Answered step by step

Verified Expert Solution

Question

1 Approved Answer

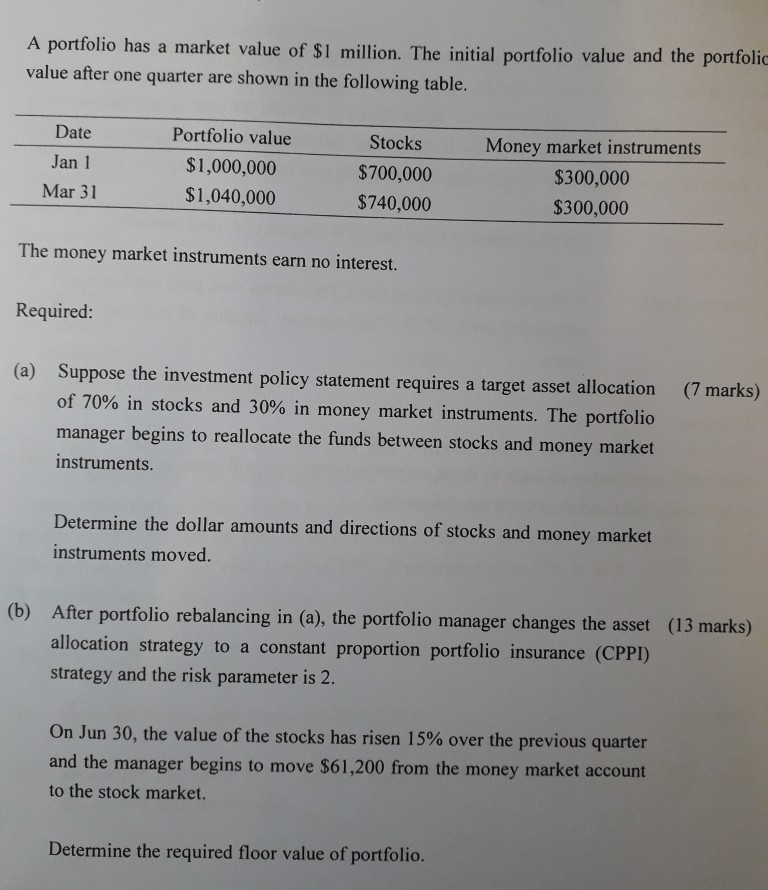

A portfolio has a market value of $1 million. The initial portfolio value and the portfoli value after one quarter are shown in the following

A portfolio has a market value of $1 million. The initial portfolio value and the portfoli value after one quarter are shown in the following table. Portfolio value Date Stocks Money market instruments $1,000,000 Jan 1 $700,000 $300,000 Mar 31 $1,040,000 $740,000 $300,000 The money market instruments earn no interest. Required: (a) Suppose the investment policy statement requires a target asset allocation of 70% in stocks and 30% in money market instruments. The portfolio manager begins to reallocate the funds between stocks and money market (7 marks) instruments Determine the dollar amounts and directions of stocks and money market instruments moved. After portfolio rebalancing in (a), the portfolio manager changes the asset (13 marks) allocation strategy to a constant proportion portfolio insurance (CPPI) strategy and the risk parameter is 2. (b) On Jun 30, the value of the stocks has risen 15% over the previous quarter and the manager begins to move $61,200 from the money market account to the stock market. Determine the required floor value of portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started