Question

a. prepare a cash flow statement for March 2014 . b. calculate the following ratios based on B/s, income statement and Cash flow prepared in

a. prepare a cash flow statement for March 2014 .

b. calculate the following ratios based on B/s, income statement and Cash flow prepared in question (a) above 1. ROE 2.return on capital employed (post-tax) 3.net profit margin 4. EBITDA margin 5. Effective tax rate 6. operating cost ratio 7.Gross profit margin 8. Total Assets turnover ratio 9. Fixed asset turnover ratio 10.Receivable turnover ratio 11. leverage ratio ( avg. total assets/avg.total equity) 12. FCF/EBITDA 13. Interest coverage ratio 14. Debt service coverage ratio 15. basic EPS ( assume face value of equity share is INR 10) 16. Debt:equity Ratio

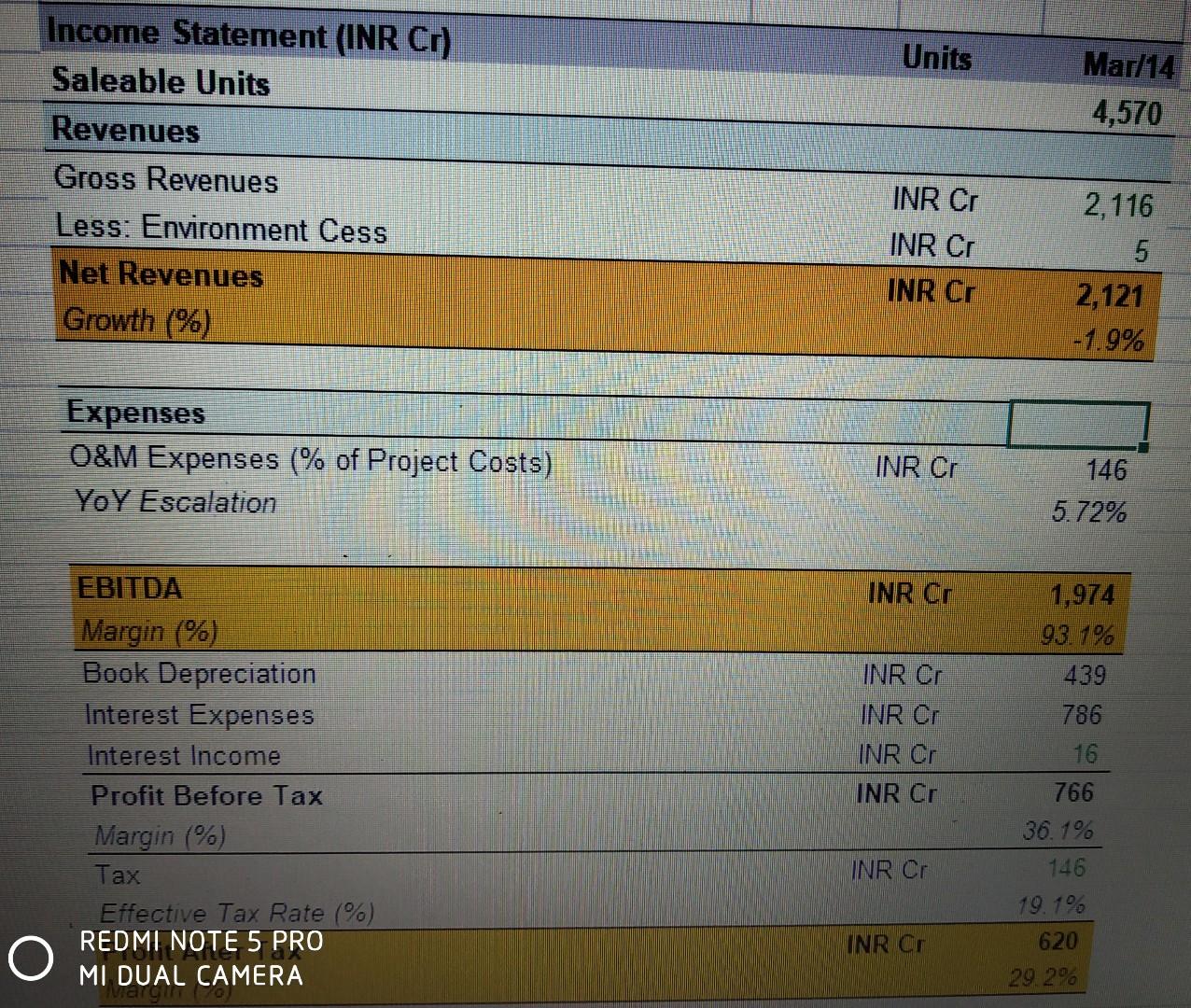

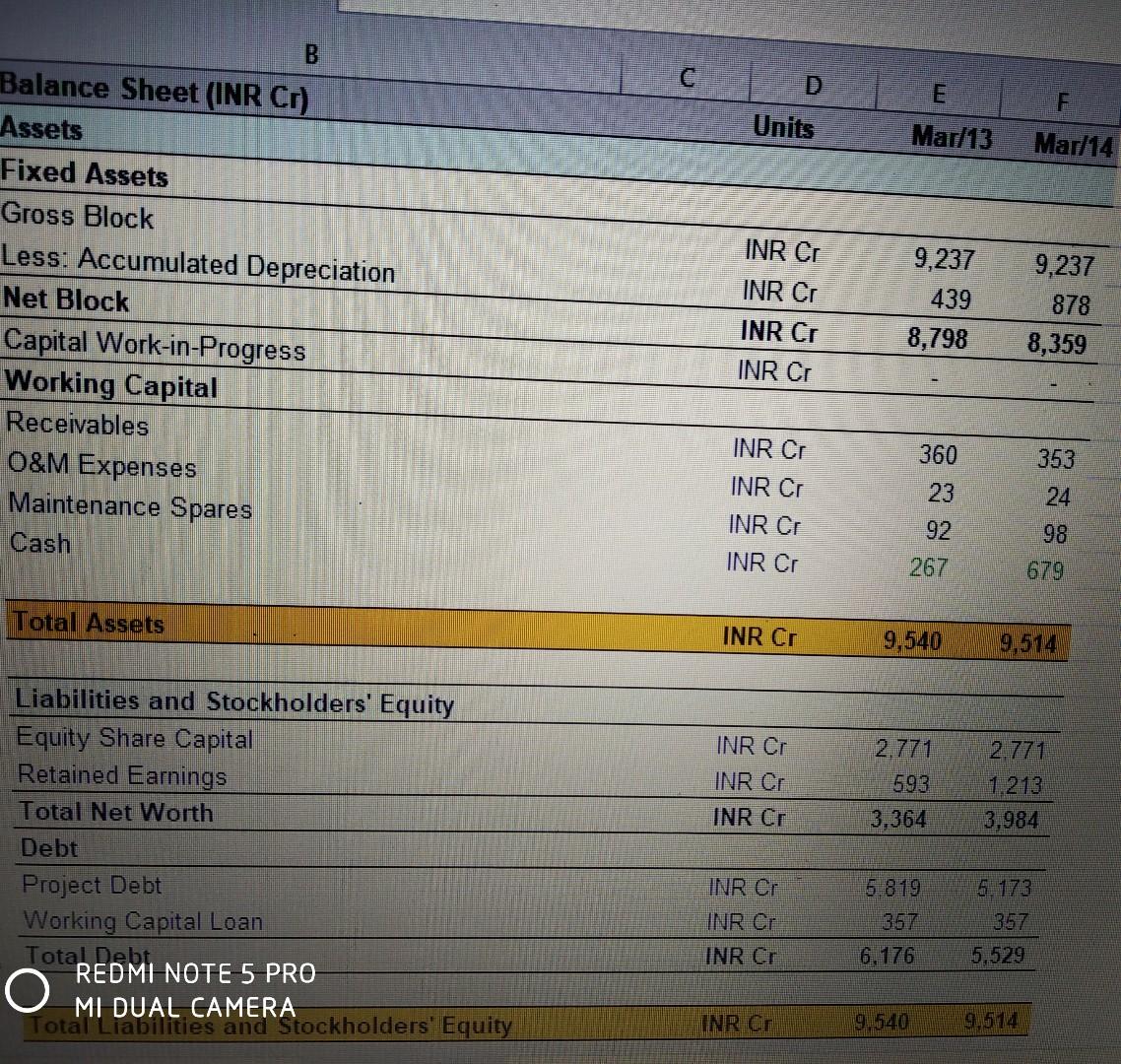

Units Mar/14 4,570 Income Statement (INR CI) Saleable Units Revenues Gross Revenues Less: Environment Cess Net Revenues Growth (%) INR Cr INR C. INR Cr 2,116 5 2,121 -1.9% Expenses O&M Expenses (% of Project Costs) Yo Y Escalation INR Cr 146 5.72% INR Cr EBITDA