Question

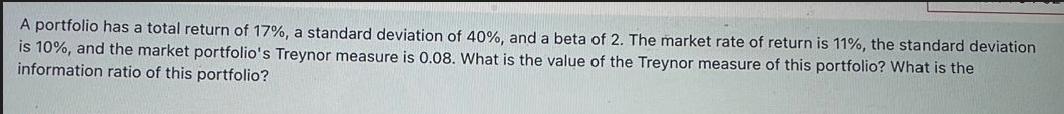

A portfolio has a total return of 17%, a standard deviation of 40%, and a beta of 2. The market rate of return is

A portfolio has a total return of 17%, a standard deviation of 40%, and a beta of 2. The market rate of return is 11%, the standard deviation is 10%, and the market portfolio's Treynor measure is 0.08. What is the value of the Treynor measure of this portfolio? What is the information ratio of this portfolio?

Step by Step Solution

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the Treynor measure of the portfolio we can use the formula Treynor measure portfolio return riskfree rate beta Since the riskfr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

14th Edition

0135175216, 978-0135175217

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App