Answered step by step

Verified Expert Solution

Question

1 Approved Answer

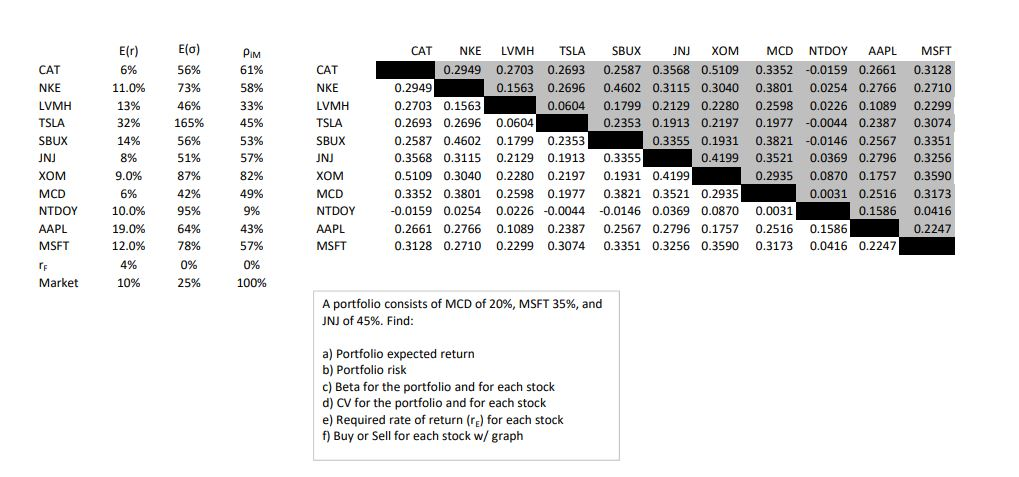

A portfolio consist of MCD of 20%, MSFT 35%, and JNJ 0f 45% please find 1) Portfolio expected return 2) Portfolio risk 3) Beta for

A portfolio consist of MCD of 20%, MSFT 35%, and JNJ 0f 45% please find

1) Portfolio expected return

2) Portfolio risk

3) Beta for the portfolio and for each stock

4) CV for the portfolio and for each stock

5) Required rate of return for each stock

6) Buy or sell for each stock w/graph

CAT NKE LVMH TSLA SBUX JNJ XOM MCD NTDOY AAPL MSFT E(r) 6% 11.0% 13% 32% 14% 8% 9.0% 6% 10.0% 19.0% 12.0% E(0) 56% 73% 46% 165% 56% 51% 87% 42% 95% 64% 78% 0% 25% PIM 61% 58% 33% 45% 53% 57% 82% 49% 9% 43% 57% 0% 100% CAT NKE LVMH TSLA SBUX JNJ XOM MCD NTDOY AAPL MSFT CAT NKE LVMH TSLASBUX JNJ XOM 0.2949 0.2703 0.2693 0.2587 0.3568 0.5109 0.2949 0.1563 0.2696 0.4602 0.3115 0.3040 0.2703 0.1563 0.0604 0.1799 0.2129 0.2280 0.2693 0.2696 0.0604 0.2353 0.1913 0.2197 0.2587 0.4602 0.1799 0.2353 0.3355 0.1931 0.3568 0.3115 0.2129 0.1913 0.3355 0.4199 0.5109 0.3040 0.2280 0.2197 0.1931 0.4199 0.3352 0.3801 0.2598 0.1977 0.3821 0.3521 0.2935 -0.0159 0.0254 0.0226 -0.0044 -0.0146 0.0369 0.0870 0.2661 0.2766 0.1089 0.2387 0.2567 0.2796 0.1757 0.3128 0.2710 0.2299 0.3074 0.3351 0.3256 0.3590 MCD NTDOYAAPL MSFT 0.3352 -0.0159 0.2661 0.3128 0.3801 0.0254 0.2766 0.2710 0.2598 0.0226 0.1089 0.2299 0.1977 -0.0044 0.2387 0.3074 0.3821 -0.0146 0.2567 0.3351 0.3521 0.0369 0.2796 0.3256 0.2935 0.0870 0.1757 0.3590 0.0031 0.2516 0.3173 0.0031 0.1586 0.0416 0.2516 0.1586 0.2247 0.3173 0.0416 0.2247 4% Market 10% A portfolio consists of MCD of 20%, MSFT 35%, and JNJ of 45%. Find: a) Portfolio expected return b) Portfolio risk c) Beta for the portfolio and for each stock d) CV for the portfolio and for each stock e) Required rate of return (re) for each stock f) Buy or Sell for each stock w/ graph CAT NKE LVMH TSLA SBUX JNJ XOM MCD NTDOY AAPL MSFT E(r) 6% 11.0% 13% 32% 14% 8% 9.0% 6% 10.0% 19.0% 12.0% E(0) 56% 73% 46% 165% 56% 51% 87% 42% 95% 64% 78% 0% 25% PIM 61% 58% 33% 45% 53% 57% 82% 49% 9% 43% 57% 0% 100% CAT NKE LVMH TSLA SBUX JNJ XOM MCD NTDOY AAPL MSFT CAT NKE LVMH TSLASBUX JNJ XOM 0.2949 0.2703 0.2693 0.2587 0.3568 0.5109 0.2949 0.1563 0.2696 0.4602 0.3115 0.3040 0.2703 0.1563 0.0604 0.1799 0.2129 0.2280 0.2693 0.2696 0.0604 0.2353 0.1913 0.2197 0.2587 0.4602 0.1799 0.2353 0.3355 0.1931 0.3568 0.3115 0.2129 0.1913 0.3355 0.4199 0.5109 0.3040 0.2280 0.2197 0.1931 0.4199 0.3352 0.3801 0.2598 0.1977 0.3821 0.3521 0.2935 -0.0159 0.0254 0.0226 -0.0044 -0.0146 0.0369 0.0870 0.2661 0.2766 0.1089 0.2387 0.2567 0.2796 0.1757 0.3128 0.2710 0.2299 0.3074 0.3351 0.3256 0.3590 MCD NTDOYAAPL MSFT 0.3352 -0.0159 0.2661 0.3128 0.3801 0.0254 0.2766 0.2710 0.2598 0.0226 0.1089 0.2299 0.1977 -0.0044 0.2387 0.3074 0.3821 -0.0146 0.2567 0.3351 0.3521 0.0369 0.2796 0.3256 0.2935 0.0870 0.1757 0.3590 0.0031 0.2516 0.3173 0.0031 0.1586 0.0416 0.2516 0.1586 0.2247 0.3173 0.0416 0.2247 4% Market 10% A portfolio consists of MCD of 20%, MSFT 35%, and JNJ of 45%. Find: a) Portfolio expected return b) Portfolio risk c) Beta for the portfolio and for each stock d) CV for the portfolio and for each stock e) Required rate of return (re) for each stock f) Buy or Sell for each stock w/ graphStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started