Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A partnership has the following capital balances: Germanese, Capital $640,000 Arent, Capital $250,000 Vertus, Capital $115,000 Profits and losses are currently split 10:7:3 Ryan

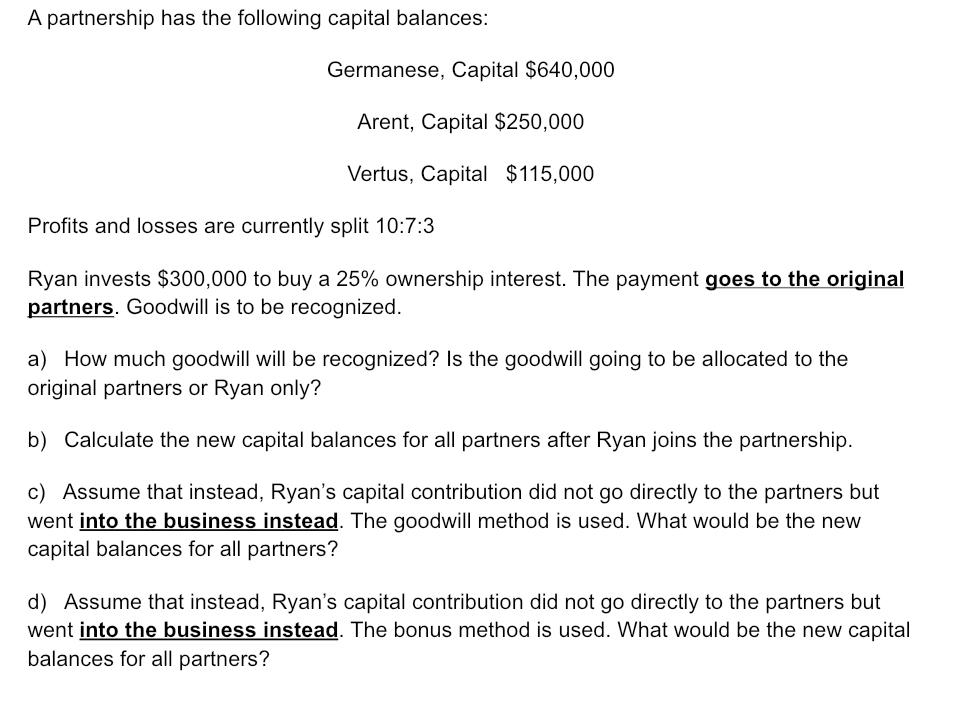

A partnership has the following capital balances: Germanese, Capital $640,000 Arent, Capital $250,000 Vertus, Capital $115,000 Profits and losses are currently split 10:7:3 Ryan invests $300,000 to buy a 25% ownership interest. The payment goes to the original partners. Goodwill is to be recognized. a) How much goodwill will be recognized? Is the goodwill going to be allocated to the original partners or Ryan only? b) Calculate the new capital balances for all partners after Ryan joins the partnership. c) Assume that instead, Ryan's capital contribution did not go directly to the partners but went into the business instead. The goodwill method is used. What would be the new capital balances for all partners? d) Assume that instead, Ryan's capital contribution did not go directly to the partners but went into the business instead. The bonus method is used. What would be the new capital balances for all partners?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided in the image we need to address the questions about the recognition of goodwill and the new capital balances in a partnership after Ryans investment Lets go through e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started