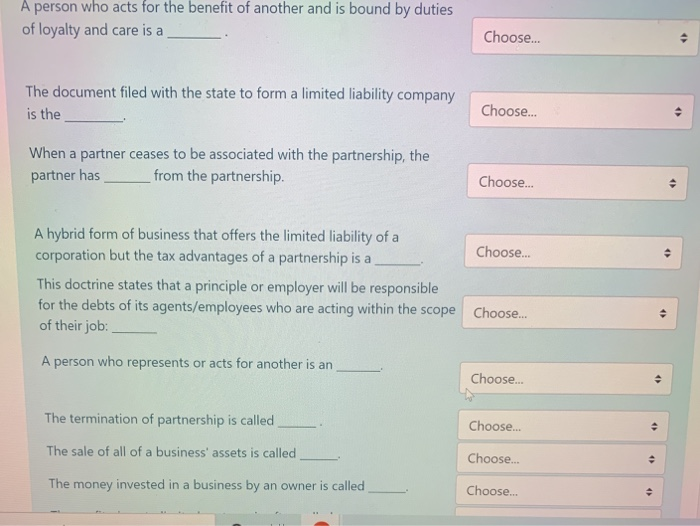

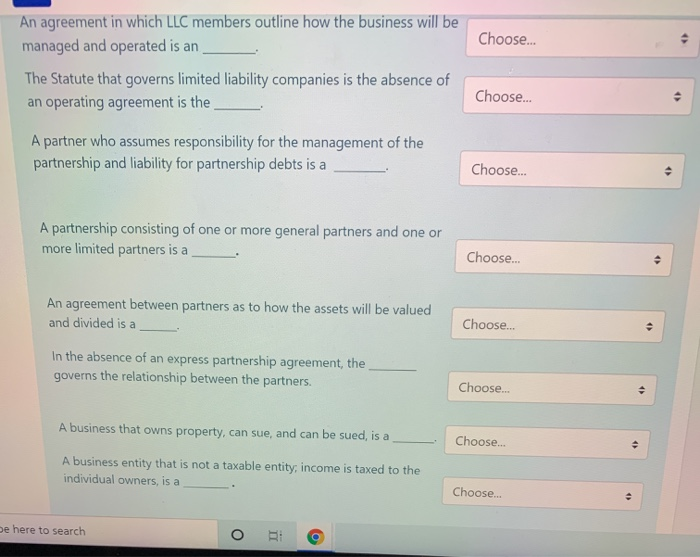

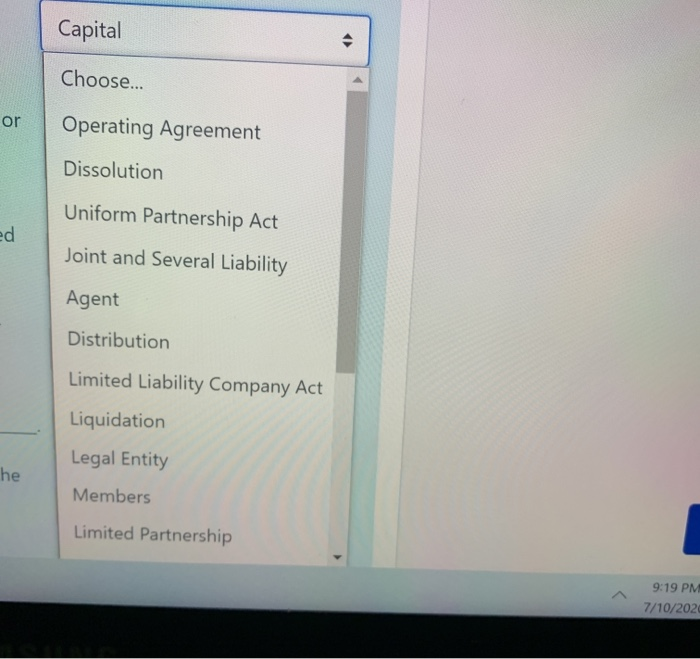

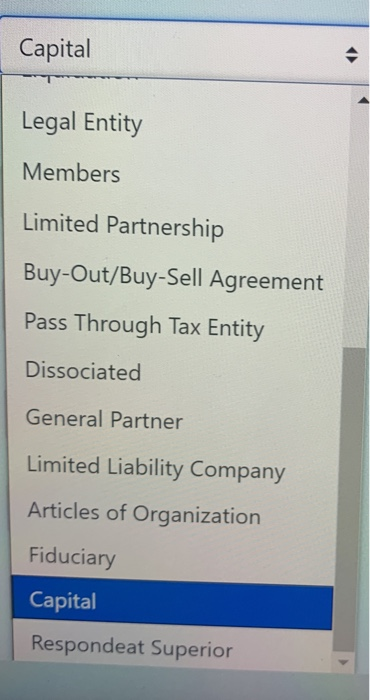

A person who acts for the benefit of another and is bound by duties of loyalty and care is a Choose.. The document filed with the state to form a limited liability company is the Choose... When a partner ceases to be associated with the partnership, the partner has from the partnership Choose... A hybrid form of business that offers the limited liability of a Choose... corporation but the tax advantages of a partnership is a This doctrine states that a principle or employer will be responsible for the debts of its agents/employees who are acting within the scope Choose... of their job: A person who represents or acts for another is an Choose... e The termination of partnership is called Choose.. . The sale of all of a business' assets is called Choose... . The money invested in a business by an owner is called Choose... An agreement in which LLC members outline how the business will be managed and operated is an Choose... e The Statute that governs limited liability companies is the absence of an operating agreement is the > Choose... A partner who assumes responsibility for the management of the partnership and liability for partnership debts is a Choose... e A partnership consisting of one or more general partners and one or more limited partners is a Choose... e An agreement between partners as to how the assets will be valued and divided is a Choose... In the absence of an express partnership agreement, the governs the relationship between the partners. Choose.. A business that owns property, can sue, and can be sued, is a Choose.. A business entity that is not a taxable entity, income is taxed to the individual owners, is a Choose... . be here to search o a Capital Choose... or Operating Agreement Dissolution Uniform Partnership Act ed Joint and Several Liability Agent Distribution Limited Liability Company Act Liquidation Legal Entity he Members Limited Partnership 9:19 PM 7/10/202 Capital Legal Entity Members Limited Partnership Buy-Out/Buy-Sell Agreement Pass Through Tax Entity Dissociated General Partner Limited Liability Company Articles of Organization Fiduciary Capital Respondeat Superior