Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A piece of land is available for sale for 5,000,000. A property developer, who can lend and horrow money at a rate of 15%

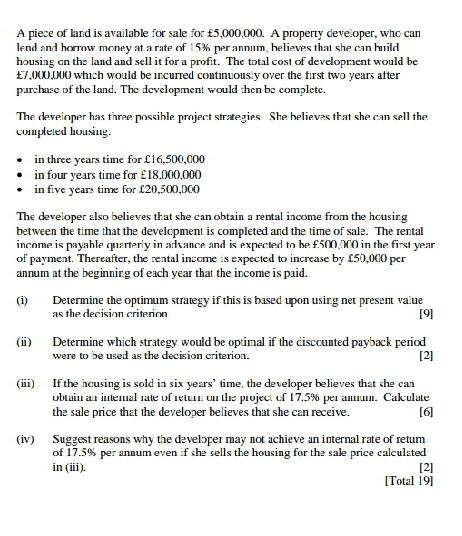

A piece of land is available for sale for 5,000,000. A property developer, who can lend and horrow money at a rate of 15% per annum, helieves that she can build housing on the land and sell it for a profit. The total cost of development would be 7,000,000 which would be incurred continuously over the first two years after purchase of the land. The development would then be complete. The developer has three possible project strategies She believes that she can sell the completed housing. in three years time for 16,500,000 in four years time for 18,000,000 in five years time for 20,500,000 The developer also believes that she can obtain a rental income from the housing between the time that the development is completed and the time of sale. The rental income is payable quarterly in advance and is expected to be 500,000 in the first year of payment. Thereafter, the rental income is expected to increase by 50,000 per annum at the beginning of each year that the income is paid. (1) Determine the optimum strategy if this is based upon using net present value as the decision criterion [9] (iv) Determine which strategy would be optimal if the discounted payback period were to be used as the decision criterion. [2] (iii) If the housing is sold in six years' time, the developer believes that she can obtain an internal rate of return on the project of 17.5% per annuin. Calculate the sale price that the developer believes that she can receive. [6] Suggest reasons why the developer may not achieve an internal rate of return of 17.5% per annum even if she sells the housing for the sale price calculated in (iii). [2] [Total 19]

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the optimum strategy based on net present value NPV as the decision criterion we need to calculate the NPV for each strategy and choose the one with the highest NPV NPV is calculated by d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started