Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio is equally invested in Stock A, Stock B, Stock C, and Treasury Bills (25% each). The expected returns of each of these

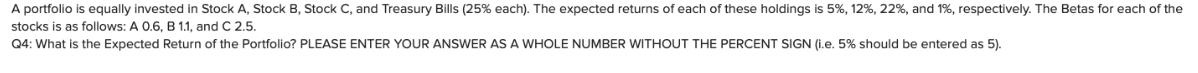

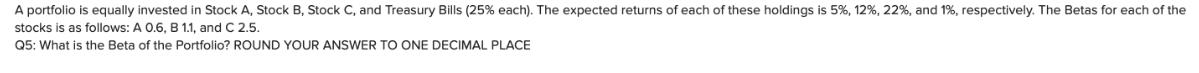

A portfolio is equally invested in Stock A, Stock B, Stock C, and Treasury Bills (25% each). The expected returns of each of these holdings is 5%, 12%, 22%, and 1%, respectively. The Betas for each of the stocks is as follows: A 0.6, B 1.1, and C 2.5. Q4: What is the Expected Return of the Portfolio? PLEASE ENTER YOUR ANSWER AS A WHOLE NUMBER WITHOUT THE PERCENT SIGN (i.e. 5% should be entered as 5). A portfolio is equally invested in Stock A, Stock B, Stock C, and Treasury Bills (25% each). The expected returns of each of these holdings is 5%, 12%, 22%, and 1%, respectively. The Betas for each of the stocks is as follows: A 0.6, B 1.1, and C 2.5. Q5: What is the Beta of the Portfolio? ROUND YOUR ANSWER TO ONE DECIMAL PLACE

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the expected return of the portfolio we need to use the weighted average of the expec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started