Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Portfolio Manager at HSBC bank is structuring a fixed income portfolio to meet the objective of a client. The client has specified the use

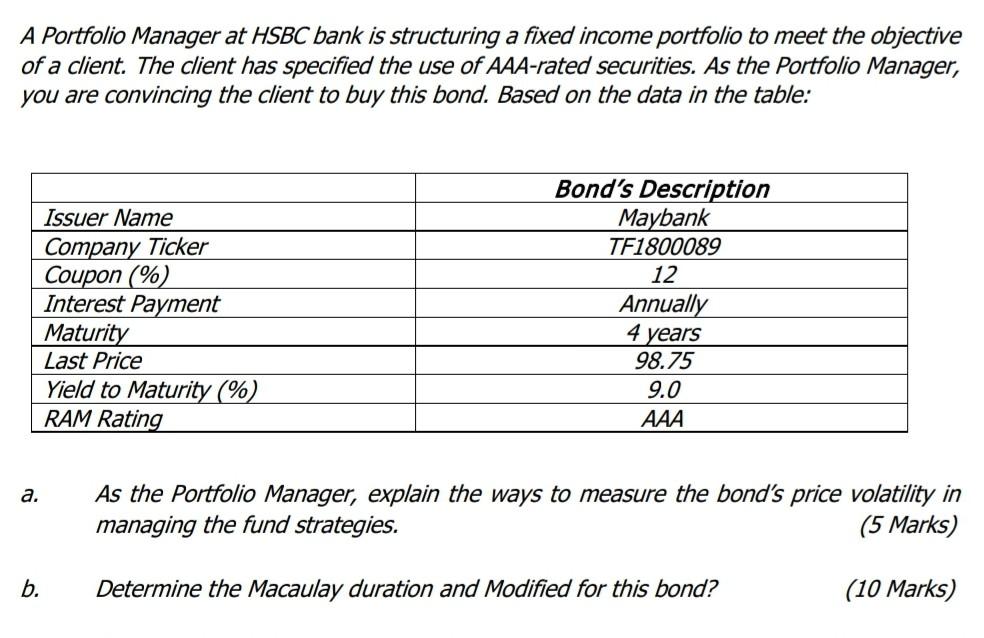

A Portfolio Manager at HSBC bank is structuring a fixed income portfolio to meet the objective of a client. The client has specified the use of AAA-rated securities. As the Portfolio Manager, you are convincing the client to buy this bond. Based on the data in the table: Bond's Description Maybank Issuer Name Company Ticker Coupon (%) TF1800089 12 Annually Interest Payment Maturity 4 years 98.75 Last Price Yield to Maturity (%) 9.0 RAM Rating AAA a. As the Portfolio Manager, explain the ways to measure the bond's price volatility in managing the fund strategies. (5 Marks) b. Determine the Macaulay duration and Modified for this bond? (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started