Answered step by step

Verified Expert Solution

Question

1 Approved Answer

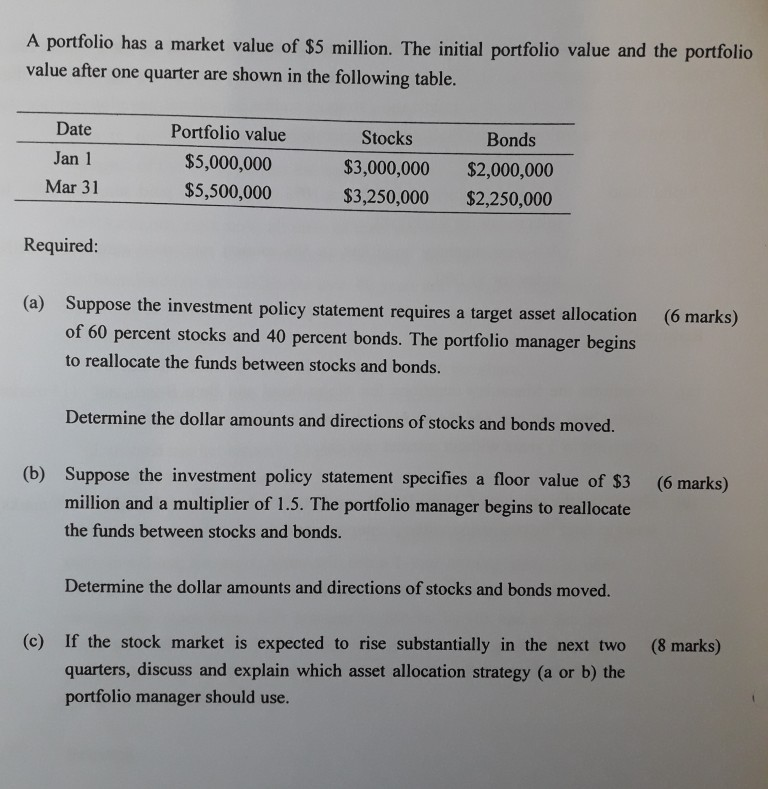

A portfolio has a market value of $5 million. The initial portfolio value and the portfolio value after one quarter are shown in the following

A portfolio has a market value of $5 million. The initial portfolio value and the portfolio value after one quarter are shown in the following table. Date Portfolio value Stocks Bonds Jan 1 $5,000,000 $3,000,000 $2,000,000 Mar 31 $5,500,000 $3,250,000 $2,250,000 Required: (a) Suppose the investment policy statement requires a target asset allocation of 60 percent stocks and 40 percent bonds. The portfolio manager begins to reallocate the funds between stocks and bonds. Determine the dollar amounts and directions of stocks and bonds moved. (b) Suppose the investment policy statement specifies a floor value of $3 (6 marks) million and a multiplier of 1.5. The portfolio manager begins to reallocate the funds between stocks and bonds. Determine the dollar amounts and directions of stocks and bonds moved. (c) If the stock market is expected to rise substantially in the next two (8 marks) quarters, discuss and explain which asset allocation strategy (a or b) the portfolio manager should use. A portfolio has a market value of $5 million. The initial portfolio value and the portfolio value after one quarter are shown in the following table. Date Portfolio value Stocks Bonds Jan 1 $5,000,000 $3,000,000 $2,000,000 Mar 31 $5,500,000 $3,250,000 $2,250,000 Required: (a) Suppose the investment policy statement requires a target asset allocation of 60 percent stocks and 40 percent bonds. The portfolio manager begins to reallocate the funds between stocks and bonds. Determine the dollar amounts and directions of stocks and bonds moved. (b) Suppose the investment policy statement specifies a floor value of $3 (6 marks) million and a multiplier of 1.5. The portfolio manager begins to reallocate the funds between stocks and bonds. Determine the dollar amounts and directions of stocks and bonds moved. (c) If the stock market is expected to rise substantially in the next two (8 marks) quarters, discuss and explain which asset allocation strategy (a or b) the portfolio manager should use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started