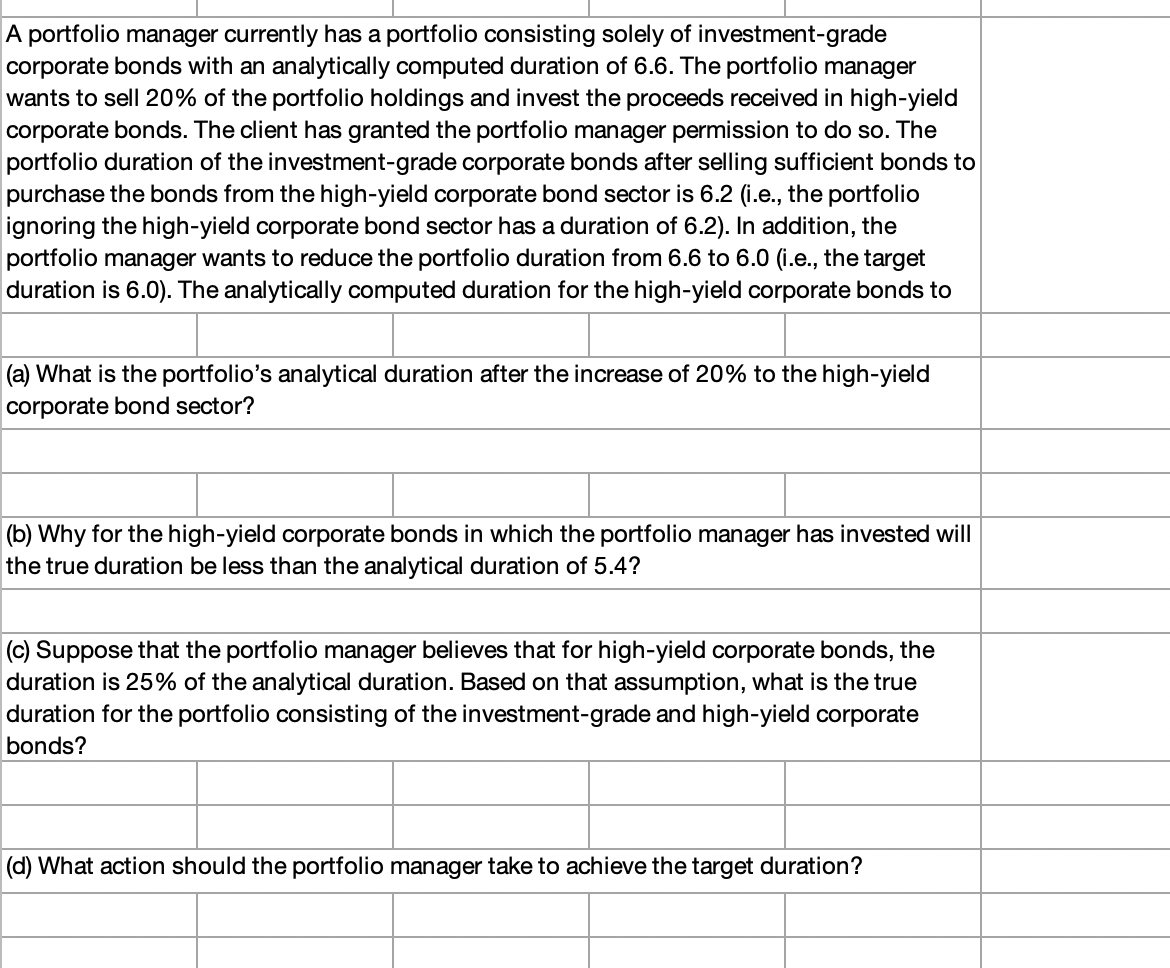

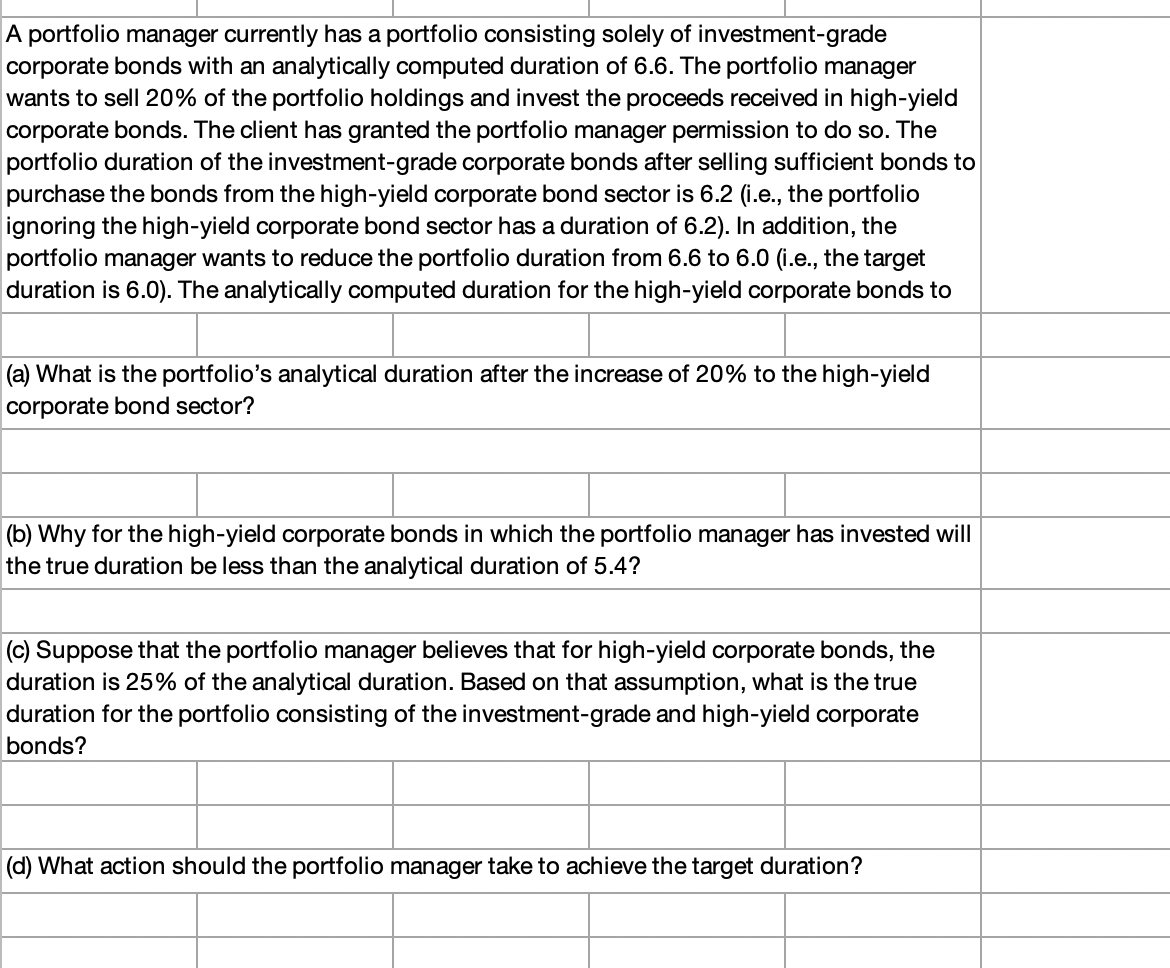

A portfolio manager currently has a portfolio consisting solely of investment-grade corporate bonds with an analytically computed duration of 6.6. The portfolio manager wants to sell 20% of the portfolio holdings and invest the proceeds received in high-yield corporate bonds. The client has granted the portfolio manager permission to do so. The portfolio duration of the investment-grade corporate bonds after selling sufficient bonds to purchase the bonds from the high-yield corporate bond sector is 6.2 (i.e., the portfolio ignoring the high-yield corporate bond sector has a duration of 6.2). In addition, the portfolio manager wants to reduce the portfolio duration from 6.6 to 6.0 (i.e., the target duration is 6.0). The analytically computed duration for the high-yield corporate bonds to (a) What is the portfolio's analytical duration after the increase of 20% to the high-yield corporate bond sector? (b) Why for the high-yield corporate bonds in which the portfolio manager has invested will the true duration be less than the analytical duration of 5.4? (C) Suppose that the portfolio manager believes that for high-yield corporate bonds, the duration is 25% of the analytical duration. Based on that assumption, what is the true duration for the portfolio consisting of the investment-grade and high-yield corporate bonds? (d) What action should the portfolio manager take to achieve the target duration? A portfolio manager currently has a portfolio consisting solely of investment-grade corporate bonds with an analytically computed duration of 6.6. The portfolio manager wants to sell 20% of the portfolio holdings and invest the proceeds received in high-yield corporate bonds. The client has granted the portfolio manager permission to do so. The portfolio duration of the investment-grade corporate bonds after selling sufficient bonds to purchase the bonds from the high-yield corporate bond sector is 6.2 (i.e., the portfolio ignoring the high-yield corporate bond sector has a duration of 6.2). In addition, the portfolio manager wants to reduce the portfolio duration from 6.6 to 6.0 (i.e., the target duration is 6.0). The analytically computed duration for the high-yield corporate bonds to (a) What is the portfolio's analytical duration after the increase of 20% to the high-yield corporate bond sector? (b) Why for the high-yield corporate bonds in which the portfolio manager has invested will the true duration be less than the analytical duration of 5.4? (C) Suppose that the portfolio manager believes that for high-yield corporate bonds, the duration is 25% of the analytical duration. Based on that assumption, what is the true duration for the portfolio consisting of the investment-grade and high-yield corporate bonds? (d) What action should the portfolio manager take to achieve the target duration