Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A payment of $4500 was due 6 months ago and another payment of $6000 is due in 4 years. These payments are replaced with

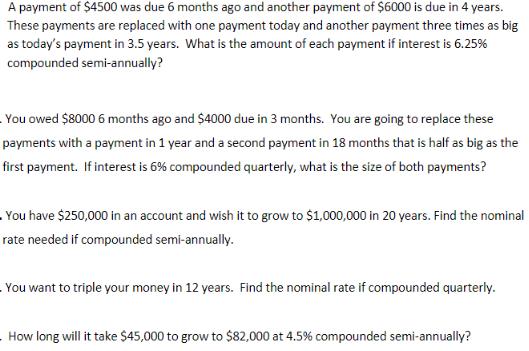

A payment of $4500 was due 6 months ago and another payment of $6000 is due in 4 years. These payments are replaced with one payment today and another payment three times as big as today's payment in 3.5 years. What is the amount of each payment if interest is 6.25% compounded semi-annually? You owed $8000 6 months ago and $4000 due in 3 months. You are going to replace these payments with a payment in 1 year and a second payment in 18 months that is half as big as the first payment. If interest is 6% compounded quarterly, what is the size of both payments? You have $250,000 in an account and wish it to grow to $1,000,000 in 20 years. Find the nominal rate needed if compounded semi-annually. You want to triple your money in 12 years. Find the nominal rate if compounded quarterly. How long will it take $45,000 to grow to $82,000 at 4.5% compounded semi-annually?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these compound interest problems we can use the formula for the future value of a single sum FV PV times 1 rnnt Where FV Future Value PV Pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started