Answered step by step

Verified Expert Solution

Question

1 Approved Answer

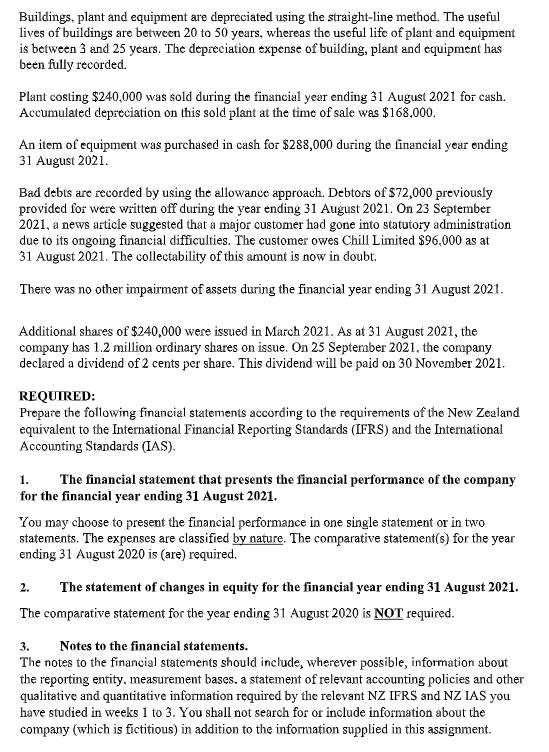

A plant costing $240,000 was sold during the financial year ending 31 August 2021 for cash. Accumulated depreciation on this sold plant at the time

A plant costing $240,000 was sold during the financial year ending 31 August 2021 for cash. Accumulated depreciation on this sold plant at the time of sale was $168,000.

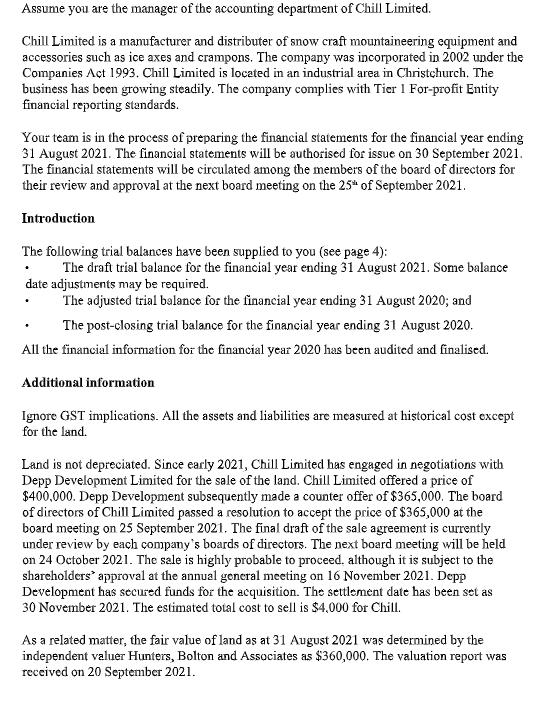

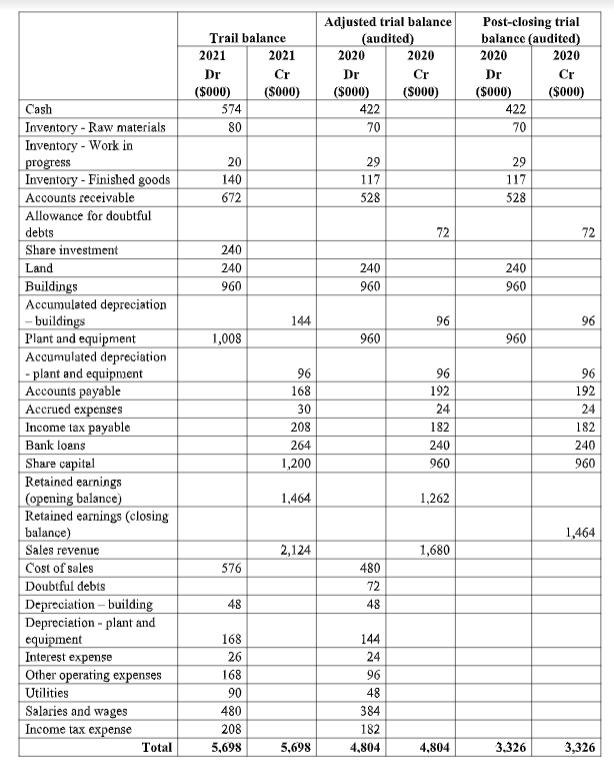

Assume you are the manager of the accounting department of Chill Limited. Chill Limited is a manufacturer and distributer of snow craft mountaineering equipment and accessories such as ice axes and crampons. The company was incorporated in 2002 under the Companies Act 1993. Chill Limited is located in an industrial area in Christchurch. The business has been growing steadily. The company complies with Tier 1 For-profit Entity financial reporting standards. Your team is in the process of preparing the financial statements for the financial year ending 31 August 2021. The financial statements will be authorised for issue on 30 September 2021. The financial statements will be circulated among the members of the board of directors for their review and approval at the next board meeting on the 25th of September 2021. Introduction The following trial balances have been supplied to you (see page 4): . The draft trial balance for the financial year ending 31 August 2021. Some balance date adjustments may be required. The adjusted trial balance for the financial year ending 31 August 2020; and The post-closing trial balance for the financial year ending 31 August 2020. All the financial information for the financial year 2020 has been audited and finalised. Additional information Ignore GST implications. All the assets and liabilities are measured at historical cost except for the land. Land is not depreciated. Since early 2021, Chill Limited has engaged in negotiations with Depp Development Limited for the sale of the land. Chill Limited offered a price of $400,000. Depp Development subsequently made a counter offer of $365,000. The board of directors of Chill Limited passed a resolution to accept the price of $365,000 at the board meeting on 25 September 2021. The final draft of the sale agreement is currently under review by each company's boards of directors. The next board meeting will be held on 24 October 2021. The sale is highly probable to proceed. although it is subject to the shareholders approval at the annual general meeting on 16 November 2021. Depp Development has secured funds for the acquisition. The settlement date has been set as 30 November 2021. The estimated total cost to sell is $4,000 for Chill. As a related matter, the fair value of land as at 31 August 2021 was determined by the independent valuer Hunters, Bolton and Associates as $360,000. The valuation report was received on 20 September 2021.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the financial statements with the given values inserted 1 The financial statement that pres...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started