Answered step by step

Verified Expert Solution

Question

1 Approved Answer

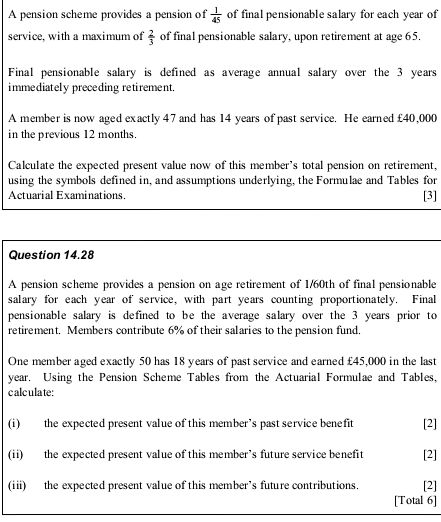

A pension scheme provides a pension of of final pensionable salary for each year of service, with a maximum of 3 of final pensionable

A pension scheme provides a pension of of final pensionable salary for each year of service, with a maximum of 3 of final pensionable salary, upon retirement at age 65. Final pensionable salary is defined as average annual salary over the 3 years immediately preceding retirement. A member is now aged exactly 47 and has 14 years of past service. He earned 40,000 in the previous 12 months. Calculate the expected present value now of this member's total pension on retirement, using the symbols defined in, and assumptions underlying, the Formulae and Tables for Actuarial Examinations. [3] Question 14.28 A pension scheme provides a pension on age retirement of 1/60th of final pensionable salary for each year of service, with part years counting proportionately. Final pensionable salary is defined to be the average salary over the 3 years prior to retirement. Members contribute 6% of their salaries to the pension fund. One member aged exactly 50 has 18 years of past service and earned 45,000 in the last year. Using the Pension Scheme Tables from the Actuarial Formulae and Tables, calculate: (i) the expected present value of this member's past service benefit (ii) the expected present value of this member's future service benefit (iii) the expected present value of this member's future contributions. [2] [2] [2] [Total 6]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started