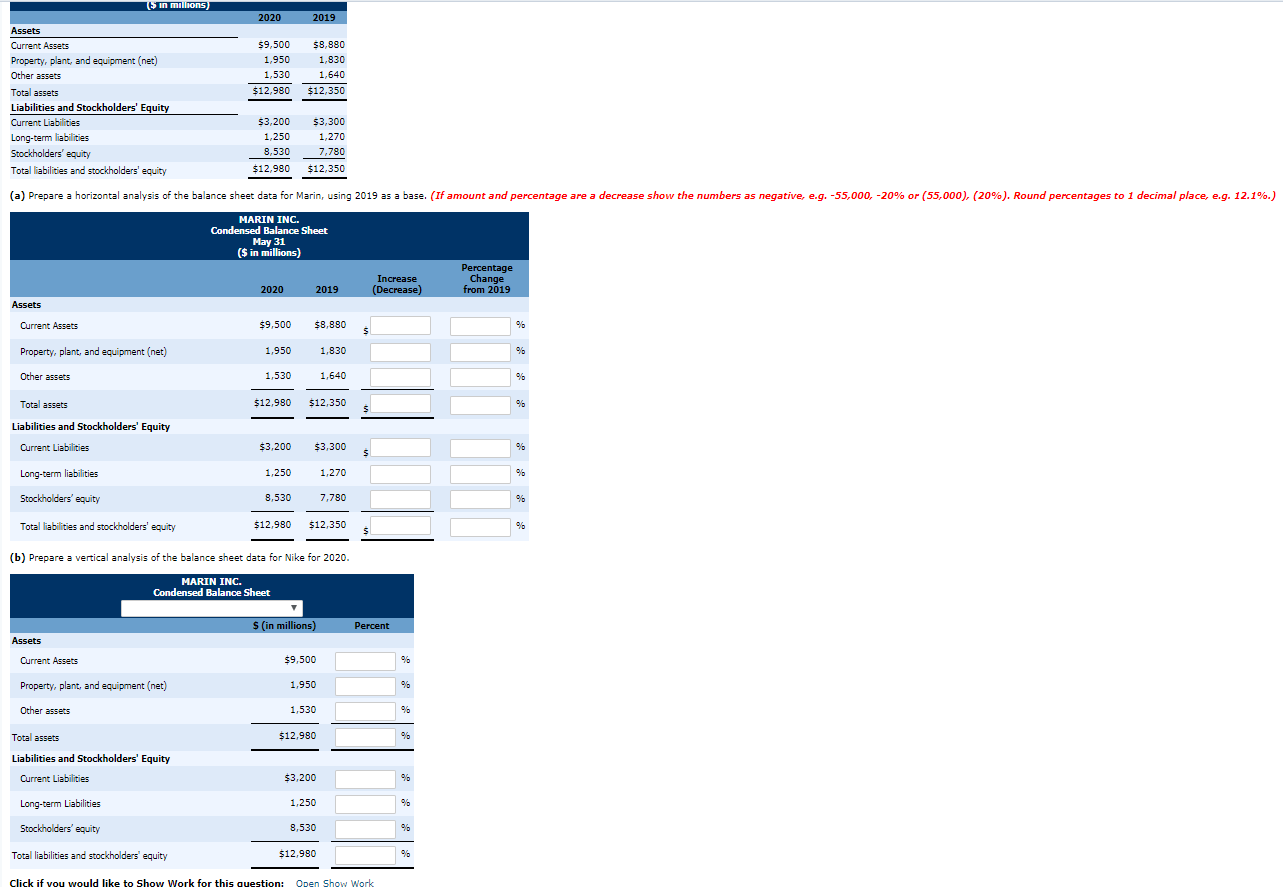

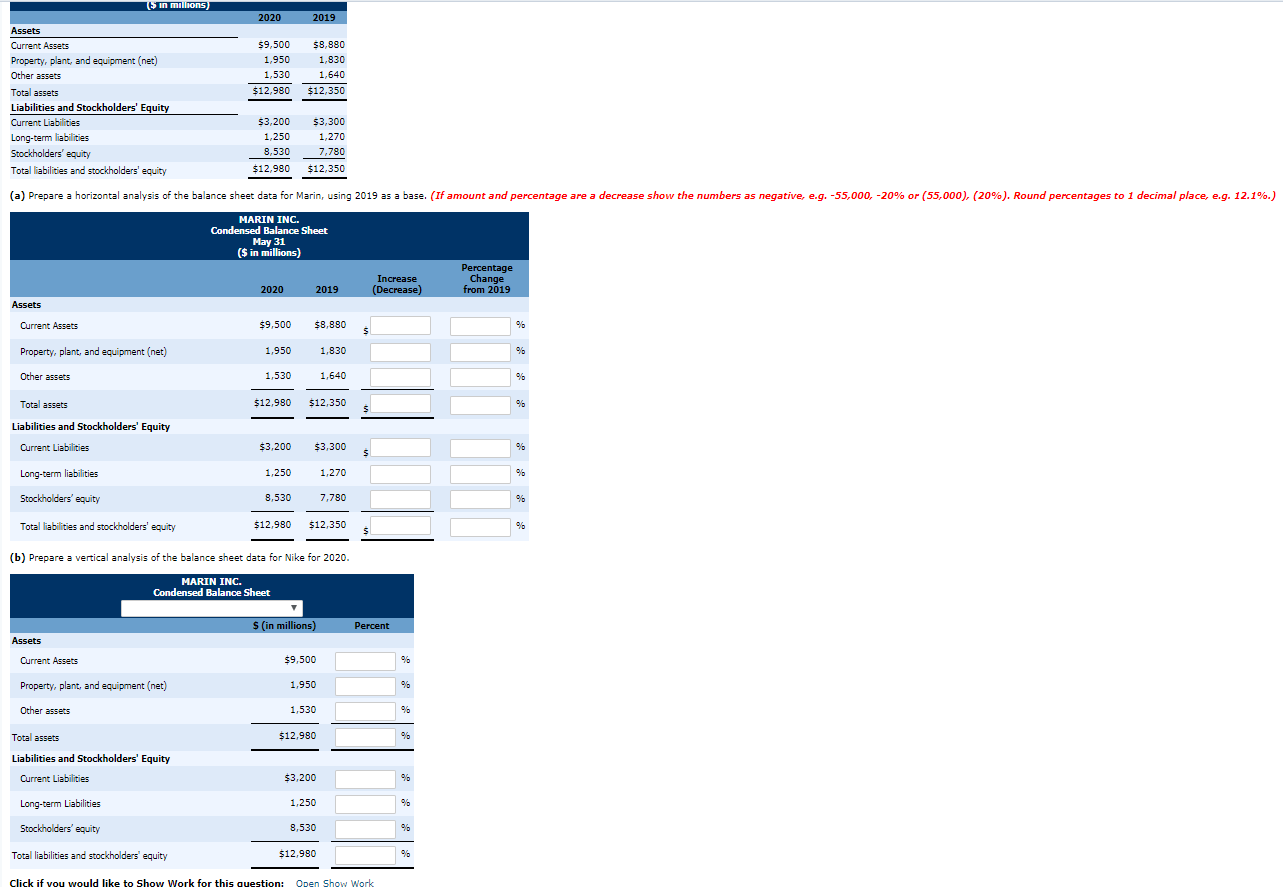

(a) Prepare a horizontal analysis of the balance sheet data for Marin, using 2019 as a base