Margin (%) Book Depreciation Interest Expenses Interest Income Profit Before Tax Margin (%) Tax Effective Tax Rate (%) REDMI NOTE 5 PRO MI DUAL CAMERA INR Cr INR Cr INR Cr INR Cr 1,974 93.1% 439 786 16 766 36.1% 146 19.1% 620 29.2% INR Cr INRC o C. E F Units Mar/13 Mar/14 B Balance Sheet (INR Cr) Assets Fixed Assets Gross Block Less: Accumulated Depreciation Net Block Capital Work-in-Progress Working Capital Receivables O&M Expenses Maintenance Spares Cash INR Cr INR CI INR CI INR CT 9,237 439 8,798 9,237 878 8,359 360 353 23 INR CI INR Cr INR Cr INR CI 24 98 92 267 679 Total Assets INR Cr 9,540 9,514 INR C. INR Cr INR Cr 2,771 693 3.364 2.771 1.213 3,984 Liabilities and Stockholders' Equity Equity Share Capital Retained Earnings Total Net Worth Debt Project Debt Working Capital Loan Total Debt REDMI NOTE 5 PRO O MI DUAL CAMERA TotalLiaonities and Stockholders' Equity INR CP 6.819 367 6.176 5.173 357 INR Cr INR Cr 5,529 INR Or 9.540 9.514 Units Mar/14 4,570 Income Statement (INR CI) Saleable Units Revenues Gross Revenues Less: Environment Cess Net Revenues Growth (%) INR Cr INR C. INR Cr 2,116 5 