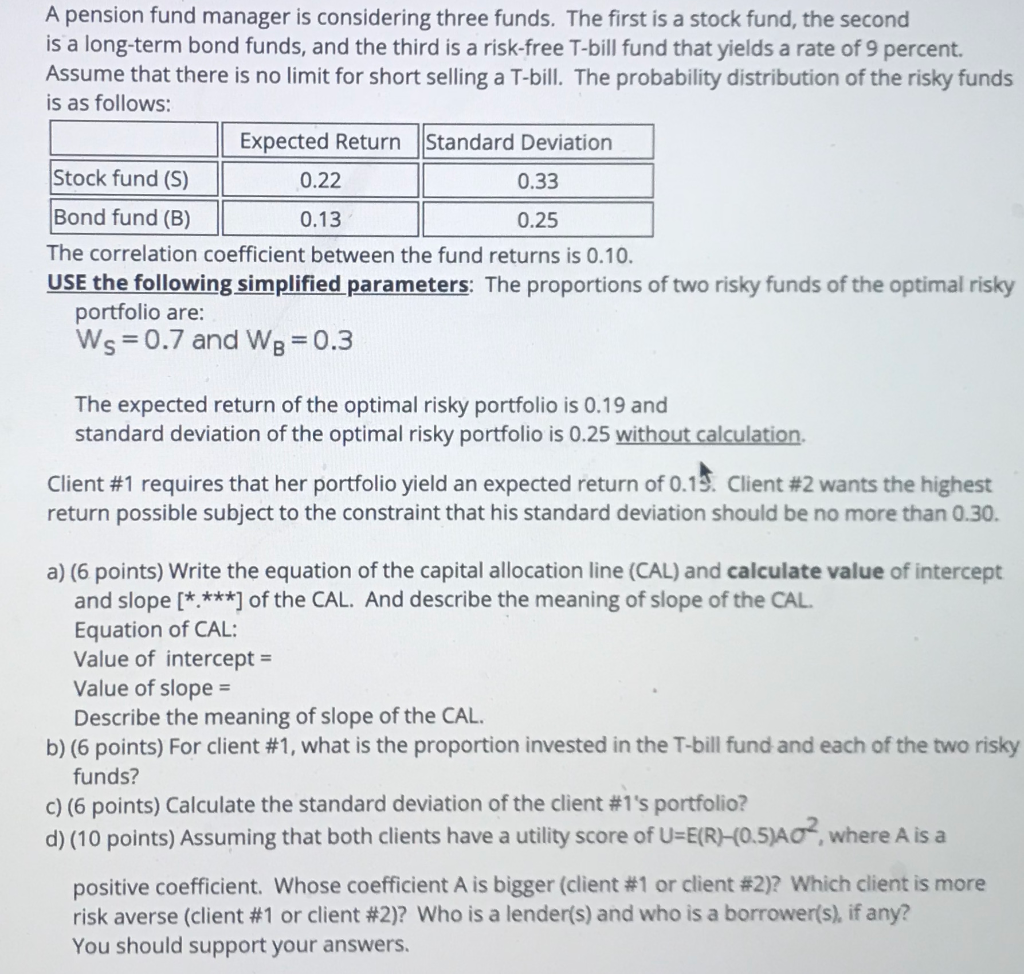

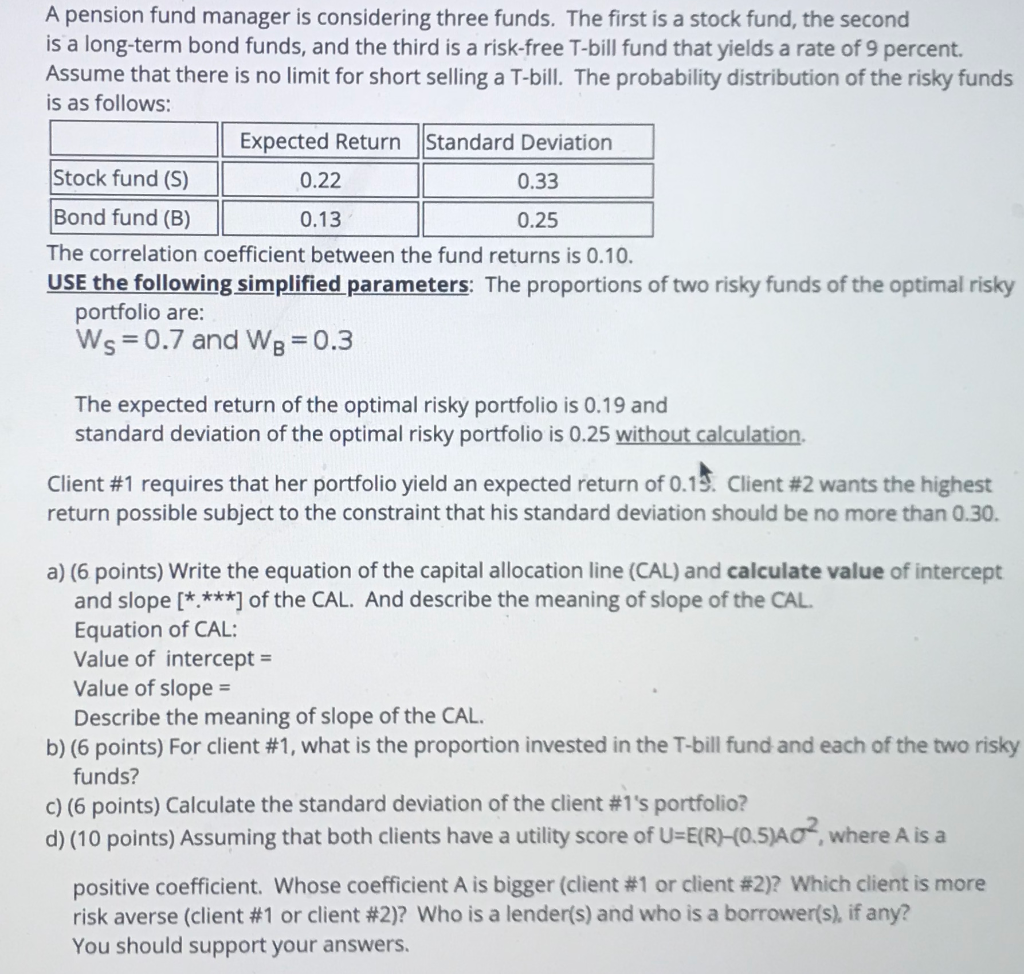

A pension fund manager is considering three funds. The first is a stock fund, the second is a long-term bond funds, and the third is a risk-free T-bill fund that yields a rate of 9 percent. Assume that there is no limit for short selling a T-bill. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (5) 0.22 0.33 Bond fund (B) 0.13 0.25 The correlation coefficient between the fund returns is 0.10. USE the following simplified parameters: The proportions of two risky funds of the optimal risky portfolio are: Ws = 0.7 and W8 = 0.3 The expected return of the optimal risky portfolio is 0.19 and standard deviation of the optimal risky portfolio is 0.25 without calculation. Client #1 requires that her portfolio yield an expected return of 0.19. Client #2 wants the highest return possible subject to the constraint that his standard deviation should be no more than 0.30. a) (6 points) Write the equation of the capital allocation line (CAL) and calculate value of intercept and slope [* ***] of the CAL. And describe the meaning of slope of the CAL. Equation of CAL: Value of intercept = Value of slope = Describe the meaning of slope of the CAL. b) (6 points) For client #1, what is the proportion invested in the T-bill fund and each of the two risky funds? C) (6 points) Calculate the standard deviation of the client #1's portfolio? d) (10 points) Assuming that both clients have a utility score of U=E(R)(0.5)A0%, where A is a positive coefficient. Whose coefficient A is bigger (client #1 or client #2)? Which client is more risk averse (client #1 or client #2)? Who is a lender(s) and who is a borrower(s). if