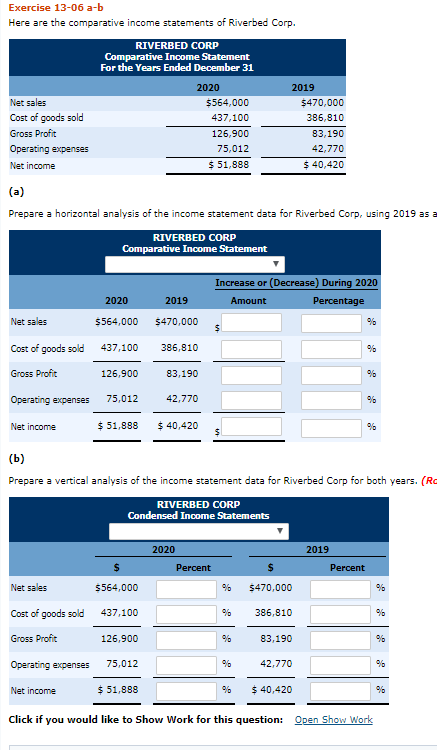

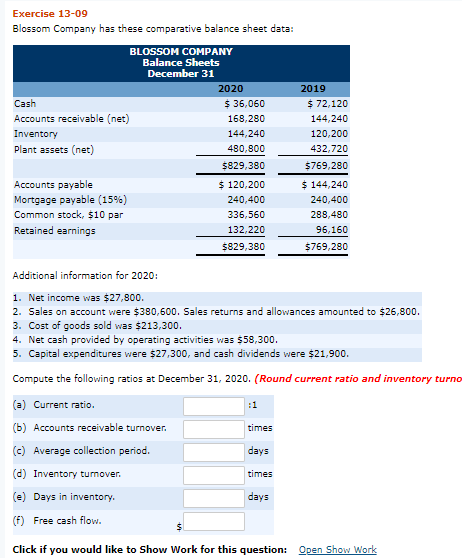

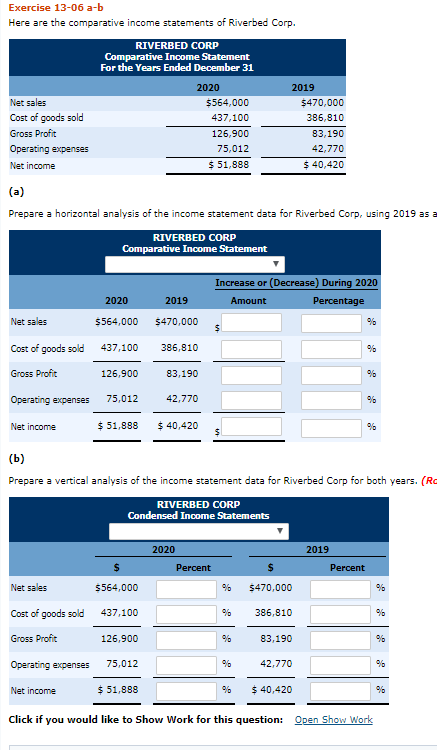

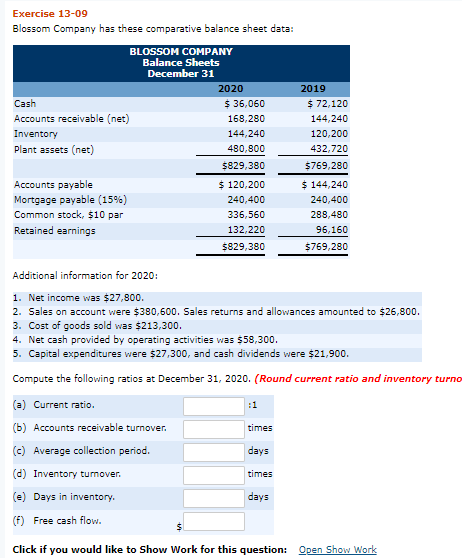

Tuin millions 2020 2019 $9,500 1,950 1,530 $12,980 $8,880 1,830 1,640 $12,350 Assets Current Assets Property, plant, and equipment (net) Other assets Total assets Liabilities and Stockholders' Equity Current Liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity $3,200 1,250 8,530 $12,980 $3,300 1,270 7,780 $12,350 (a) Prepare a horizontal analysis of the balance sheet data for Marin, using 2019 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) MARIN INC. Condensed Balance Sheet May 31 ($ in millions) Percentage Change from 2019 2020 Increase (Decrease) 2019 Assets Current Assets $9,500 $8,880 Property, plant, and equipment (net) 1.950 1,830 Other assets 1,530 1,640 Total assets $12,950 $12,350 Liabilities and Stockholders' Equity Current Liabilities $3,200 $3,300 Long-term liabilities 1,250 1,270 Stockholders' equity 8,530 7,780 Total liabilities and stockholders' equity $12.980 $12,350 (b) Prepare a vertical analysis of the balance sheet data for Nike for 2020. MARIN INC. Condensed Balance Sheet S (in millions) Percent Assets Current Assets $9,500 Property, plant, and equipment (net) 1,950 Other assets 1,530 $12.980 Total assets Liabilities and Stockholders' Equity Current Liabilities $3,200 Long-term Liabilities 1,250 Stockholders' equity 3,530 Total liabilities and stockholders' equity $12.980 Click if you would like to Show Work for this question: Open Show Work Exercise 13-06 a-b Here are the comparative income statements of Riverbed Corp. 2019 Net sales Cost of goods sold Gross Profit Operating expenses Net Income RIVERBED CORP Comparative Income Statement For the Years Ended December 31 2020 5564,000 437.100 126.900 75,012 $ 51,888 5470,000 386,810 