Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio consists of two types of loans. The first is a $30 million loan that requires a single payment of $37.8 million in

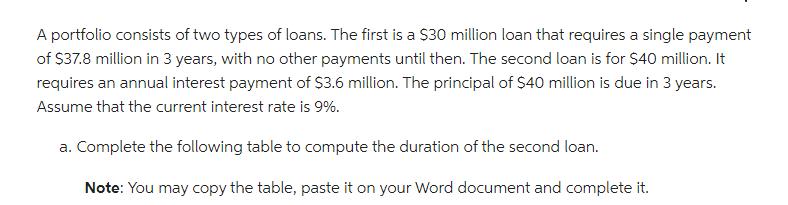

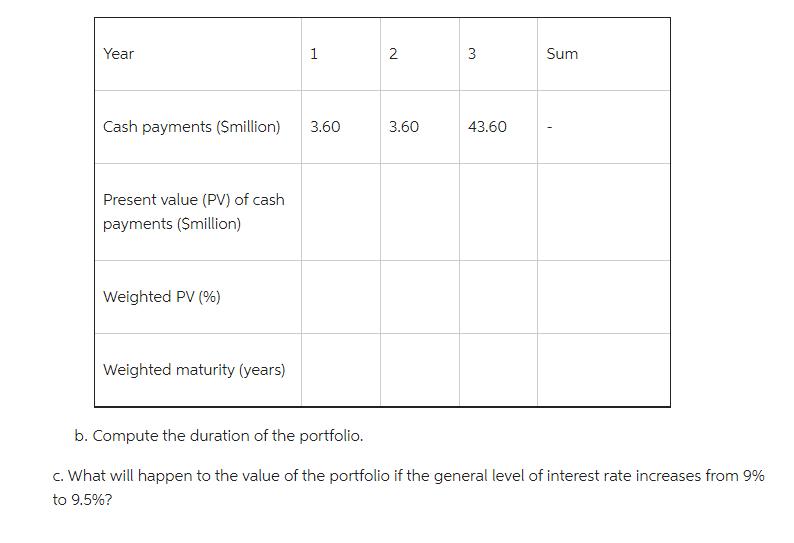

A portfolio consists of two types of loans. The first is a $30 million loan that requires a single payment of $37.8 million in 3 years, with no other payments until then. The second loan is for $40 million. It requires an annual interest payment of $3.6 million. The principal of $40 million is due in 3 years. Assume that the current interest rate is 9%. a. Complete the following table to compute the duration of the second loan. Note: You may copy the table, paste it on your Word document and complete it. Year Cash payments (Smillion) Present value (PV) of cash payments (Smillion) Weighted PV (%) Weighted maturity (years) 1 3.60 2 3.60 3 43.60 Sum b. Compute the duration of the portfolio. c. What will happen to the value of the portfolio if the general level of interest rate increases from 9% to 9.5%?

Step by Step Solution

★★★★★

3.25 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started