Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio manager has a mandate to maintain the portfolio at 6-7 years. Currently, in his portfolio, half of them is investing in Bond

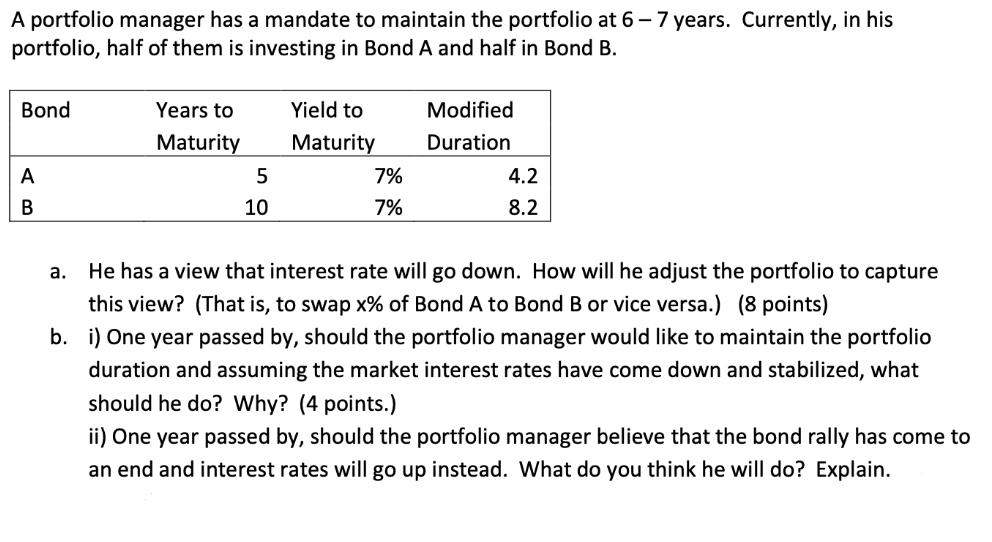

A portfolio manager has a mandate to maintain the portfolio at 6-7 years. Currently, in his portfolio, half of them is investing in Bond A and half in Bond B. Bond A B Years to Maturity 5 10 Yield to Maturity 7% 7% Modified Duration 4.2 8.2 a. He has a view that interest rate will go down. How will he adjust the portfolio to capture this view? (That is, to swap x% of Bond A to Bond B or vice versa.) (8 points) b. i) One year passed by, should the portfolio manager would like to maintain the portfolio duration and assuming the market interest rates have come down and stabilized, what should he do? Why? (4 points.) ii) One year passed by, should the portfolio manager believe that the bond rally has come to an end and interest rates will go up instead. What do you think he will do? Explain.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a If the portfolio manager has a view that interest rates will go down he should adjust the portfolio by swapping some of Bond B with Bond A Since Bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started