83,190 42.770 $ 40,420 (a) Prepare a horizontal analysis of the income statement data for Riverbed Corp, using 2019 as 1 RIVERBED CORP Comparative Income Statement Increase or (Decrease) During 2020 Amount Percentage 2020 $564,000 Net sales 2019 $470,000 386,810 Cost of goods sold 437,100 Gross Profit 126,900 83,190 Operating expenses 75,012 42,770 Net income $ 51,888 $ 40,420 (b) Prepare a vertical analysis of the income statement data for Riverbed Corp for both years. (Rc RIVERBED CORP Condensed Income Statements 2020 Percent 2019 Percent 5 5470.000 Net sales % Cost of goods sold $564,000 437.100 126.900 % 386.810 Gross Profit % 83,190 Operating expenses 75,012 % 42.770 Net income $51,888 % $ 40,420 Click if you would like to Show Work for this question: Open Show Work Exercise 13-09 Blossom Company has these comparative balance sheet data: 2010 BLOSSOM COMPANY Balance Sheets December 31 2020 Cash 36,060 Accounts receivable (net) 168,280 Inventory 144,240 Plant assets (net) 480,800 $829,380 Accounts payable $ 120,200 Mortgage payable (15%) 240,400 Common stock, $10 par 336,560 Retained earnings 132,220 $829,380 2019 $ 72,120 144.240 120,200 432,720 $769,280 $ 144,240 240,400 288,480 96,160 $769,280 Additional information for 2020: 1. Net income was $27,800. 2. Sales on account were $380,600. Sales returns and allowances amounted to $26,800. 3. Cost of goods sold was $213,300. 4. Net cash provided by operating activities was 558,300. 5. Capital expenditures were $27,300, and cash dividends were $21.900. Compute the following ratios at December 31, 2020. (Round current ratio and inventory turno (a) Current ratio. (6) Accounts receivable turnover. times days (c) Average collection period. (d) Inventory tumover. (e) Days in inventory. times days (f) Free cash flow. Click if you would like to Show Work for this question: Open Show Work