Question

A portfolio consists of three stocks: Stock A, Stock B, and Stock C. The table below provides the covariances between the returns of each

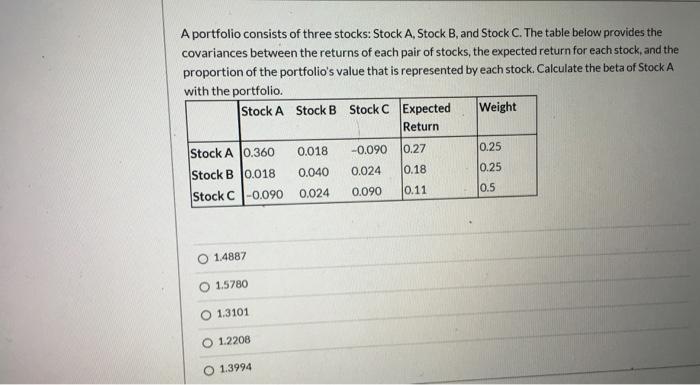

A portfolio consists of three stocks: Stock A, Stock B, and Stock C. The table below provides the covariances between the returns of each pair of stocks, the expected return for each stock, and the proportion of the portfolio's value that is represented by each stock. Calculate the beta of Stock A with the portfolio. Stock A Stock B Stock C Expected Return Stock A Stock B Stock C 0.360 0.018 -0.090 1.4887 1.5780 O 1.3101 1.2208 1.3994 0.018 -0.090 0.040 0.024 0.024 0.090 0.27 0.18 0.11 Weight 0.25 0.25 0.5

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

02514887 02515780 0513101 13994 13994 Stock A has a bet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Global Investments

Authors: Bruno Solnik, Dennis McLeavey

6th edition

321527704, 978-0321527707

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App