Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A pension fund manager expects to receive an inflow of funds in 60 days time. The manager would like to use these funds to

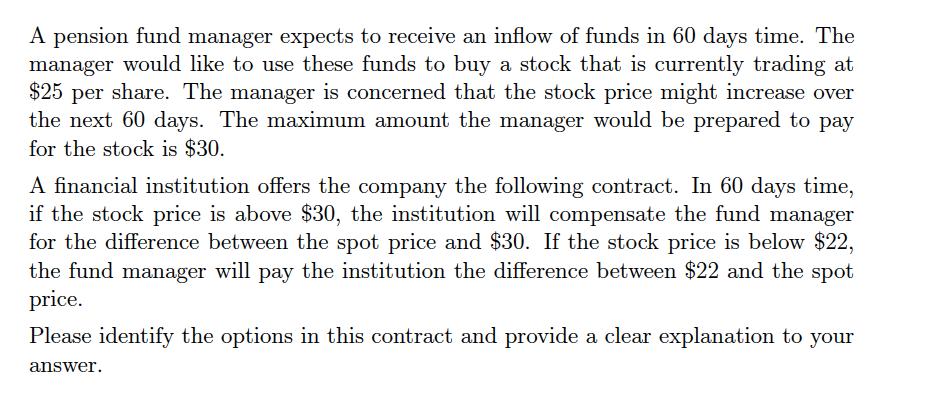

A pension fund manager expects to receive an inflow of funds in 60 days time. The manager would like to use these funds to buy a stock that is currently trading at $25 per share. The manager is concerned that the stock price might increase over the next 60 days. The maximum amount the manager would be prepared to pay for the stock is $30. A financial institution offers the company the following contract. In 60 days time, if the stock price is above $30, the institution will compensate the fund manager for the difference between the spot price and $30. If the stock price is below $22, the fund manager will pay the institution the difference between $22 and the spot price. Please identify the options in this contract and provide a clear explanation to your answer.

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1call option The pension fund manager has entered a call op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started