Answered step by step

Verified Expert Solution

Question

1 Approved Answer

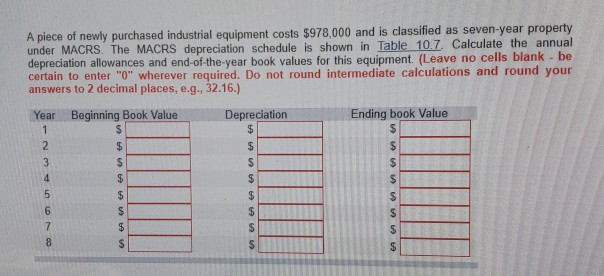

A piece of newly purchased industrial equipment costs $978,000 and is classified as seven-year property under MACRS. The MACRS depreciation schedule is shown in Table

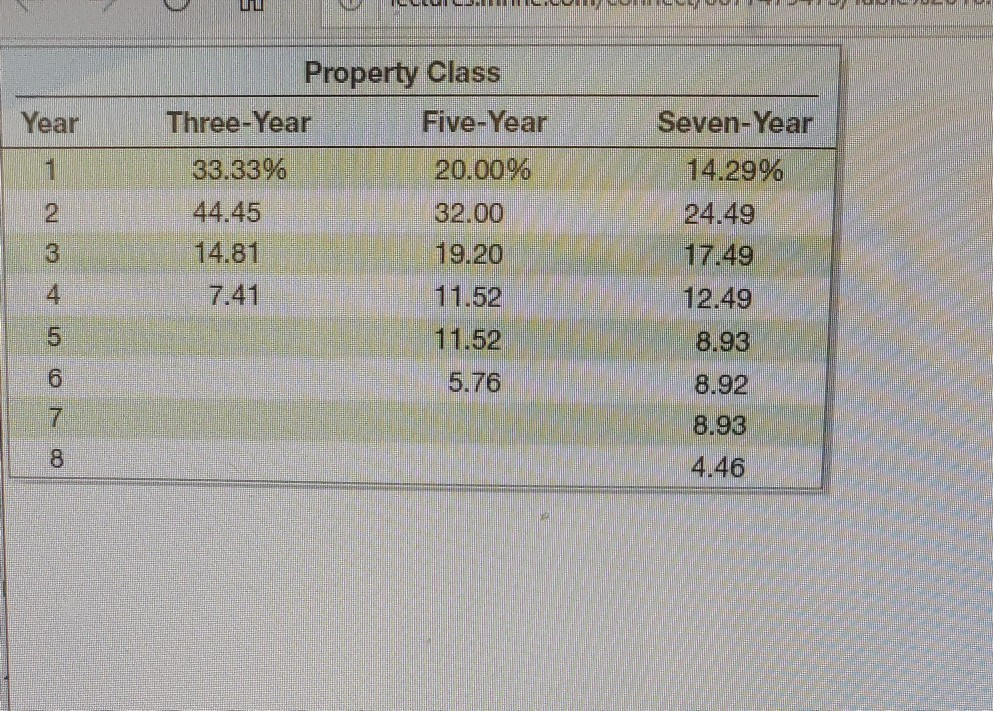

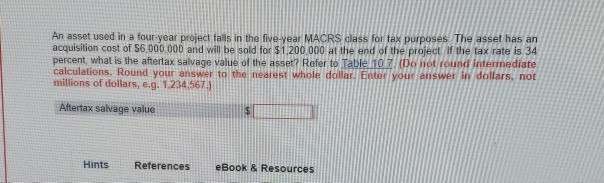

A piece of newly purchased industrial equipment costs $978,000 and is classified as seven-year property under MACRS. The MACRS depreciation schedule is shown in Table 10.7 Calculate the annual depreciation allowances and end-of-the-vear book values for this equipment (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Year Beginning Book Value Depreciation Ending book Value ta in in on EA in an A c LLLLLLLLLLLL Year 1 2 3 ooo a AWN + Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 11.52 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5.76 An asset used in a four-year project fats in the five-year MACRS dass for tax purposes. The asset has an acquisition cost of $6,000 000 and will be sold for $1.200.000 at the end of the project. If the tax rate is 34 percent, what is the aftertax salvage value of the asset? Refer to Table / Do Riot found intermediate calculations. Round your answer to the nearest whole dalla V answer in dollars not millions of dollars, e.g. 1.234,567) Aftertax salvage value Hints References eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started