Sloane is an insurance agent and he meets with his client, Darcy, for an annual review. Darcy purchased a G2 whole life insurance policy

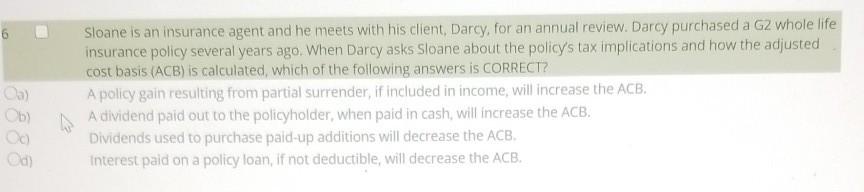

Sloane is an insurance agent and he meets with his client, Darcy, for an annual review. Darcy purchased a G2 whole life insurance policy several years ago. When Darcy asks Sloane about the policy's tax implications and how the adjusted cost basis (ACB) is calculated, which of the following answers is CORRECT? A policy gain resulting from partial surrender, if included in income, will increase the ACB. A dividend paid out to the policyholder, when paid in cash, will increase the ACB. Dividends used to purchase paid-up additions will decrease the ACB. Interest paid on a policy loan, if not deductible, will decrease the ACB. Oa) Ob) Od) l8888

Step by Step Solution

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

aA policy gain resulting from partial surrender if included in income will incre...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started