Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Peruvian Investor buys 170 shares of a U.S. stock for $8,500 ($50 per share). Over the course of a year, the stock goes

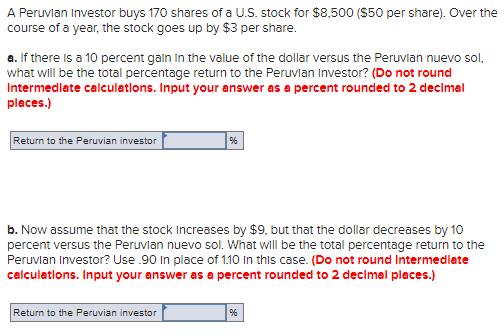

A Peruvian Investor buys 170 shares of a U.S. stock for $8,500 ($50 per share). Over the course of a year, the stock goes up by $3 per share. a. If there is a 10 percent gain in the value of the dollar versus the Peruvian nuevo sol, what will be the total percentage return to the Peruvian Investor? (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return to the Peruvian investor % b. Now assume that the stock increases by $9, but that the dollar decreases by 10 percent versus the Peruvian nuevo sol. What will be the total percentage return to the Peruvian Investor? Use .90 In place of 1.10 In this case. (Do not round Intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return to the Peruvian investor %

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the calculations for each scenario a Initially the Peruvian investor buys 170 shares ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started