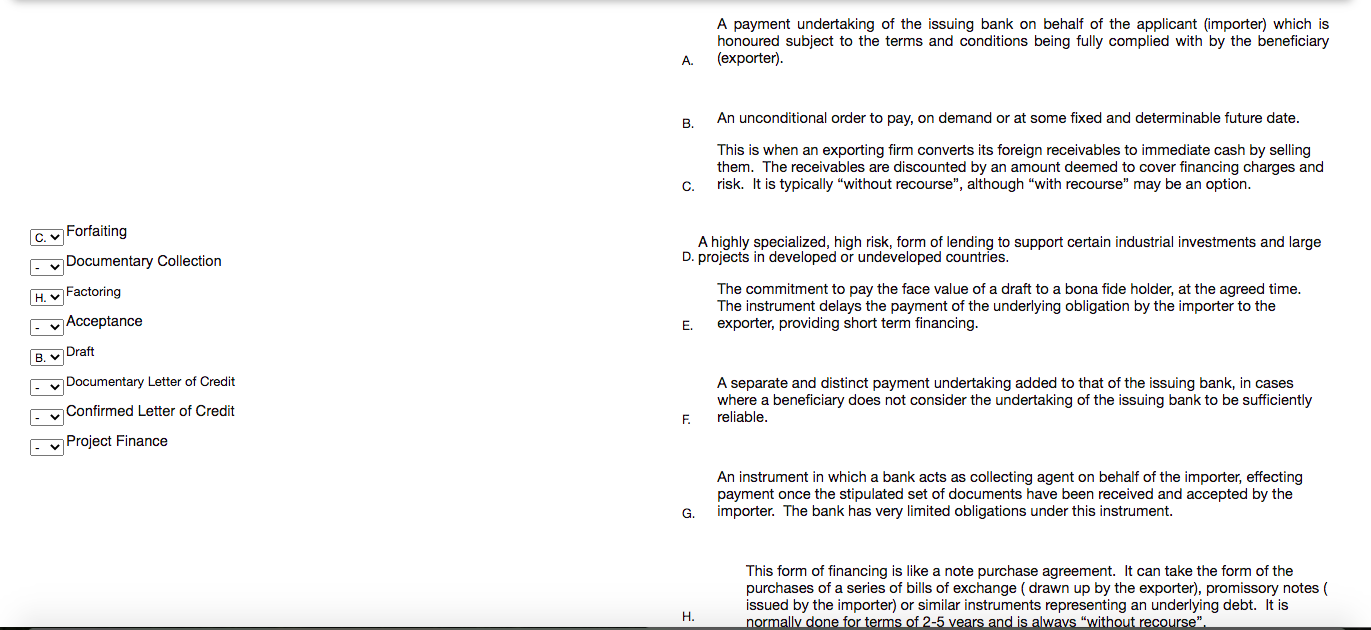

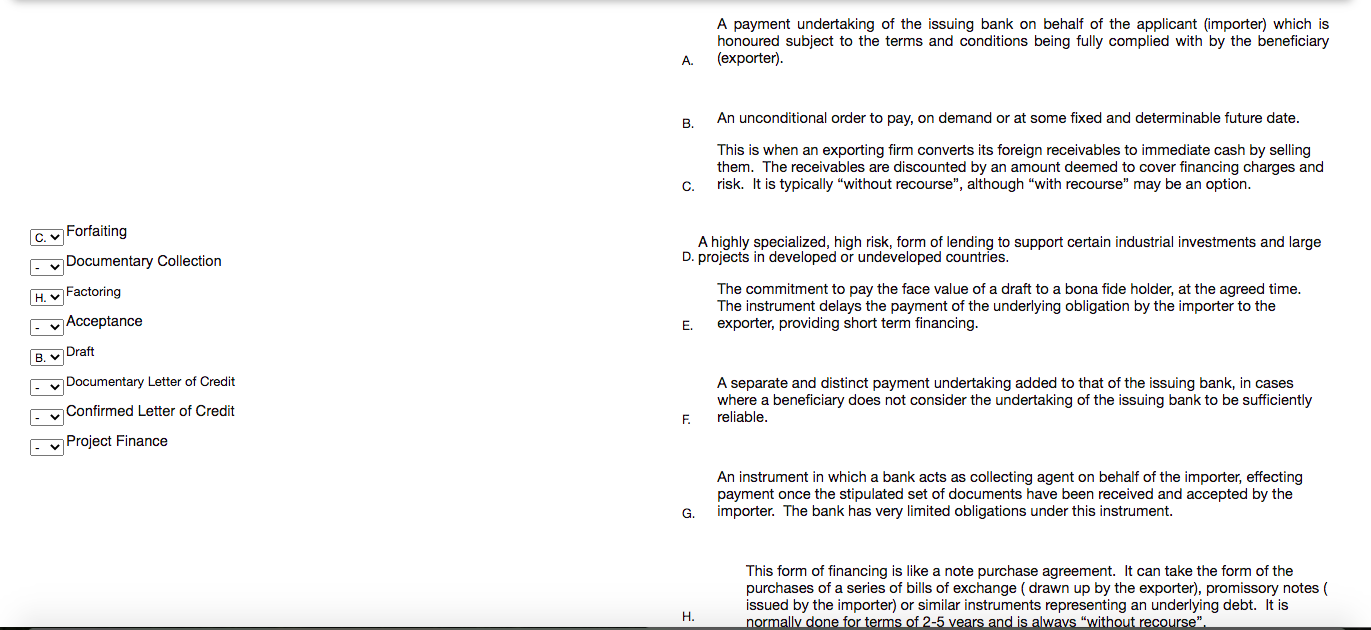

A payment undertaking of the issuing bank on behalf of the applicant (importer) which is honoured subject to the terms and conditions being fully complied with by the beneficiary (exporter). A. B. An unconditional order to pay, on demand or at some fixed and determinable future date. This is when an exporting firm converts its foreign receivables to immediate cash by selling them. The receivables are discounted by an amount deemed to cover financing charges and risk. It is typically "without recourse", although "with recourse" may be an option. C. Forfaiting A highly specialized, high risk, form of lending to support certain industrial investments and large D. projects in developed or undeveloped countries. Documentary Collection H. Factoring The commitment to pay the face value of a draft to a bona fide holder, at the agreed time. The instrument delays the payment of the underlying obligation by the importer to the exporter, providing short term financing. Acceptance E B. v Draft Documentary Letter of Credit A separate and distinct payment undertaking added to that of the issuing bank, in cases where a beneficiary does not consider the undertaking of the issuing bank to be sufficiently reliable. Confirmed Letter of Credit F. Project Finance An instrument in which a bank acts as collecting agent on behalf of the importer, effecting payment once the stipulated set of documents have been received and accepted by the importer. The bank has very limited obligations under this instrument. G. This form of financing is like a note purchase agreement. It can take the form of the purchases of a series of bills of exchange ( drawn up by the exporter), promissory notes issued by the importer) or similar instruments representing an underlying debt. It is normally done for terms of 2-5 