Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A power company is planning on developing a new concentrating solar power plant. The capital cost for the plant is $75M in 2021 and

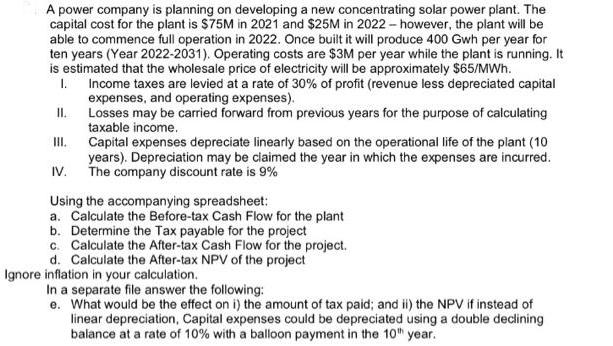

A power company is planning on developing a new concentrating solar power plant. The capital cost for the plant is $75M in 2021 and $25M in 2022-however, the plant will be able to commence full operation in 2022. Once built it will produce 400 Gwh per year for ten years (Year 2022-2031). Operating costs are $3M per year while the plant is running. It is estimated that the wholesale price of electricity will be approximately $65/MWh. I. III. Income taxes are levied at a rate of 30% of profit (revenue less depreciated capital expenses, and operating expenses). Losses may be carried forward from previous years for the purpose of calculating taxable income. Capital expenses depreciate linearly based on the operational life of the plant (10 years). Depreciation may be claimed the year in which the expenses are incurred. The company discount rate is 9% IV. Using the accompanying spreadsheet: a. Calculate the Before-tax Cash Flow for the plant b. Determine the Tax payable for the project c. Calculate the After-tax Cash Flow for the project. d. Calculate the After-tax NPV of the project Ignore inflation in your calculation. In a separate file answer the following: e. What would be the effect on i) the amount of tax paid; and ii) the NPV if instead of linear depreciation, Capital expenses could be depreciated using a double declining balance at a rate of 10% with a balloon payment in the 10th year.

Step by Step Solution

★★★★★

3.55 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The beforetax cash flow for the plant is 495 million b The tax payable for the project is 1485 million c The aftertax cash flow for the proje...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started