2,121 -1.9% Expenses O&M Expenses (% of Project Costs) Yo Y Escalation INR Cr 146 5.72% INR Cr EBITDA Margin (%) Book Depreciation Interest Expenses Interest Income Profit Before Tax Margin (%) Tax Effective Tax Rate (%) REDMI NOTE 5 PRO MI DUAL CAMERA INR Cr INR Cr INR Cr INR Cr 1,974 93.1% 439 786 16 766 36.1% 146 19.1% 620 29.2% INR Cr INRC o C. E F Units Mar/13 Mar/14 B Balance Sheet (INR Cr) Assets Fixed Assets Gross Block Less: Accumulated Depreciation Net Block Capital Work-in-Progress Working Capital Receivables O&M Expenses Maintenance Spares Cash INR Cr INR CI INR CI INR CT 9,237 439 8,798 9,237 878 8,359 360 353 23 INR CI INR Cr INR Cr INR CI 24 98 92 267 679 Total Assets INR Cr 9,540 9,514 INR C. INR Cr INR Cr 2,771 693 3.364 2.771 1.213 3,984 Liabilities and Stockholders' Equity Equity Share Capital Retained Earnings Total Net Worth Debt Project Debt Working Capital Loan Total Debt REDMI NOTE 5 PRO O MI DUAL CAMERA TotalLiaonities and Stockholders' Equity INR CP 6.819 367 6.176 5.173 357 INR Cr INR Cr 5,529 INR Or 9.540 9.514Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started