Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A physical inventory taking was performed in the warehouse on 7 January 2023 and the inventory value was ascertained as $34 500 before the

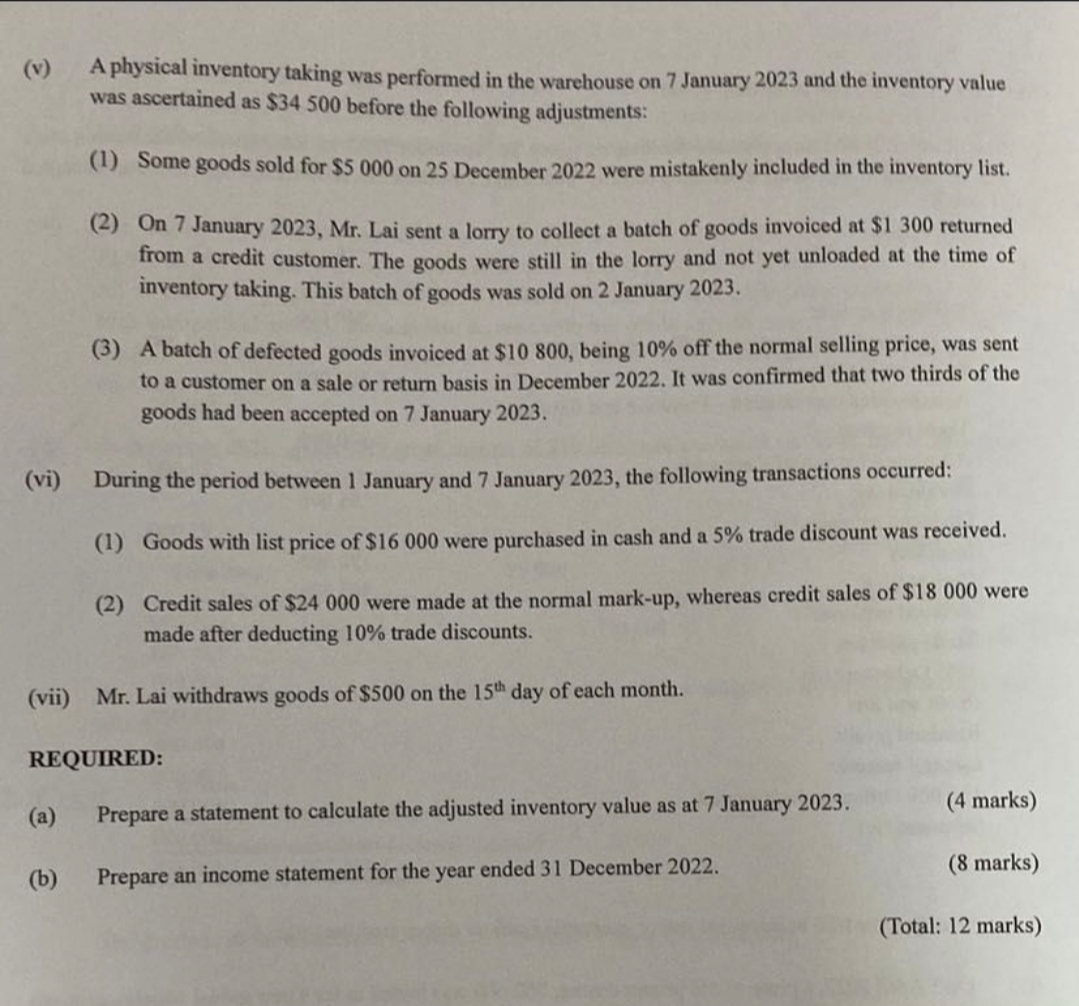

A physical inventory taking was performed in the warehouse on 7 January 2023 and the inventory value was ascertained as $34 500 before the following adjustments: (1) Some goods sold for $5 000 on 25 December 2022 were mistakenly included in the inventory list. (2) On 7 January 2023, Mr. Lai sent a lorry to collect a batch of goods invoiced at $1 300 returned from a credit customer. The goods were still in the lorry and not yet unloaded at the time of inventory taking. This batch of goods was sold on 2 January 2023. (3) A batch of defected goods invoiced at $10 800, being 10% off the normal selling price, was sent to a customer on a sale or return basis in December 2022. It was confirmed that two thirds of the goods had been accepted on 7 January 2023. (vi) During the period between 1 January and 7 January 2023, the following transactions occurred: (1) Goods with list price of $16 000 were purchased in cash and a 5% trade discount was received. (2) Credit sales of $24 000 were made at the normal mark-up, whereas credit sales of $18 000 were made after deducting 10% trade discounts. (vii) Mr. Lai withdraws goods of $500 on the 15th day of each month. REQUIRED: (a) (b) Prepare a statement to calculate the adjusted inventory value as at 7 January 2023. Prepare an income statement for the year ended 31 December 2022. (4 marks) (8 marks) (Total: 12 marks)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Statement to calculate the adjusted inventory value as at 7 January 2023 Inventory 7 January 2023 before adjustments 34500 Less Goods sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started