal Entries and Prepare a Post-Closing Trial Balance.

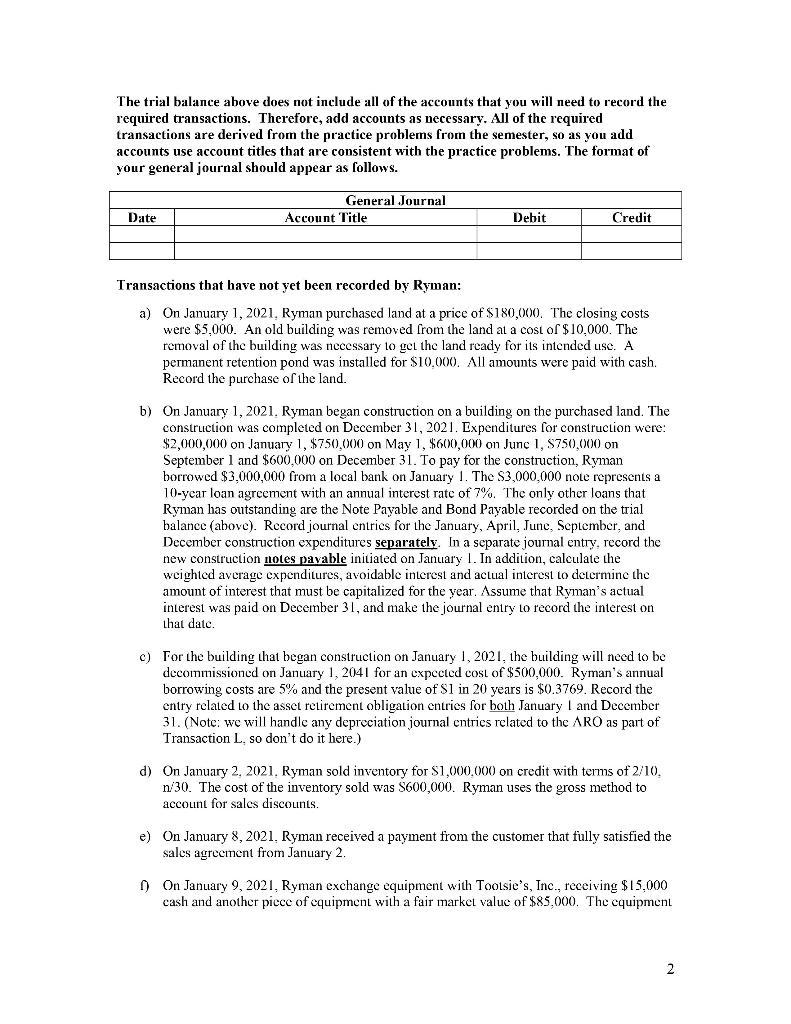

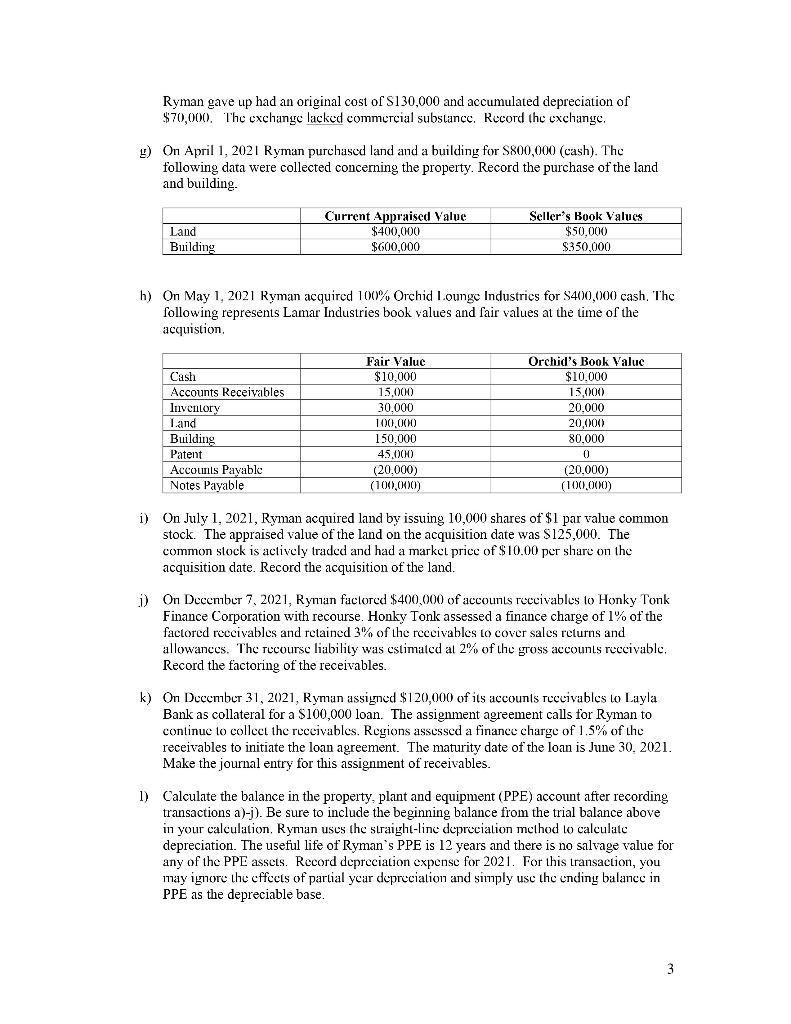

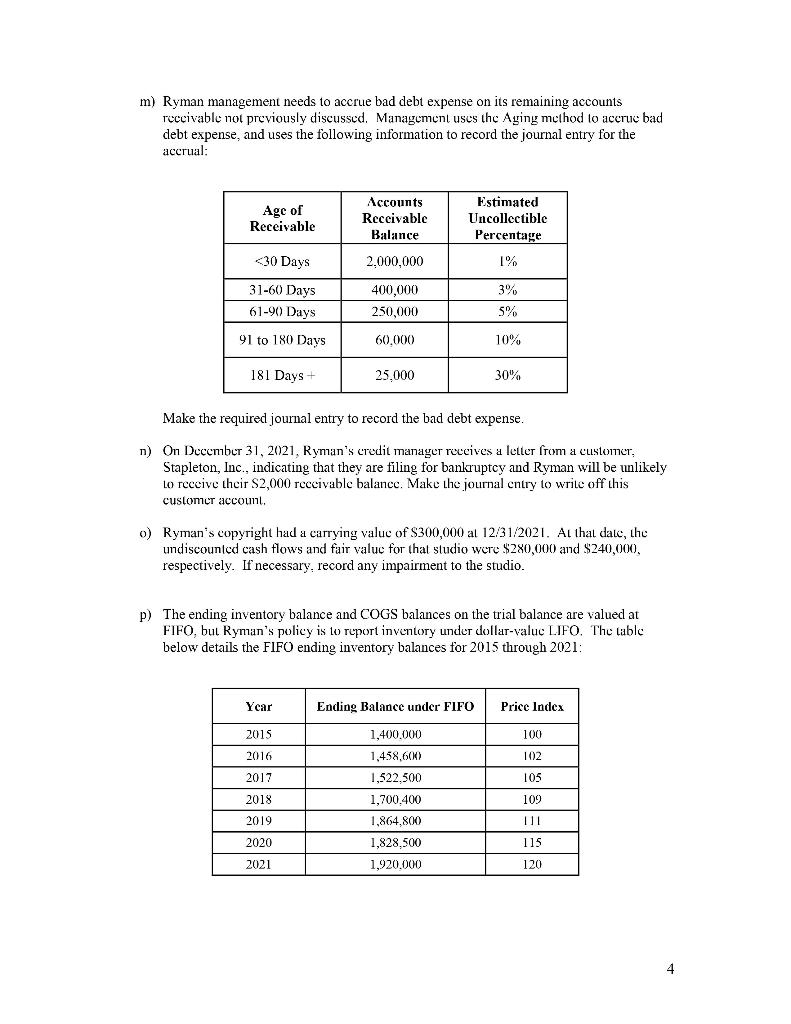

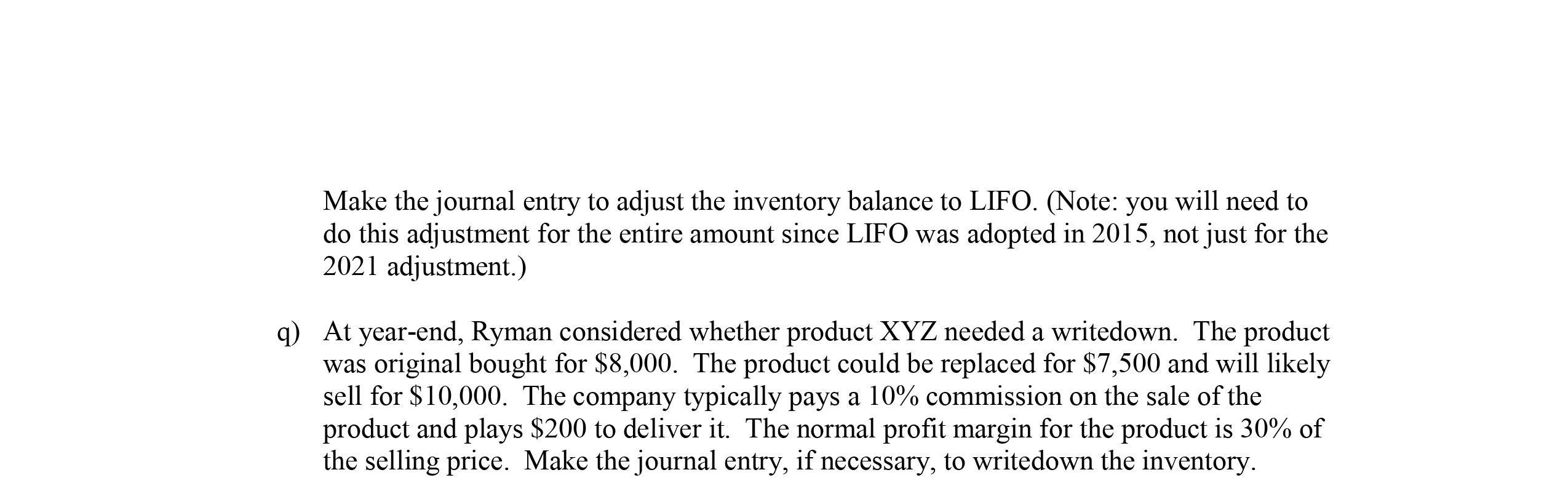

Cash Accounts Receivable. Allowance for Doubtful Accounts Inventory Land Buildings & Equipment Copyright Accumulated Depreciation Accounts Payable Ryman Corporation Partial Trial Balance 12/31/2021 Debit Credit 6,480,000 3,120,000 30,000 2,590,000 900,000 8,000,000 300,000 2,750,000 400,000 Notes Payable (4% interest rate, maturity date of 1/1/2022) Bond Payable (6% interest rate, maturity date of 2/1/2024) Common Stock ($1 par value) 1,500,000 2,500,000 180,000 Additional Paid in Capital - Common Retained Earnings Sales Cost of Goods Sold Selling Expenses Administrative Expenses Totals 1,450,000 7,322,000 15,400,000 8,000,000 1,900,000 242,000 31,532,000 31,532,000 Step 1: Record the Remaining Journal Entries. The following transactions have not yet been recorded by Ryman. Create a general journal in Excel and record these transactions. Show all of your calculations for creating the amounts for your journal entries as the supporting calculations will maximize the possibility of carning partial credit for an incorrect answer. All of the amounts for the journal entries should be rounded to whole numbers. Please order your transactions in the general journal by the letter of the requirement (i.e., requirements a)-n)) not by the date of the journal entry. You do not need to calculate and accrue any income tax expense related to the required transactions. In addition, there are several property transactions in the required journal entries. All non-land property transactions may be recorded in the existing "Property, Plant & Equipment" account. It is not necessary to create separate accounts for assets such as buildings or equipment; rather, these transactions can be recorded using the existing "Property, Plant & Equipment" account. 1

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To proceed lets outline the steps for creating and completing the financial documents as requested Step 1 Record the Remaining Journal Entries Follow ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started