Answered step by step

Verified Expert Solution

Question

1 Approved Answer

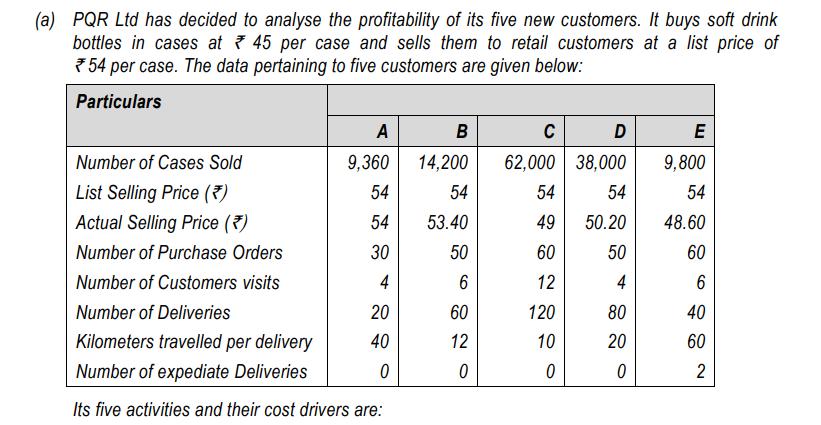

(a) PQR Ltd has decided to analyse the profitability of its five new customers. It buys soft drink bottles in cases at 45 per

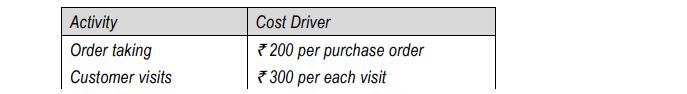

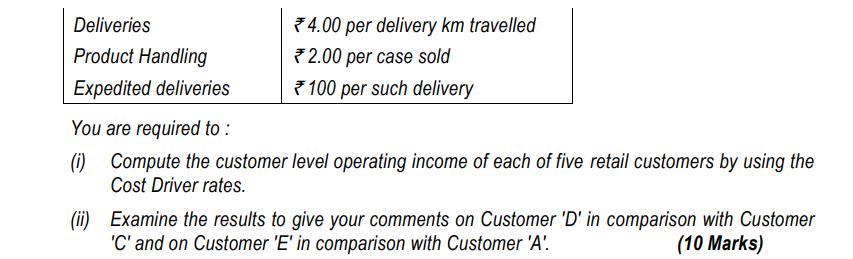

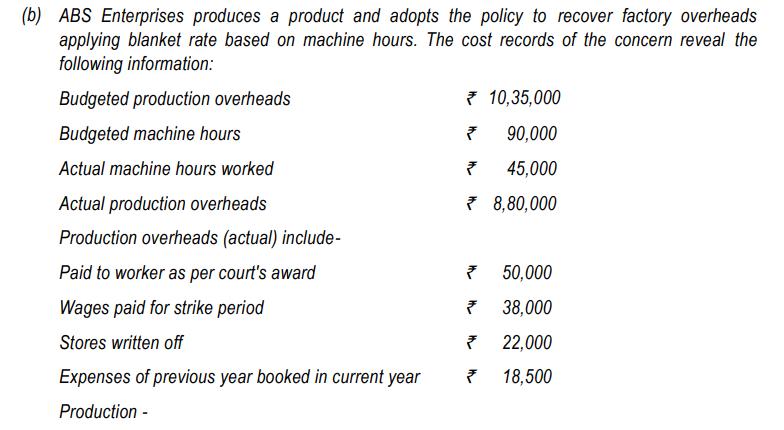

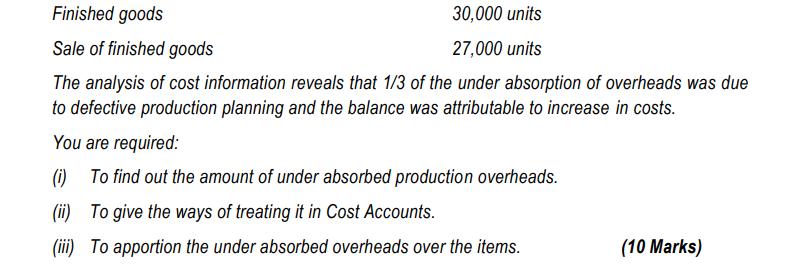

(a) PQR Ltd has decided to analyse the profitability of its five new customers. It buys soft drink bottles in cases at 45 per case and sells them to retail customers at a list price of 54 per case. The data pertaining to five customers are given below: Particulars A 9,360 54 54 30 4 20 40 0 Number of Cases Sold List Selling Price (7) Actual Selling Price (*) Number of Purchase Orders Number of Customers visits Number of Deliveries Kilometers travelled per delivery Number of expediate Deliveries Its five activities and their cost drivers are: B 14,200 54 53.40 50 6 60 12 0 C D 62,000 38,000 54 54 49 50.20 60 50 12 120 10 0 4 80 20 0 E 9,800 54 48.60 60 6 40 60 2 Activity Order taking Customer visits Cost Driver *200 per purchase order *300 per each visit Deliveries Product Handling Expedited deliveries 4.00 per delivery km travelled *2.00 per case sold 100 per such delivery You are required to : (i) Compute the customer level operating income of each of five retail customers by using the Cost Driver rates. (ii) Examine the results to give your comments on Customer 'D' in comparison with Customer 'C' and on Customer 'E' in comparison with Customer 'A'. (10 Marks) (b) ABS Enterprises produces a product and adopts the policy to recover factory overheads applying blanket rate based on machine hours. The cost records of the concern reveal the following information: Budgeted production overheads Budgeted machine hours Actual machine hours worked Actual production overheads Production overheads (actual) include- Paid to worker as per court's award Wages paid for strike period Stores written off Expenses of previous year booked in current year Production - 10,35,000 90,000 45,000 8,80,000 50,000 38,000 22,000 18,500 Finished goods 30,000 units Sale of finished goods 27,000 units The analysis of cost information reveals that 1/3 of the under absorption of overheads was due to defective production planning and the balance was attributable to increase in costs. You are required: (i) To find out the amount of under absorbed production overheads. (ii) To give the ways of treating it in Cost Accounts. (iii) To apportion the under absorbed overheads over the items. (10 Marks)

Step by Step Solution

★★★★★

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution Computation of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started