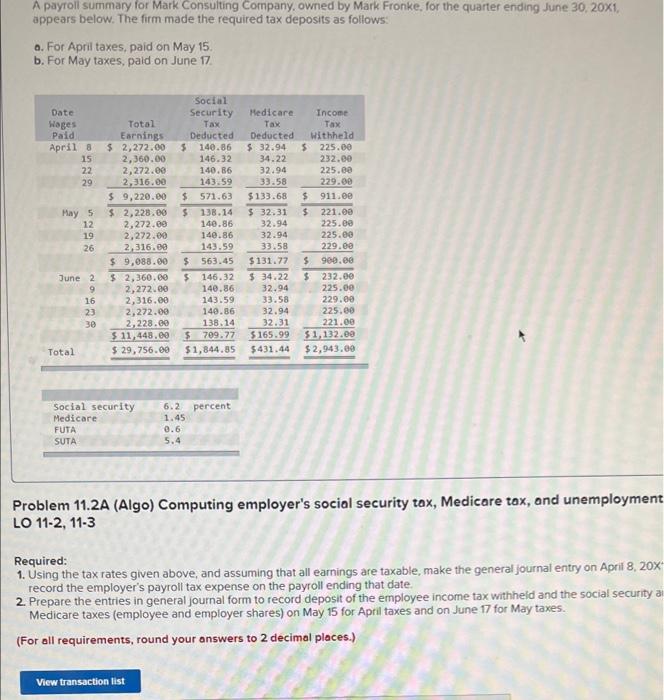

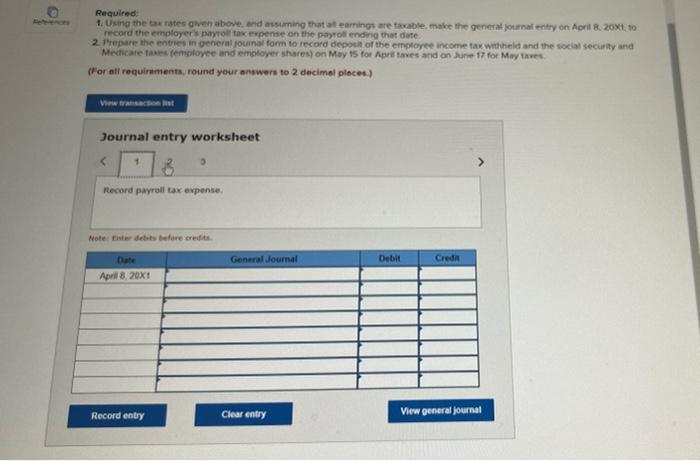

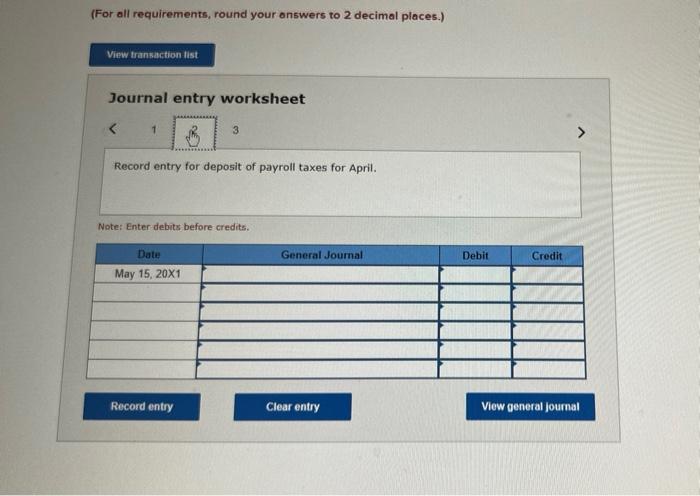

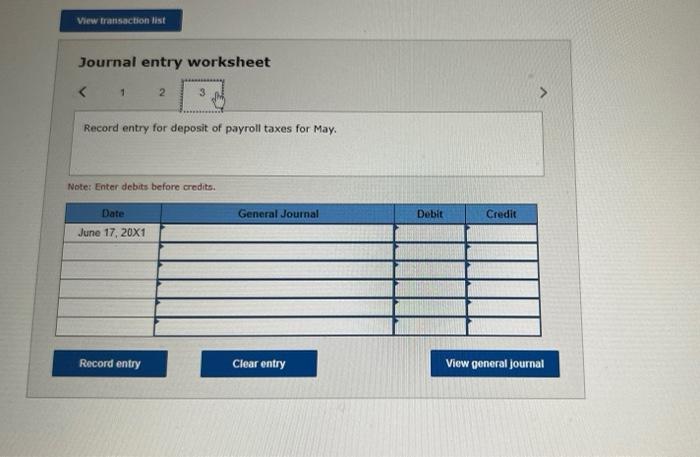

A payroll summary for Mark Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 20X1. appears below. The firm made the required tax deposits as follows: o. For April taxes, paid on May 15. b. For May taxes, paid on June 17 Date Wages Paid April 15 22 29 May 5 12 19 26 Total Earnings $ 2,272.00 2,360.00 2,272.00 2,316.00 $ 9,220.00 $ 2,228.00 2,272.89 2,272.00 2,316.00 $ 9,088.00 $ 2,360.00 2,272.00 2,316.00 2,272.00 2,228.00 $ 11,448.00 $ 29,756.00 Social Security Tax Deducted 5 140.86 146.32 140.86 143.59 $ 571.63 $ 138.14 140.86 140.86 143.59 $ 563.45 $ 146.32 140.86 143.59 140.86 138.14 $709.77 $1,844.85 Medicare Tax Deducted $32.94 34.22 32.94 33.58 $133.68 $ 32.31 32.94 32.94 33.58 $131.77 $ 34.22 32.94 33.58 32.94 32.31 $165.99 $431.44 Income Tax withheld $225.00 232.00 225.00 229.00 $ 911.ee $ 221.00 225.00 225.00 229.00 $ 900.00 $ 232.00 225.00 229.00 225.00 221.00 $1,132.00 $ 2,943.00 June 2 9 16 23 30 Total percent social security Medicare FUTA SUTA 6.2 1.45 0.6 5.4 Problem 11.2A (Algo) Computing employer's social security tax, Medicare tex, and unemployment LO 11-2, 11-3 Required: 1. Using the tax rates given above, and assuming that all earnings are taxable, make the general journal entry on April 8, 20% record the employer's payroll tax expense on the payroll ending that date 2. Prepare the entries in general journal form to record deposit of the employee income tax withheld and the social security a Medicare taxes (employee and employer shares) on May 15 for April taxes and on June 17 for May taxes. (For all requirements, round your answers to 2 decimal places.) View transaction list Required: 1. Using the tax rates given above and assuming that earnings are table, make the general Journal entry on April 20x110 record the employer payroll tax expense on the payroll ending that date 2. Prepare the entries in general journal form to record deposit of the employee income tax withheld and the social security and Medicare as employee and employer shares) on May 15 for Apaves and on June 17 for Mytes (For all requirements, round your answers to 2 decimal places) Journal entry worksheet