Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A particularly difficult issue with revenue recognition occurs when multiple elements are essentially sold to the customer in one transaction (in accounting lingo this

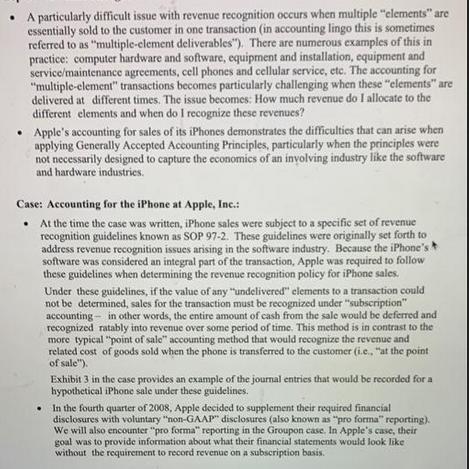

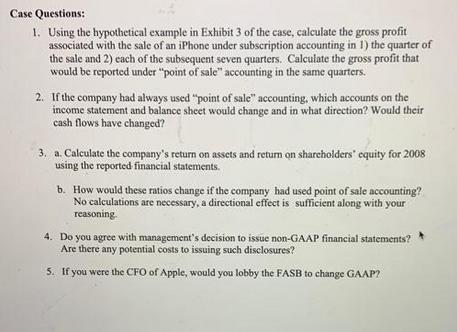

A particularly difficult issue with revenue recognition occurs when multiple "elements" are essentially sold to the customer in one transaction (in accounting lingo this is sometimes referred to as "multiple-element deliverables"). There are numerous examples of this in practice: computer hardware and software, equipment and installation, equipment and service/maintenance agreements, cell phones and cellular service, etc. The accounting for "multiple-element" transactions becomes particularly challenging when these "elements" are delivered at different times. The issue becomes: How much revenue do I allocate to the different elements and when do I recognize these revenues? Apple's accounting for sales of its iPhones demonstrates the difficulties that can arise when applying Generally Accepted Accounting Principles, particularly when the principles were not necessarily designed to capture the economics of an involving industry like the software and hardware industries. Case: Accounting for the iPhone at Apple, Inc.: At the time the case was written, iPhone sales were subject to a specific set of revenue recognition guidelines known as SOP 97-2. These guidelines were originally set forth to address revenue recognition issues arising in the software industry. Because the iPhone's h software was considered an integral part of the transaction, Apple was required to follow these guidelines when determining the revenue recognition policy for iPhone sales. Under these guidelines, if the value of any "undelivered" elements to a transaction could not be determined, sales for the transaction must be recognized under "subscription" accounting in other words, the entire amount of cash from the sale would be deferred and recognized ratably into revenue over some period of time. This method is in contrast to the more typical "point of sale" accounting method that would recognize the revenue and related cost of goods sold when the phone is transferred to the customer (i.e.. "at the point of sale"). Exhibit 3 in the case provides an example of the journal entries that would be recorded for a hypothetical iPhone sale under these guidelines. In the fourth quarter of 2008, Apple decided to supplement their required financial disclosures with voluntary "non-GAAP" disclosures (also known as "pro forma" reporting). We will also encounter "pro forma" reporting in the Groupon case. In Apple's case, their goal was to provide information about what their financial statements would look like without the requirement to record revenue on a subscription basis. Case Questions: 1. Using the hypothetical example in Exhibit 3 of the case, calculate the gross profit associated with the sale of an iPhone under subscription accounting in 1) the quarter of the sale and 2) each of the subsequent seven quarters. Calculate the gross profit that would be reported under "point of sale" accounting in the same quarters. 2. If the company had always used "point of sale" accounting, which accounts on the income statement and balance sheet would change and in what direction? Would their cash flows have changed? 3. a. Calculate the company's return on assets and return on shareholders' equity for 2008 using the reported financial statements. b. How would these ratios change if the company had used point of sale accounting? No calculations are necessary, a directional effect is sufficient along with your reasoning. 4. Do you agree with management's decision to issue non-GAAP financial statements? Are there any potential costs to issuing such disclosures? 5. If you were the CFO of Apple, would you lobby the FASB to change GAAP?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started