Answered step by step

Verified Expert Solution

Question

1 Approved Answer

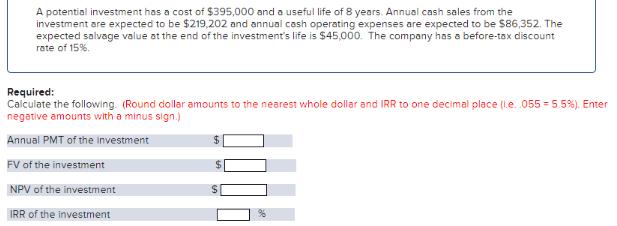

A potential investment has a cost of $395,000 and a useful life of 8 years. Annual cash sales from the investment are expected to

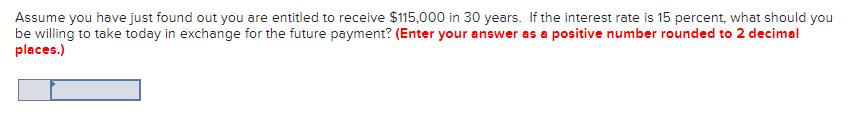

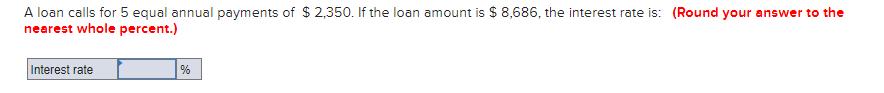

A potential investment has a cost of $395,000 and a useful life of 8 years. Annual cash sales from the investment are expected to be $219,202 and annual cash operating expenses are expected to be $86,352. The expected salvage value at the end of the investment's life is $45,000. The company has a before-tax discount rate of 15%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment Assume you have just found out you are entitled to receive $115,000 in 30 years. If the interest rate is 15 percent, what should you be willing to take today in exchange for the future payment? (Enter your answer as a positive number rounded to 2 decimal places.) A loan calls for 5 equal annual payments of $2,350. If the loan amount is $ 8,686, the interest rate is: (Round your answer to the nearest whole percent.) Interest rate %

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started