vears and is always "without recourse". H. A payment undertaking of the issuing bank on behalf of the applicant (importer) which is honoured subject to the terms and conditions being fully complied with by the beneficiary (exporter). A. B. An unconditional order to pay, on demand or at some fixed and determinable future date. This is when an exporting firm converts its foreign receivables to immediate cash by selling them. The receivables are discounted by an amount deemed to cover financing charges and risk. It is typically "without recourse", although "with recourse" may be an option. C. Forfaiting A highly specialized, high risk, form of lending to support certain industrial investments and large D. projects in developed or undeveloped countries. Documentary Collection H. Factoring The commitment to pay the face value of a draft to a bona fide holder, at the agreed time. The instrument delays the payment of the underlying obligation by the importer to the exporter, providing short term financing. Acceptance E B. v Draft Documentary Letter of Credit A separate and distinct payment undertaking added to that of the issuing bank, in cases where a beneficiary does not consider the undertaking of the issuing bank to be sufficiently reliable. Confirmed Letter of Credit F. Project Finance An instrument in which a bank acts as collecting agent on behalf of the importer, effecting payment once the stipulated set of documents have been received and accepted by the importer. The bank has very limited obligations under this instrument. G. This form of financing is like a note purchase agreement. It can take the form of the purchases of a series of bills of exchange ( drawn up by the exporter), promissory notes issued by the importer) or similar instruments representing an underlying debt. It is normally done for terms of 2-5 vears and is always "without recourse". H