Question

A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney, Inc., defined benefit pension plan follows. Six years earlier, Carney revised

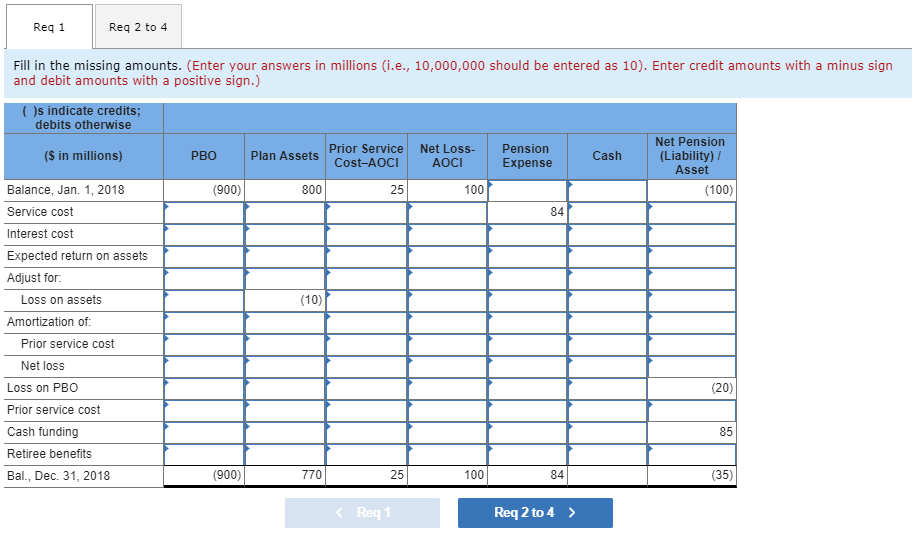

A partially completed pension spreadsheet showing the relationships among the elements that constitute Carney, Inc., defined benefit pension plan follows. Six years earlier, Carney revised its pension formula and recalculated benefits earned by employees in prior years using the more generous formula. The prior service cost created by the recalculation is being amortized at the rate of $4 million per year. At the end of 2018, the pension formula was amended again, creating an additional prior service cost of $45 million. The expected rate of return on assets and the actuarys discount rate were 10%, and the average remaining service life of the active employee group is 10 years. Required:

1. Fill in the missing amounts. 2. to 4. Prepare all the necessary journal entries for 2018.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started