any? You should support your answers. A pension fund manager is considering three funds. The first is a stock fund, the second is a long-term bond funds, and the third is a risk-free T-bill fund that yields a rate of 9 percent. Assume that there is no limit for short selling a T-bill. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Stock fund (5) 0.22 0.33 Bond fund (B) 0.13 0.25 The correlation coefficient between the fund returns is 0.10. USE the following simplified parameters: The proportions of two risky funds of the optimal risky portfolio are: Ws = 0.7 and W8 = 0.3 The expected return of the optimal risky portfolio is 0.19 and standard deviation of the optimal risky portfolio is 0.25 without calculation. Client #1 requires that her portfolio yield an expected return of 0.19. Client #2 wants the highest return possible subject to the constraint that his standard deviation should be no more than 0.30. a) (6 points) Write the equation of the capital allocation line (CAL) and calculate value of intercept and slope [* ***] of the CAL. And describe the meaning of slope of the CAL. Equation of CAL: Value of intercept = Value of slope = Describe the meaning of slope of the CAL. b) (6 points) For client #1, what is the proportion invested in the T-bill fund and each of the two risky funds? C) (6 points) Calculate the standard deviation of the client #1's portfolio? d) (10 points) Assuming that both clients have a utility score of U=E(R)(0.5)A0%, where A is a positive coefficient. Whose coefficient A is bigger (client #1 or client #2)? Which client is more risk averse (client #1 or client #2)? Who is a lender(s) and who is a borrower(s). if any? You should support your answers