Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A partnership is considering possible liquidation because one of the partners (Bell) is personally insolvent. Profits and losses are divided on a 4:3:2:1 basis,

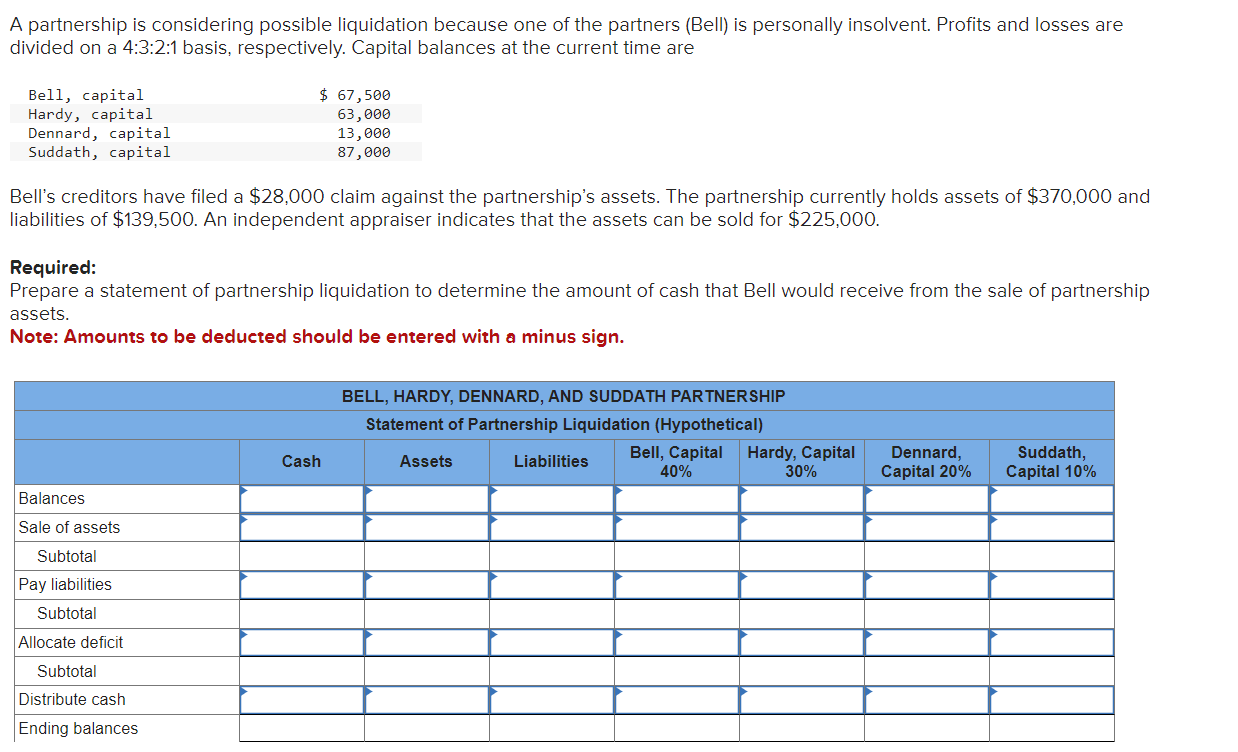

A partnership is considering possible liquidation because one of the partners (Bell) is personally insolvent. Profits and losses are divided on a 4:3:2:1 basis, respectively. Capital balances at the current time are Bell, capital Hardy, capital Dennard, capital Suddath, capital $ 67,500 63,000 13,000 87,000 Bell's creditors have filed a $28,000 claim against the partnership's assets. The partnership currently holds assets of $370,000 and liabilities of $139,500. An independent appraiser indicates that the assets can be sold for $225,000. Required: Prepare a statement of partnership liquidation to determine the amount of cash that Bell would receive from the sale of partnership assets. Note: Amounts to be deducted should be entered with a minus sign. Balances Sale of assets Subtotal Pay liabilities Subtotal Allocate deficit Subtotal Distribute cash Ending balances Cash BELL, HARDY, DENNARD, AND SUDDATH PARTNERSHIP Statement of Partnership Liquidation (Hypothetical) Assets Liabilities Bell, Capital 40% Hardy, Capital 30% Dennard, Capital 20% Suddath, Capital 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started