Answered step by step

Verified Expert Solution

Question

1 Approved Answer

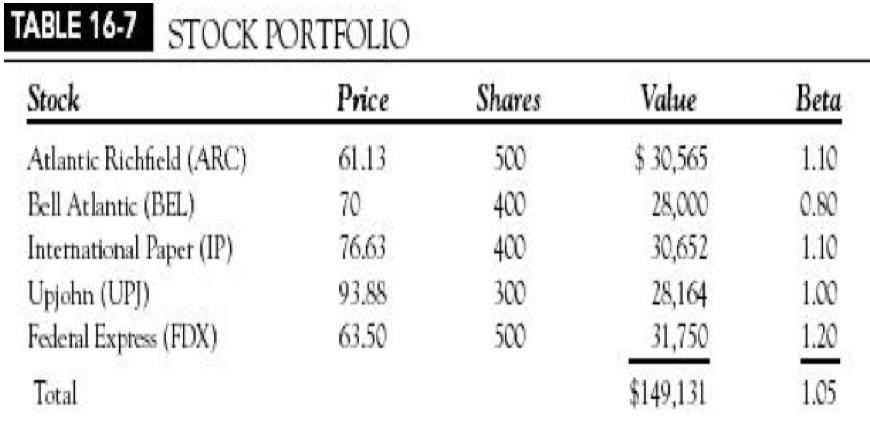

A portfolio manager has a portfolio of 5 stocks (refer to the table below) and wants to generate income shorting calls on all 5 stocks.

- A portfolio manager has a portfolio of 5 stocks (refer to the table below) and wants to generate income shorting calls on all 5 stocks. At the expiration of the options contract the market has increased by 3%.

Show in a table, the complete P&L results for the shares, the options and the total.

show all calculations

- Calculate the final P&L (in $) and the returns (in %) over the total initial value of the portfolio. Indicate which stocks could be assigned (sold) at the options expirations and why.

Short 5 ARC June 62.5 Calls at $0.90

Short 4 BEL June 68 Calls at $3.90

Short 4 IP June 77 Calls at $1.20

Short 3 UPJ June 92 Calls at $3.90

Short 5 FDX June 63.50 Calls at $1.30

- What would be the final result if this investor sell 2 options Call contracts June 890 (strike) OEX at $ 6.20 (premium) , with OEX currently trading at $870. Calculate the P&L (in $) and the additional return (in %) on the current portfolio. Show all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started