Question: A pension plan would like to shield its liabilities, due in exactly 3 years, from interest rate fluctuations. The current YTM is 10%. The

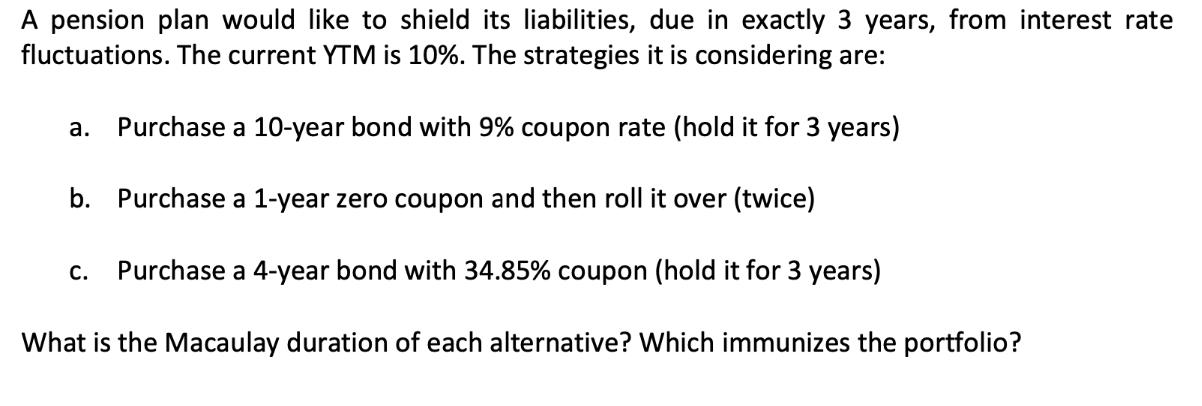

A pension plan would like to shield its liabilities, due in exactly 3 years, from interest rate fluctuations. The current YTM is 10%. The strategies it is considering are: a. Purchase a 10-year bond with 9% coupon rate (hold it for 3 years) b. Purchase a 1-year zero coupon and then roll it over (twice) C. Purchase a 4-year bond with 34.85% coupon (hold it for 3 years) What is the Macaulay duration of each alternative? Which immunizes the portfolio?

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Calculate the Macaulay duration for each alternative and determine which one immunizes the portfolio ... View full answer

Get step-by-step solutions from verified subject matter experts